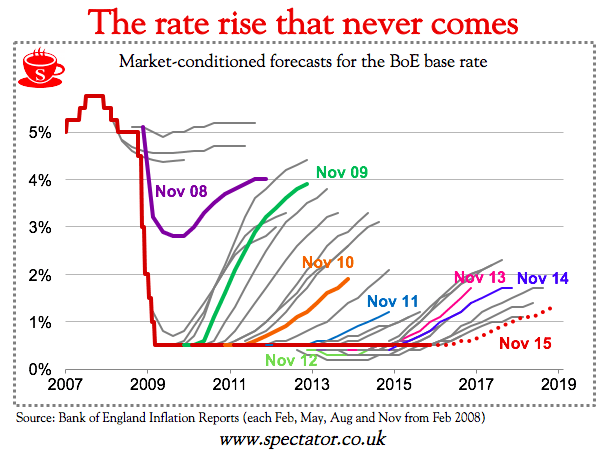

Is there anything more predictable than a Mark Carney press conference? The poor sod in Groundhog Day got to enjoy more variety and suspense. Explaining why, yet again, the Bank of England had decided not to raise interest rates, Governor Carney told us that rates could rise ‘faster than markets expect’. That wouldn’t be all that hard, given that markets have pretty well given up on Carney ever shifting rates. Maybe they believed him the first time, in June 2014, when he said that a rate rise could come ‘sooner than markets expect’. Maybe they were still inclined to take a little bit of notice in July 2015 when he told us that he expected rates to rise over the next three years to reach around 2 per cent. But now Carney has become a bit of a yawn.

The markets have gone to sleep. The FTSE flatlined throughout Carney’s press conference and interview on the World at One. It took more guidance from the Archers than it did from Carney. We know the score by now: Carney doesn’t want to raise rates, probably ever. He will go to his grave with ‘0.25 per cent’ chiselled into his headstone. But he will keep trying to give us the impression that he is expecting to raise rates at some point in the foreseeable future, just to try to keep savers and investors happy.

Today’s conference will be widely reported for Carney’s remarks on Brexit, claiming that it is inevitable that it will make us poorer than we would otherwise have been – a belief he couldn’t suppress during the referendum campaign and which he has tried to sustain ever since. This was in spite of being wrong about a post-referendum slowdown – a belief which led to the bank of England’s sole interest rate change on his watch, a cut from 0.5 per cent to 0.25 per cent.

But there is little point in Carney trying to tell us that Brexit is the reason why rates are remaining at rock-bottom levels. He wouldn’t have wanted to raise them anyway, in spite of inflation at 2.6 per cent, in spite of consumer credit roaring back to where it was on the eve of the crash in 2007.

None of this means, however, that rates won’t rise. For all the importance put on Carney’s press statements it isn’t down to him alone — as rates are, of course, decided by a committee. The Monetary Policy Committee voted on this occasion by 6-2 to leave rates unchanged. Carney wasn’t even involved, as he only provides a casting vote in the event of a tie. All of which begs the question: what is the point in the Governor giving forward guidance on interest rates at all? He might as well have taken the day off.

Comments