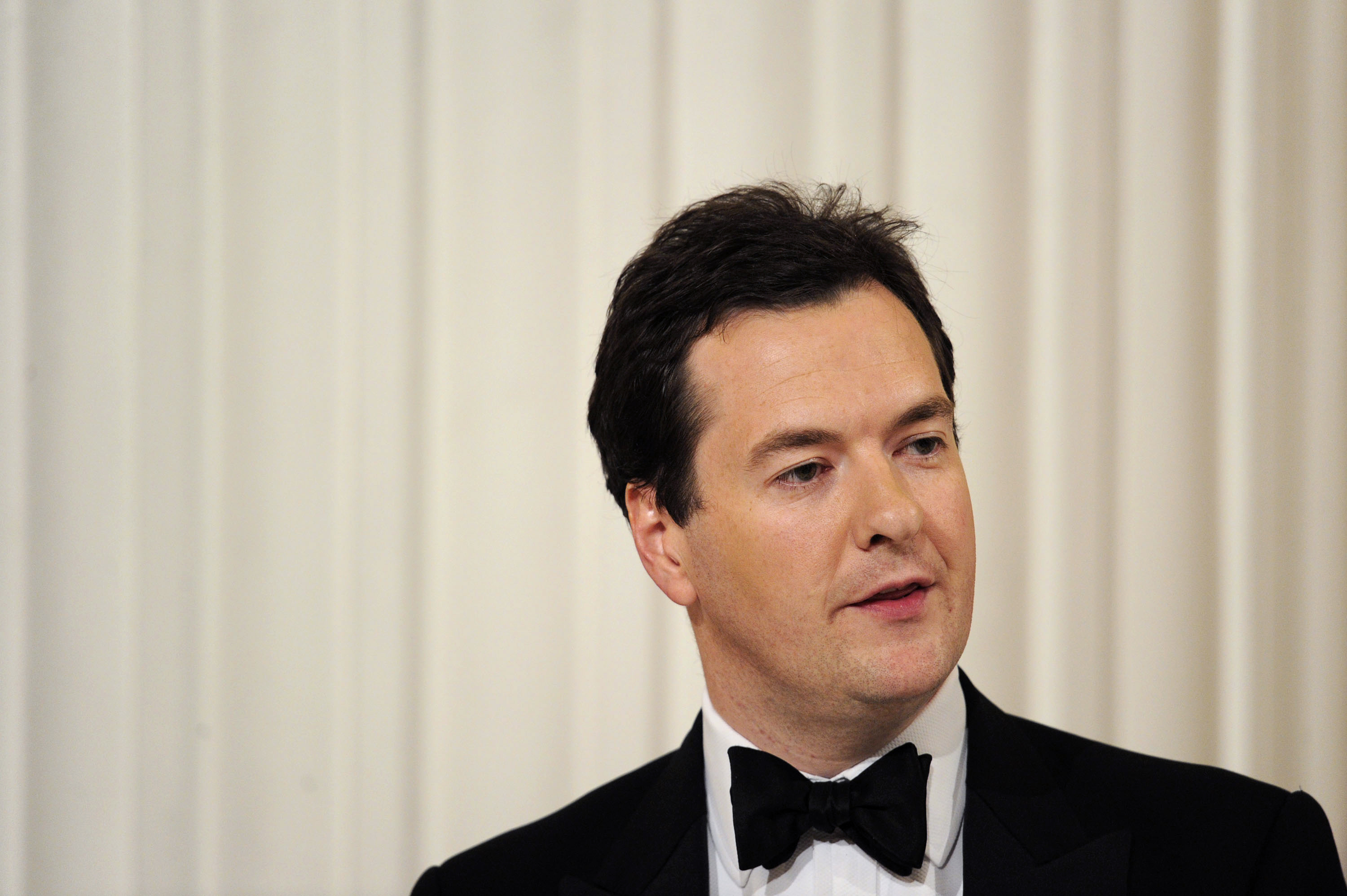

The bustle around public sector pensions has obscured an equally significant,

pensions-related story today: the Sunday Telegraph’s claim that George Osborne is considering sucking £7 billion from the pensions of higher earners. The way

it would be achieved, reports Patrick Hennessey, would be to terminate the tax relief on pension contributions made by those in the 40 and 50 per cent income tax brackets. He adds that the

Exchequer could spend the resulting funds on deficit reduction, or on notching up the basic state pension.

The bustle around public sector pensions has obscured an equally significant,

pensions-related story today: the Sunday Telegraph’s claim that George Osborne is considering sucking £7 billion from the pensions of higher earners. The way

it would be achieved, reports Patrick Hennessey, would be to terminate the tax relief on pension contributions made by those in the 40 and 50 per cent income tax brackets. He adds that the

Exchequer could spend the resulting funds on deficit reduction, or on notching up the basic state pension.

At the moment, it sounds as though this is just one of those on-the-table type deals: an idea being passed around the Treasury, but not yet decided upon. It will certainly require a dose of fortitude — or, perhaps, of foolhardiness — to turn it into reality. There’s already an argument that 40 per cent bracketeers are suffering unduly under this government. This could just mean more pain for them, even if, as Hennessey hints, Osborne shelves his plan to limit their child benefits.

But there are also political gains for Osborne from this policy, that will make it hard for him to ignore it. For starters, it was mooted by the Lib Dems before the election, so could help tape the

coalition together. And then there’s its simple, fundraising potential. £7 billion is not a sum that the Chancellor will sniff at, particularly should his deficit reduction plans veer off

track, or the NHS require more money to meet the Tories’ spending pledge.

Come 2015, Osborne may require these sweeping raids to make sweeping giveaways elsewhere.

UPDATE: Downing Street gets in touch to say that the Sunday Telegraph story is “totally untrue”.

Comments