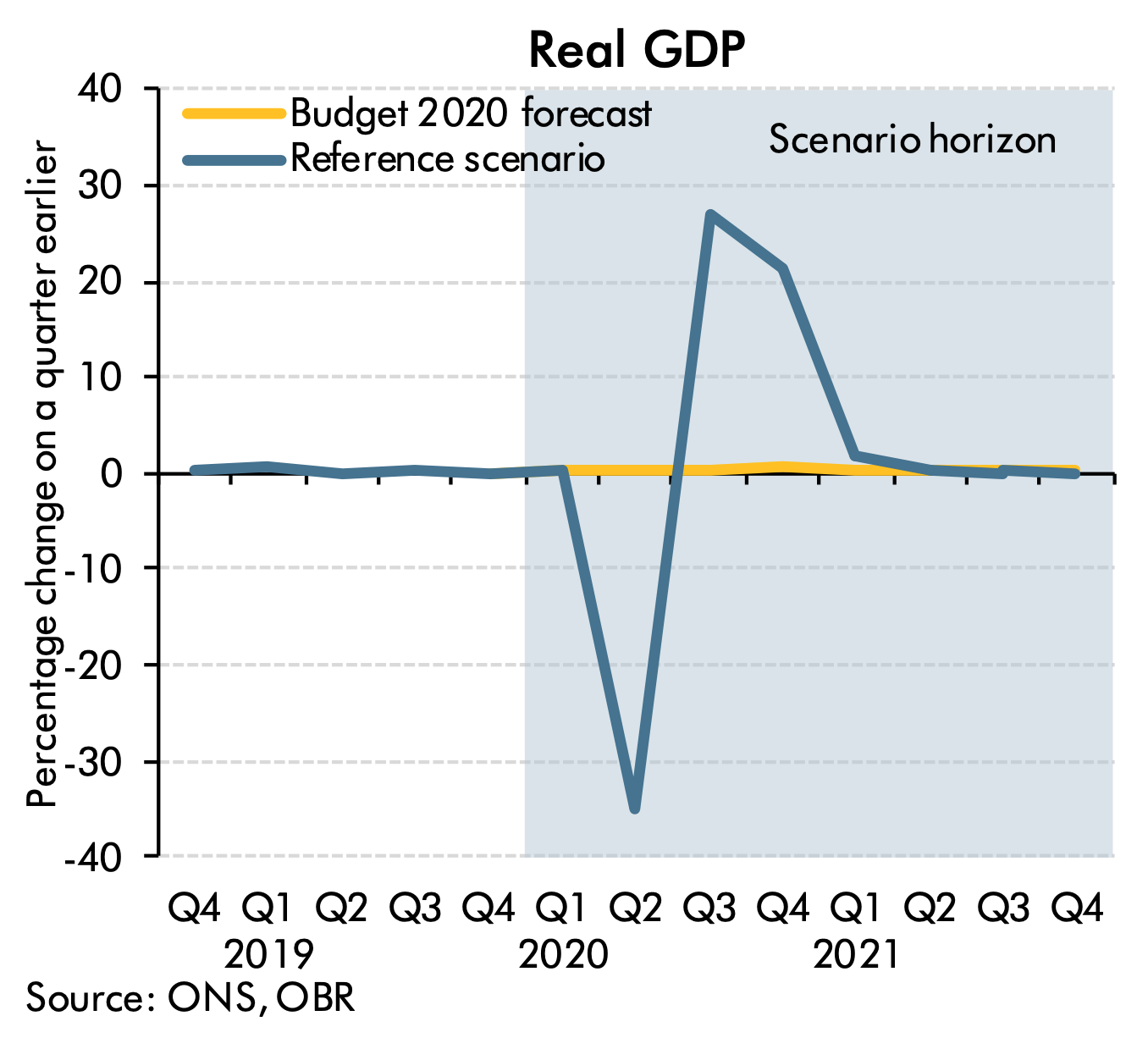

Just days after the Office for Budget Responsibility announced its economic forecasts in March, the reality of Covid-19’s impact on the UK economy sunk in, and its projection was rendered completely obsolete. A month later, with a clearer picture of the toll the virus and lockdown have taken, the OBR today released its new coronavirus analysis, showing a staggering 35 per fall in real GDP in the second quarter, and an unemployment spike of up to 10 per cent – that is, 2 million additional people out of work. A long way off its Budget 2020 forecast for the year:

As the graph above shows, the OBR’s scenario predicts a ‘V-shaped’ recovery – a quick economic downturn followed by a quick upturn once the lockdown measures are lifted – but it is not predicting a recovery in full. The start of a GDP uptick in Q3, followed by ‘pre-virus levels’ of GDP in Q4 would still mean a 13 per cent fall in annual GDP in 2020 – the biggest quarterly economic contraction since 1908, worse than the financial crash and both world wars. And even if the economy bounces back quickly, unemployment is not expected to fall at the same rate, despite unprecedented measures from the Treasury to keep people in employment.

