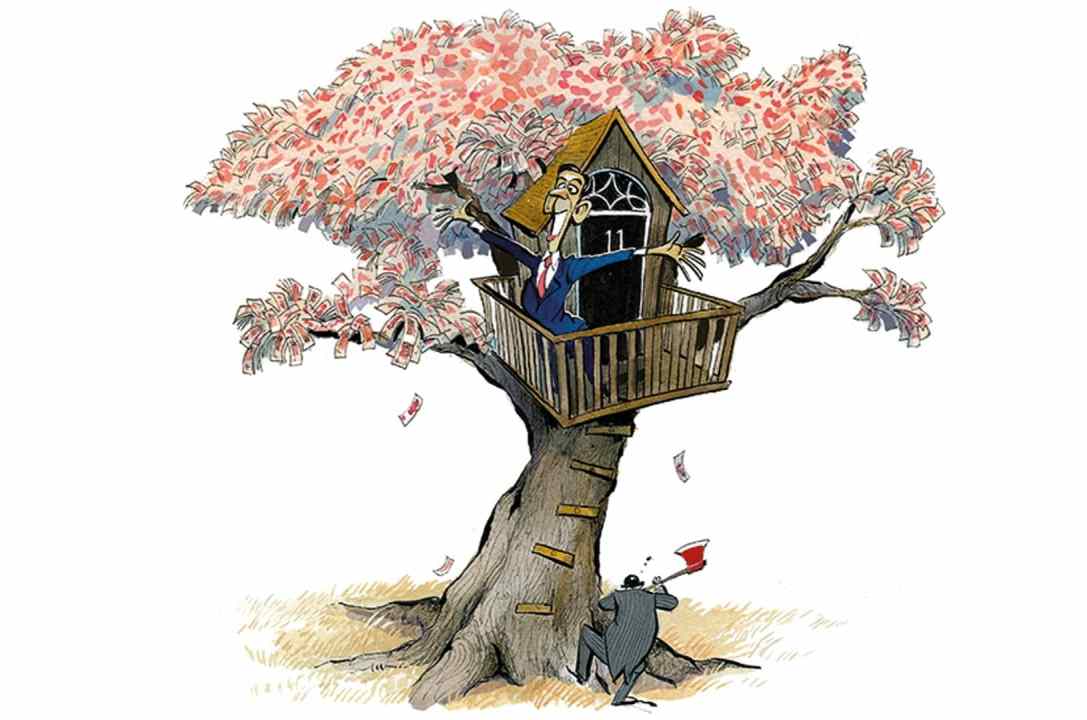

Is Rishi Sunak losing his battle within the Cabinet to promote fiscal responsibility? We’ll find out this week, when he unveils his Budget and three-year Spending Review on Wednesday, but there were hints this morning that more spending is coming down the track. Speaking to Andrew Marr on BBC One, Sunak laid out the principles that guided his Budget process this time round:

‘Strong investment in public services, driving economic growth by investing in infrastructure, innovation and skills, giving businesses confidence and then supporting working families. Those are the ingredients of what makes a stronger Budget and that’s what we will deliver next week.’

This is not the language of a Chancellor ready to retire the many arms of the state that have been working overtime during the Covid crisis. That economic growth is being framed as a job of government and state investment – not the market economy – suggests the tax breaks and scale back of state interference desperately needed to kickstart organic growth are still far off.

Rather than fighting yesterday’s battles, Sunak is instead doubling down on the runner-up option

It’s a change in tone from Tory party conference, where Sunak was a lone voice on the importance of repairing the public finances, and prioritising fiscal responsibility over tax cuts and spending sprees. But the competing pledges in the Tory manifesto – to spend lots more money while not touching key taxes – came to a head months ago, when National Insurance was hiked to provide extra funds for the NHS and social care. Something Sunak tapped into in his interview today: ‘One of the elements of building a stronger economy is strong public services,’ he said. ‘And you will see that next week. Whether that’s the NHS… children, schools, skills, all of these things. Policing and crime, you will see investment across the board in public services, because that’s what we were elected to deliver.’

Rather than fighting yesterday’s battles, Sunak is instead doubling down on the runner-up option: to cost and fund increases in day-to-day spending without borrowing. ‘Believe me, I wish I didn’t have to raise taxes,’ he told Marr, in response to being asked if he was still a ‘tax-cutting Chancellor’, if not in practice, but in spirit. ‘My instincts are to [cut taxes]. That’s what I believe… I want to reward people for working. I think that’s a good thing, and it would help drive economic growth.’

While there have been some rumours about rabbits in hats — a freeze or cut in alcohol duty is making the rounds – it is gearing up to be a Budget far more focused on spending than cuts (to taxes or services). The Treasury has already announced more money for a range of sectors to be detailed in the Budget, including a £3bn investment into the Lifetime Skills Guarantee, to provide more post-16 education. Spending boosts are likely to be funded, in part, by the estimated borrowing windfall from the past six months. The government has borrowed over £40bn less than anticipated in March’s Budget, thanks to higher-than-expected tax receipts and a fairly consistent economic rebound, that leaves the UK economy, in the latest count, 0.8 per cent below pre-pandemic levels.

But how much of Sunak’s wriggle room might be taken up by rising inflation and a looming interest rate hike? The Chancellor wasn’t drawn in to giving any specific prediction on Marr this morning, but made clear his acute awareness of inflationary pressures, which have haunted him long before the economic consensus caught up. The culprits – which he said now are the crunch on ‘global supply chains’ and ‘energy prices’ – are ‘global factors’, which the UK is ‘not alone’ in. ‘I don’t have a magic wand that can make either of those things disappear.’

Perhaps his notable change in tone on spending is not evidence that he’s changed his mind, but rather changed his priorities: that keeping Britain from locking down again this winter is back at the top of his list. Almost half of this morning’s BBC interview was dominated by the possibility of pivoting to Plan B – or going further – with the Chancellor being grilled on the possibility of bringing back the furlough scheme.

Despite his robust pushback on such ideas – insistent that the data does not justify moving away from Plan A at this time – this is likely to become an uphill battle in the coming months, not just between healthcare stakeholders and the government, but even within Johnson’s Cabinet, as whispers of a ‘Plan C’ that could bring back major restrictions, though denied by the government, have started to make the rounds. A reminder that before the more nuanced debates around debt and deficits play out in full, common ground must be found on the topic that has solely defined the government for the last 18 months.

Sign up to my weekly economics newsletter here.

Comments