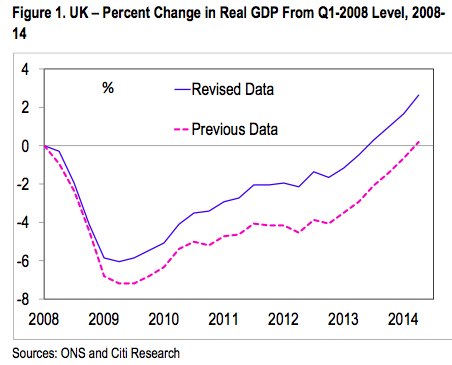

Why do economists use decimal points? To show that they have a sense of humour. Never was this old gag more relevant than when considering the data on Britain’s economic output, or GDP. A couple of months ago, the ONS announced that the economy had returned to its pre-crash levels – the FT splashed the news. Today, the Office for National Statistics admits that after improvements to its methodology this actually happened last year. The old picture, compared to the new, is above – produced by Michael Saunders at Citi (pdf here). The ONS has not made an error, it is simply applying new methodology under instruction. But it suggests Osborne has been making more progress than he had been given credit for.

Needless to say, this revision affects other metrics. Before, for example, there had been concern about the apparent refusal of British businesses to invest in the economy – well, now, it emerges they have not been so hesitant.

This also has an effect on debt – which, it now emerges, is down to levels not seen since 2003. Suddenly, the huge jobs growth of recent months makes more sense. (And having interest rates nailed to the floor and distorting asset prices makes less sense.)

Why has economic history been rewritten? The ONS continually crunch and re-crunch the numbers. But there’s also been a once-in-a-generation change in the accounting system used to work out the figures. It means that national debt is up by £100bn, that illegal drugs and prostitution count towards GDP, and so too do R&D, military weapons systems and pensions.

Anyway, next time there’s a fuss about whether GDP is 0.1 points higher or lower than had been expected, let’s remember massive revisions and methodological changes like this. Not for nothing is economics called ‘the dismal science’. GDP estimates are more scientific than pinning a tail on a donkey – but not, as we see, much more.

Comments