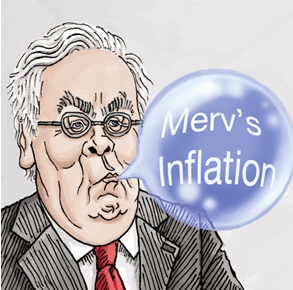

We at The Spectator have not had much company in criticising Mervyn King for the failure

of his monetary policy. The Bank of England governor has a status like the Speaker used to: someone whose position must command respect, otherwise the system collapses. And yet there are Octopuses

with a better track record in inflation forecasting. People have been repeating that the Bank’s independence is a great success for so long that it has become a truism. Why? We’ve just

had a huge crash, the result of a credit bubble – fuelled by dangerously low lending rates. And the recipe for restoration? Even cheaper debt, with resurgent inflation.

We at The Spectator have not had much company in criticising Mervyn King for the failure

of his monetary policy. The Bank of England governor has a status like the Speaker used to: someone whose position must command respect, otherwise the system collapses. And yet there are Octopuses

with a better track record in inflation forecasting. People have been repeating that the Bank’s independence is a great success for so long that it has become a truism. Why? We’ve just

had a huge crash, the result of a credit bubble – fuelled by dangerously low lending rates. And the recipe for restoration? Even cheaper debt, with resurgent inflation.

The British economic commentators agree with King that inflation is not a problem; 0.5 percent base rates are somehow appropriate for an economy now growing back at a trend rate of 2 percent a year. But, overseas, bondholders are asking why they should lend money to Britain if the interest is less than the inflation rate.

We are in the realms of negative interest rates. UK gilts have recently been delivering dismal “returns” of minus 1.9 percent – the worst in Western Europe. International investors look at British inflation rates, and see that Britain is

second only to Greece for runaway inflation. And they listen to Mervyn King nonchalantly declaring that – as a result of this inflation – living standards are going down at the fastest rate since

the 1920s. He discusses this with the same air of resignation that he discusses the weather. Britain has a major inflation problem, a government that says ‘blame the central bank’ and a

central banker who doesn’t much care. There is increasing talk that it’s a bluff; that he has decided to inflate his way out of a debt crisis. But to do so, he needs to keep pretending

to be surprised by inflation.

So, the New York Times is the first major newspaper to look at King. Its article, ‘A crisis of faith in

Britain’s central banker‘ says what all too many British newspapers still refrain from saying – that King’s being proved wrong. He keeps predicting that inflation will come back,

and he’s always wrong. He has offered no particular insight into the causes of the crash, and has incredible faith in the only trick that policymakers have to deal with economic hardship:

lower interest rates, more debt, more spending.

The shock GDP figures for Q4 will soon be exposed as a blip. I suspect they’ll both be revised up by the ONS and shown to have been rebounded by strong January figures. Interest rates need to

rise. Better they do so gently now, than sharply in a panic later. As I’ve said before: King should either tackle inflation, or make way for someone who can. The New York Times is saying what

many in the City are thinking: that Britain’s central banker is losing credibility. And, as our vast borrowing needs rest on his credibility, it’s a dangerous situation for us all.

Comments