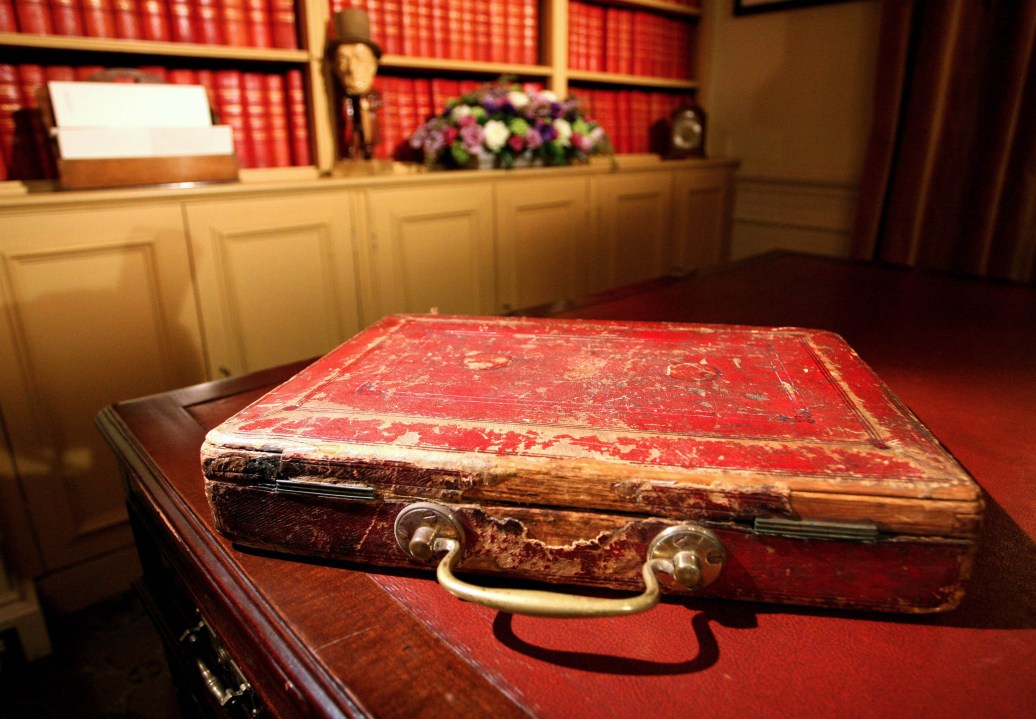

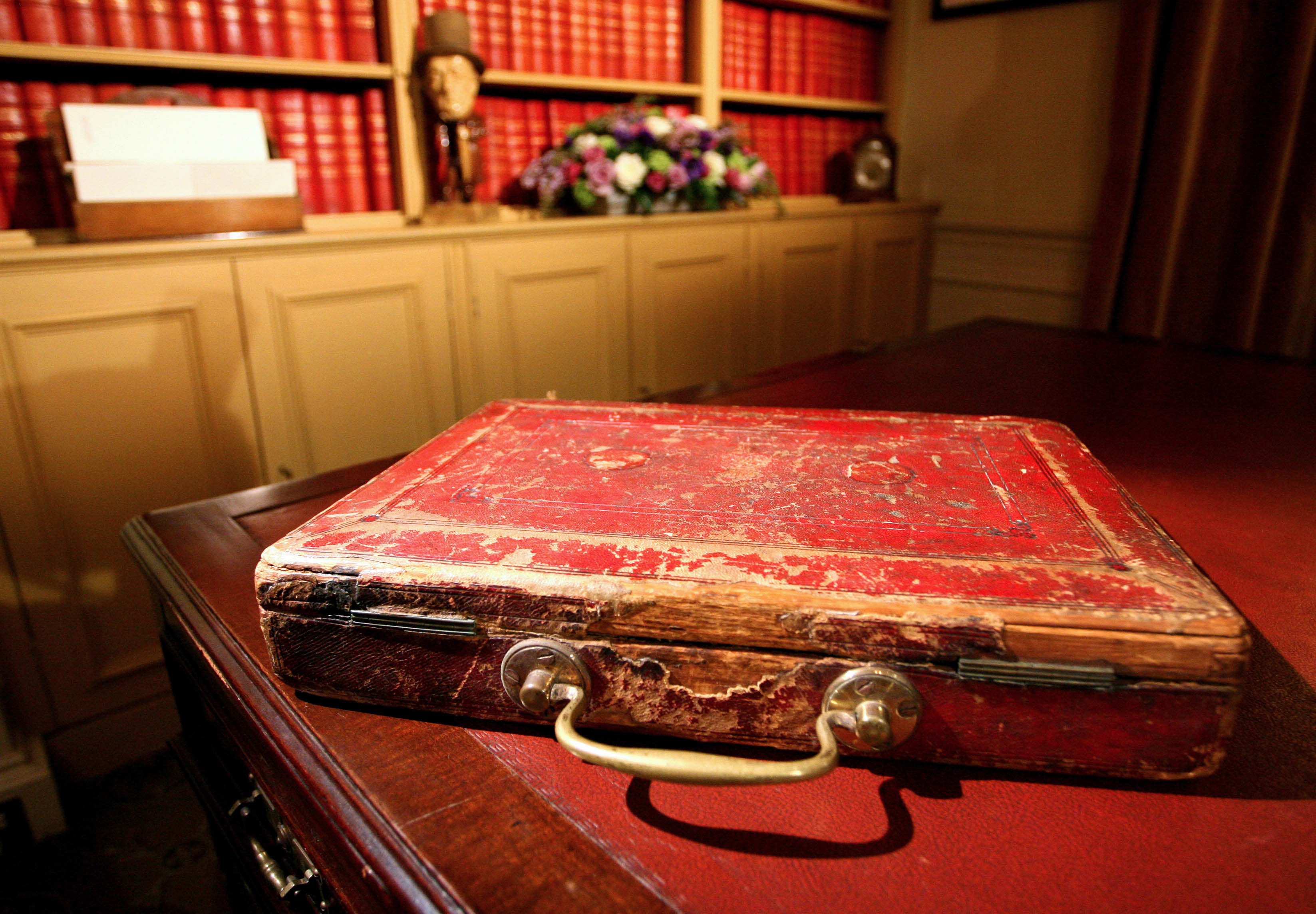

The opening remarks of Alistair Darling’s Budget speech showed that the Chancellor is well aware of Britain and the world economy’s ongoing economic woes. How troubling and disappointing, then, that his first Red Book will only make things worse.

The opening remarks of Alistair Darling’s Budget speech showed that the Chancellor is well aware of Britain and the world economy’s ongoing economic woes. How troubling and disappointing, then, that his first Red Book will only make things worse.

There are four key failings. First, the Budget raised taxes yet again, the very worst thing to do at the start of an economic downturn. £1.5 billion extra will be raised from alcohol over the next three years, £1.6 billion from cars (even with the delayed fuel duty rise), and £1.7 billion extra from businesses, much of it in the familiar form of anti-avoidance measures.

Second, it failed to modify previously announced tax rises. An 80 per cent increase in the capital gains tax rate paid by many businesses will still go ahead, despite the concession on entrepreneurs’ relief. The £30,000 non-dom charge will stay, although Mr Darling offered a small consolation not to make any further raids for this parliament and the next. Small businesses will also be hit by the increase in the small companies rate of corporation tax. Britain’s economy is not well served by higher taxes on productive investment, on highly skilled and internationally mobile people, and on the small firms that employ almost 60 per cent of the private sector workforce.

Third, the Budget was a contemporary case of “fiddling while Rome burns”. The Treasury should not be wasting its time devising measures on plastic bags when it has made such a mess of capital gains tax and Northern Rock.