The UK is also heading for its ‘largest single-year deficit since the second world war’, with public sector net borrowing set to increase by £218bn this financial year – confirming speculation that a decade’s worth of austerity measures to recover from spending during the financial crash has been completely wiped out and a staggering budget deficit reinstated. The combination of low GDP and high spending is estimated to take UK debt figures over 100 per cent of GDP, dropping back to 95 per cent by the end of the year – a financial danger zone that could result in grave long-term problems.

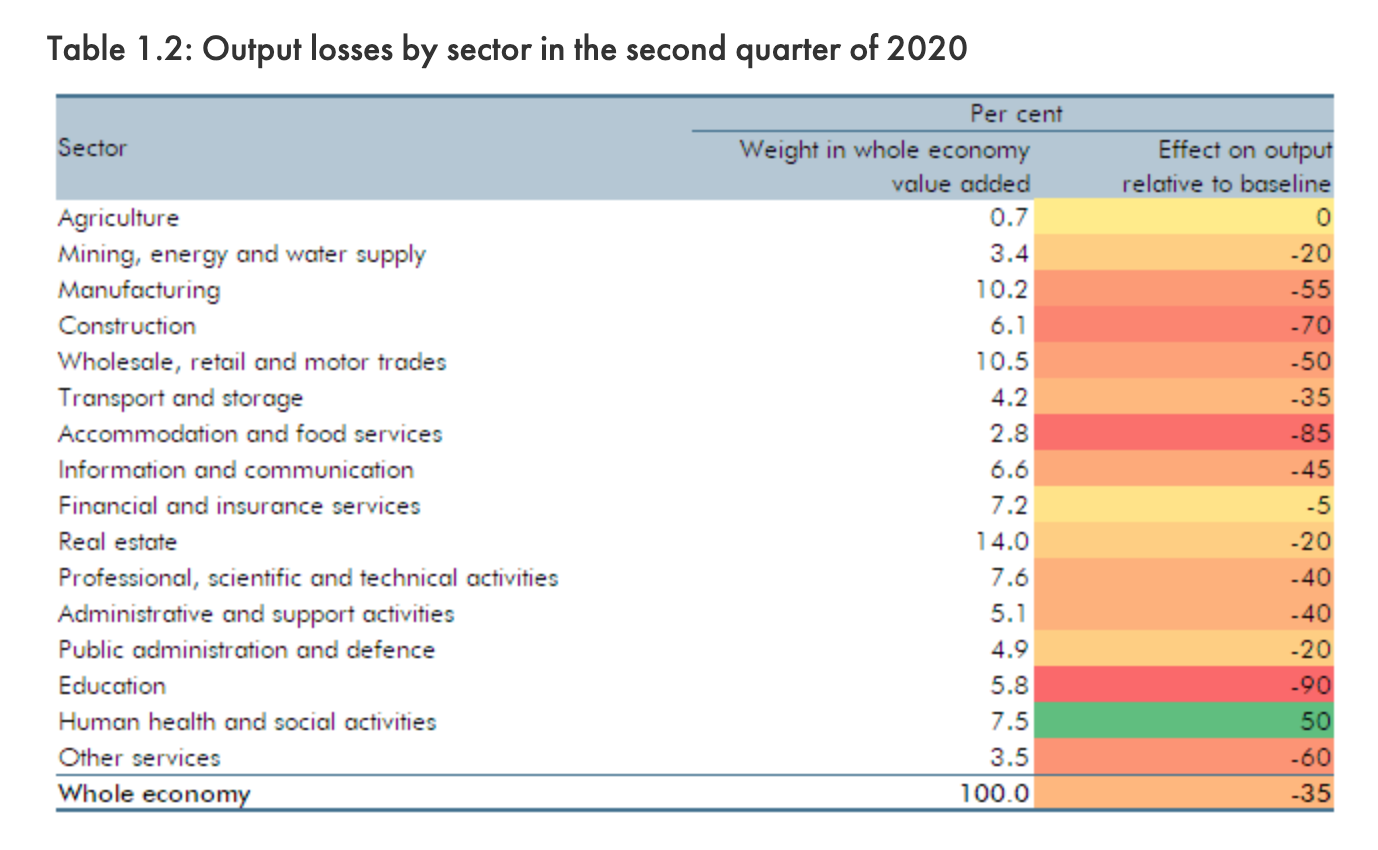

While the temporary hit to the UK economy is extraordinary across the board, not all sectors will be hit equally. The OBR expects manufacturing, construction, retail, travel and food industries will see the biggest losses relative to their baseline, with the education sector the worst affected (a worrying prediction for multiple reasons).

These calculations assume a three-month lockdown, followed by an additional three months with only some restrictions lifted. These assumptions are subject to change as our understanding of the virus – and our answers for it – develop. But while there’s still plenty to discover, we don’t need hindsight to confirm that in just a month, Covid-19 has outpaced a century’s worth of quarterly economic contractions.

The figures make for sobering reading – for all of us, but especially ministers, who are set to discuss an extension of the UK’s lockdown measures today. While an extension is thought to be inevitable, the trade-offs revealed by today’s analysis have become undeniable. Striking the right balance between the public health agenda and the knock-on effects of the lockdown is only growing in importance.

Comments