Last Thursday Mervyn King said ‘the case for further monetary easing is growing’, and today’s surprise inflation figures give the Governor and his policymakers more leeway to introduce the next round of QE, probably as early as next month.

Consumer price inflation fell to 2.8 per cent in May from 3.0 per cent in April, below analysts’ average forecast of a flat reading. It’s the weakest monthly inflation since November 2009, with the main contributors being falling food and oil prices. This is good news indeed, especially given that inflation has been – and still is – eroding savers’ earnings by about 8 per cent over five years. Let’s not forget that CPI is still stubbornly above the Bank of England’s official target of 2 per cent, with inflation still not pulling back as quickly as the BoE itself initially predicted.

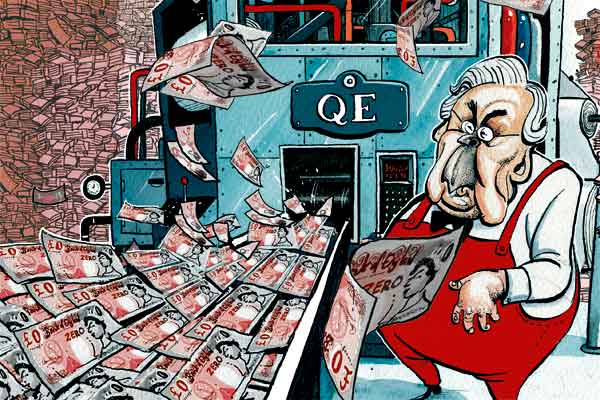

Still, the Governor appears convinced that, especially with Eurogeddon expected to bear down on the UK economy any minute, more monetary stimulus is in order. ING’s Rob Carnell expects the BoE’s ‘asset purchase scheme’ to be expanded to £450 billion from the £325 billion already put in so far; RBS and Citi economists think the next bout of QE may occur next month. Says Citi: ‘The Monetary Policy Committee is likely, in our view, to resume QE in July, raising it a lot further in coming quarters.’

If the Bank of England does oblige, it probably won’t be the only central bank to do so in the next few months – while the US Federal Reserve is unlikely to introduce more QE this week, it’s likely to extend its ‘Operation Twist’, and the EU itself may well carry out some form of monetary easing, among a slew of (increasingly desperate) measures. We seem to be trying to cure the problem of cheap funding with – more cheap funding.

Comments