Fourth, once again borrowing has surged, up £20 billion over the next four years compared with the estimate in the Pre-Budget Report just five months ago.

The Government has only itself to blame for lacking room for fiscal manoeuvre. It failed to save during the good years, leaving Britain dangerously exposed at the start of the bad. Can Alistair Darling really believe that Britain’s economy is “better placed than other economies to withstand the slowdown in the global economy”, when Britain’s deficit is the worst in the developed world?

One interesting point for future political debates that came up in the Chancellor’s Budget speech was that public spending is pencilled in to grow at 1.9 per cent in real terms from 2011, when the three-year Comprehensive Spending Review period ends. If that turns into a firm commitment, it seems likely that the Conservatives will pledge to follow it. So the political argument will then hinge on how much of the remaining “proceeds of growth” will be used to cut taxes, and how much to cut borrowing. Judging by Philip Hammond’s comments on Monday, it seems that tax cuts will be low down the list of priorities. If the Tories win the next election, and unless the Party’s big government leaning changes, expect little in the way of overall tax relief in their first parliament.

Overall, today’s performance shows that Alistair Darling seems to have learnt little from the failures of his predecessor at No. 11. Tax rises to pay for higher welfare spending, more complexity, higher borrowing and yet more meddling changes – hardly a coherent response to the current economic crisis.

Matthew Elliott is Chief Executive of the TaxPayers’ Alliance [TPA]. Corin Taylor is the TPA’s Research Director.

Comments