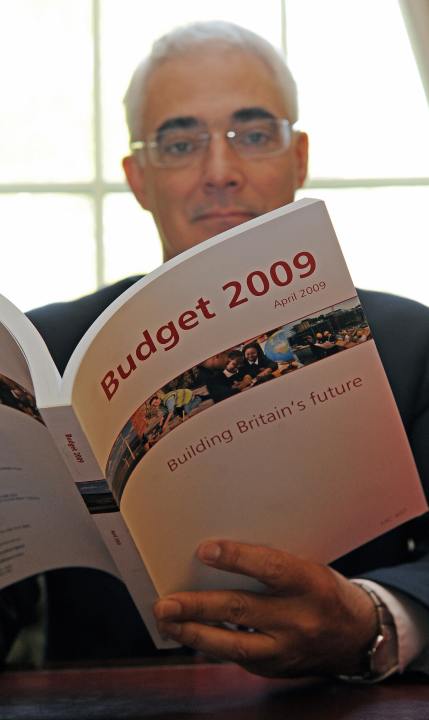

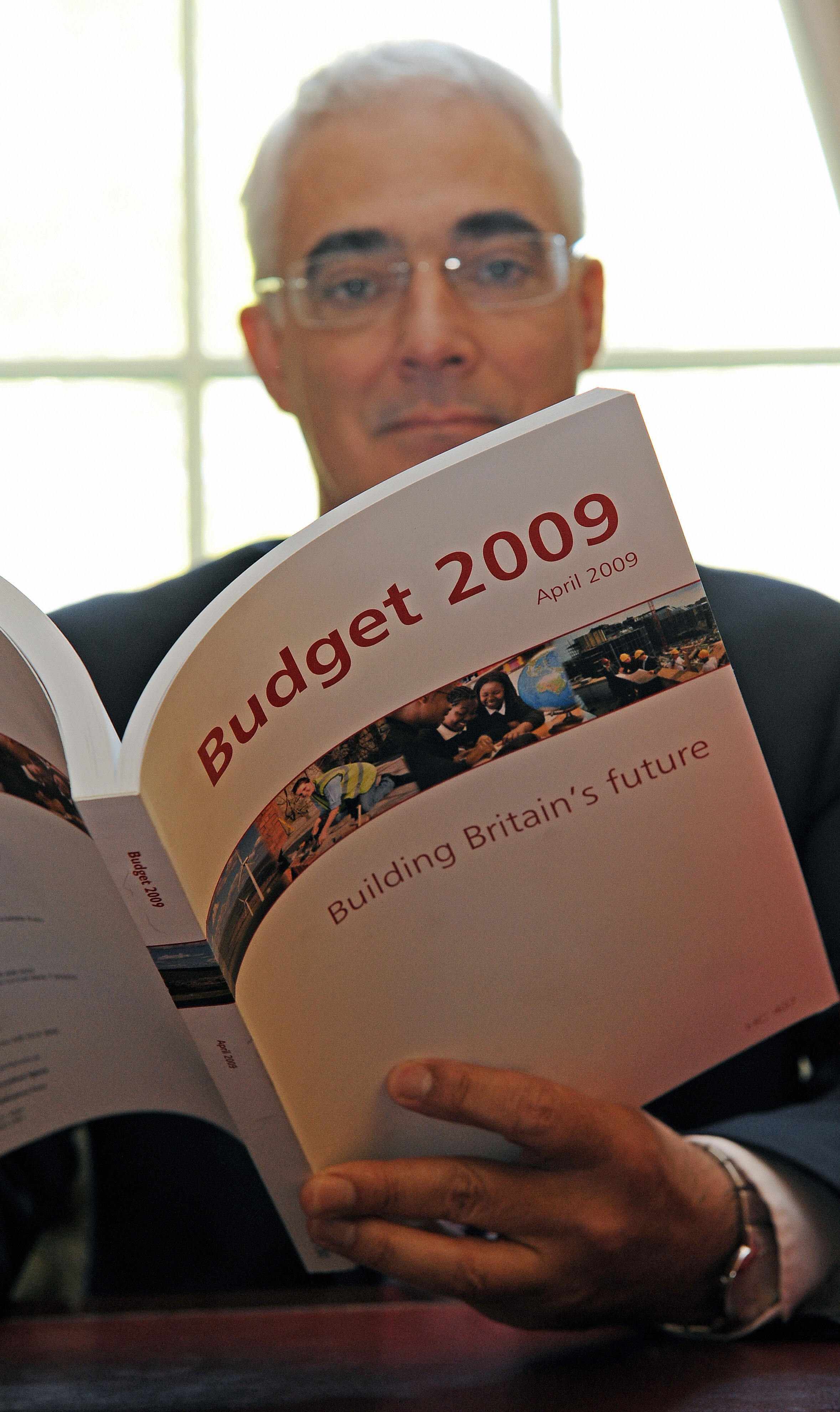

Debt, debt, debt. That’s the real story of today’s Budget, as Brown has created an even worse mess than expected. Sure, £606 billion of borrowing over the next 4 years isn’t all that surprising, but Darling’s optimistic growth forecasts are. They mean that the Treasury is probably overestimating tax receipts for the next few years, and – in turn – that the real borrowing figures will be even worse than those in the Red Book.

Debt, debt, debt. That’s the real story of today’s Budget, as Brown has created an even worse mess than expected. Sure, £606 billion of borrowing over the next 4 years isn’t all that surprising, but Darling’s optimistic growth forecasts are. They mean that the Treasury is probably overestimating tax receipts for the next few years, and – in turn – that the real borrowing figures will be even worse than those in the Red Book.

Something tells you that the government knows this. As Robert Peston points out over at his blog, gilt sales are forecast at £220 billion this year – well above the £180 billion or so that most analysts thought we’d see. The markets will be wondering: just why does the Treasury need to borrow so much now? And the response to that question will have investors trembling.

UPDATE: The Red Book is using trend growth of 2.75 percent for the public finances. But, crucially, even this is exaggerated. HMT independent forecasts have 2.2 percent for 2011; 2.6 percent for 2012; and 2.6 percent for 2013.

UPDATE 2: Scratch the first update. The Treasury is using 3.25 percent growth assumptions for public finances from 2011 onwards. Absolutely unbelievable.

Comments