Denis Healey’s ‘caretaker Budget’ on 3 April 1979 is an odd focus for Labour nostalgia. It came a week after Jim Callaghan’s government had lost a vote of no confidence, paving the way for Margaret Thatcher’s arrival in No. 10. Healey was reduced to merely introducing the finance bill to maintain normal tax collection functions, and made no other announcements at all. But as chaos surrounds Rachel Reeves’s second Budget next week, one senior figure fondly recalled that simpler time.

Healey began his 27-minute ‘non-Budget’ (as Geoffrey Howe called it) speech by confessing: ‘I feel a little bit like a man who turns up to play the leading role in the opera and all they want him to do is to help them hold the scenery together.’ In truth, holding the scenery together is the best that the City, the markets and business can hope for from next week’s Budget.

‘The Chancellor has to land a dodgy jumbo jet on the postage stamp of a highly uncertain forecast’

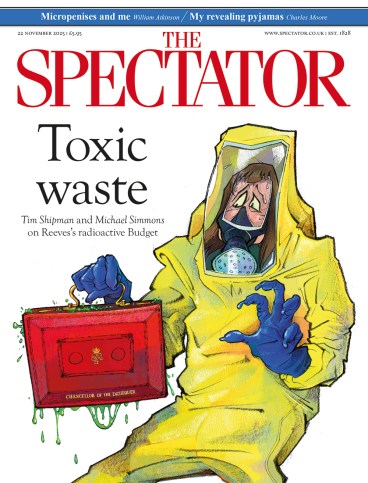

Reeves and her Treasury team have created months of chaos and confusion. Endless potential tax rises on mansions, pensions, savings, gambling and business partnerships have been trailed, briefed and leaked, damaging the economy and making the Chancellor’s task more difficult. This culminated in a Reeves speech designed to roll the pitch for a 2p rise in income tax, which was only ditched last week when the Office for Budget Responsibility (OBR) told Reeves she had £10 billion more to play with. It was the capstone of what Lindsay Hoyle, the Commons Speaker, branded ‘the hokey-cokey Budget: one minute something is in, the next minute it is out’.

A lot of blame can be placed at Reeves’s door. This year and last she waited far too long to announce her plans, allowing damaging speculation to spiral. However, the rot runs deeper. Serious voices are questioning whether it is time to blow up the Budget as we know it.

Former mandarins are also openly asserting that the Treasury itself is dysfunctional and should be broken up. Simon Case, the previous cabinet secretary, says: ‘Former chancellors, governors of the Bank of England and senior officials are now talking about the madness of our current processes.’

‘We’ve known for months that the Chancellor needed to raise tax,’ says a serving senior civil servant. ‘If Argentina invaded the Falklands again tomorrow, Keir Starmer would not wait six months to tell the public what he was going to do about it.’

Every incautious remark and U-turn has caused measurable damage. When Starmer reversed plans to cut winter-fuel payments for pensioners, ten-year gilt yields jumped sharply. Had that increase been sustained, it would have added an estimated £2.1 billion to debt-interest costs over the coming years. When the government backed away from proposed cuts to disability benefits, yields spiked again – representing more than £5 billion more in interest. When Andy Burnham criticised the government as being ‘in hock to the bond markets’, it added another £2.9 billion to projected debt servicing. Then when the Financial Times revealed that income tax rises were off the table, gilt yields jumped again – their sharpest spike since July – this time representing a further £5.5 billion in future interest payments.

The depth of the debt crisis is revealed in soon to be released research from the TaxPayers’ Alliance, which finds that UK government net debt rose by nearly 18 percentage points in the five years to 2024, compared to just 0.7 across other advanced economies. It now stands at nearly £3 trillion gross (or 101 per cent of GDP). Getting that down to 60 per cent – considered a level which doesn’t crush growth – within a quarter of a century would require the state running an annual surplus of 2 per cent every single year. In cash terms, that’s £122 billion in cuts this year alone.

It’s not just debt that is the problem. RightMove says Budget speculation has hit the housing market, with asking prices down 1.8 per cent in November (reminiscent of the time in 2008 when Gordon Brown knocked 20 per cent off housing market activity by briefing that he was considering a cut in stamp duty to stimulate demand). Even the Bank of England, usually wary of commenting on government policy, has weighed in. Paul Johnson, former head of the Institute for Fiscal Studies, says: ‘What was the number one reason that it gave for slowing down in GDP growth? Uncertainty about the Budget. What was the number one reason it gave for falling investment? Uncertainty about the Budget.’

Others want changes to the OBR. By law, the watchdog has to deliver two estimates of the state of the public finances per year, but the process by which updates are delivered to the chancellor over a period of six weeks is widely seen as ridiculous. Jeremy Hunt had to find an extra £1 billion in the final week before one Budget because of an OBR statistic correction.

Case sums up the madness: ‘Against the backdrop of huge trends in global security, economic performance, technological revolution and societal shift, the OBR invites the chancellor once or twice a year to land a dodgy, unpredictable jumbo jet on the postage stamp of a highly uncertain forecast. It leaves chancellors fiddling around at the margins of tax and spend – the odd billion here and there take up huge amounts of time in the process and mean nowhere near enough time is spent on the big chunks of the economy and public spending.’

The other problem is that the OBR only looks five years ahead. William Hague this week called for it to adopt a 20-year window to encourage longer-term thinking. Helen MacNamara, the former deputy cabinet secretary, agrees: ‘The five-years horizon is nuts.’ Case adds: ‘Longer-term forecasts with bigger ranges would probably be more realistic. I think you have to remove the spurious accuracy that leads to bad, short-term, spreadsheet-driven decisions.’

Almost everyone agrees that the pre-Budget pitch-rolling has gone too far. In the past, chancellors would make a low-key scene-setting speech a couple of months before the big day (often when announcing the date) and an equally low-key briefing to one or two financial journalists about the broad fiscal picture, to ensure no big surprises for the markets. The likes of Geoffrey Howe, Nigel Lawson and Ken Clarke then actively sought to disappear, mainly to minimise speculation and protect whatever big stories they had for the day. The Treasury would then surface the Sunday before with trails for the main papers.

Somewhere in the coalition period, the notion took hold that too many good stories were being wasted, and a fortnight of coverage became the norm. Reeves has taken this to the point of absurdity. A former Treasury official says: ‘I doubt that even the architects of this strategy could explain what they were trying to achieve, or why they thought this was a sensible way to do it, but this surely has to trigger a change in approach.’ Ken Clarke has called for a return to ‘purdah’, where ‘for any minister, political adviser, civil servant, to breathe a word about what might be in the Budget was a kind of hanging offence’.

Good practice in other countries suggests greater transparency is the answer. In the Commons on Monday, Daisy Cooper of the Liberal Democrats suggested a ‘move to the Swedish system in which the Swedish parliament gets to debate the government’s Budget, proposes alternatives and amendments before it is finalised, and gets a proper period of scrutiny and accountability in the months that follow’. Case agrees: ‘The Swedes have a very good process.’

In New Zealand, the government sets out its strategy, then its tactics, and then it designs and reviews its policies all in advance and in public. Ireland, Australia and Canada publish ‘exposure drafts’ of tax proposals under consideration. Martin Fraser, who was cabinet secretary in Dublin for a decade before he became Irish ambassador in London, tells friends on the diplomatic circuit that he wanted to scrap fixed Budget statements altogether.

‘The Budget should not be a rolling drama of leaks, endless kite-flying and self-inflicted market jitters’

Reform will be difficult because of the overweening power of the Treasury. A recent report by MacNamara called for the creation of a prime minister’s department which could ‘bring HM Treasury’s spending control and decision-making functions alongside Downing Street’s policy and delivery functions’. She says now: ‘Should you split the Treasury? The answer is yes, of course you should. Keep the chancellor as responsible for fiscal policy and macro economic policy. What the chancellor should be focusing on is how we’re going to actually grow the economy. It’s decisions about taxation which drive growth.’

The role of the chief secretary in deciding how much money each department gets would be more closely aligned with the prime minister’s political strategy, she argues, if the decisions were made in No. 10, not No. 11. This is different from the Wilson government creating a department of economic affairs, since the beneficiary would be the First Lord of the Treasury, not a rival minister.

Case almost persuaded Johnson to take that path, until the Treasury, in the form of chancellor Rishi Sunak, vetoed the plans. ‘To create a prime minister’s department properly you have to break up the Treasury, take powers off the Treasury. I advised Boris to do it, and he was ready to do it. Then he had one conversation with Rishi and changed his mind. But it would allow you to align political strategy and priorities and government funding.’

This is the nub of the debate. Budgets are a force multiplier, a theatrical moment for governments clear on what they are about. But when there is no clear political strategy, as now, with Starmer trapped between the contradictory views of the markets and his MPs, the Budget becomes a minefield.

‘Budgets are an organising moment for the domestic policy of the government,’ says George Osborne. ‘They are a powerful political instrument for a strong prime minister. The stage is there for the chancellor to shape the future of the country.’ He doesn’t want to criticise Reeves, but notes: ‘You knew with Gordon Brown that he would build his political argument from Budget to Budget. The second Budget shouldn’t be a complete mystery.’

Yet that is where we are. Just as Theresa May seemed to work out what she thought about Brexit only by making speeches about it, Starmer appears to have devolved the responsibility for defining his premiership to Reeves. MacNamara adds: ‘It should not be the case that you are trying to work out what your government is there for on the back of a fag packet, in the pre-Budget period.’

Mel Stride, the shadow chancellor, says: ‘The answer isn’t to abolish the Budget, it’s to rebuild trust in it. The Budget should not be a rolling drama of leaks, endless kite-flying and self-inflicted market jitters.’

The obvious conclusion is that one budget tradition Reeves must revive is drinking hard liquor at the despatch box. Come Wednesday, we’re all going to need a stiff drink.

Comments