Rhetoric aside, what’s the difference between left and right in British politics? You won’t catch either party quantifying it, because the answer embarrasses both. The ever-cautious

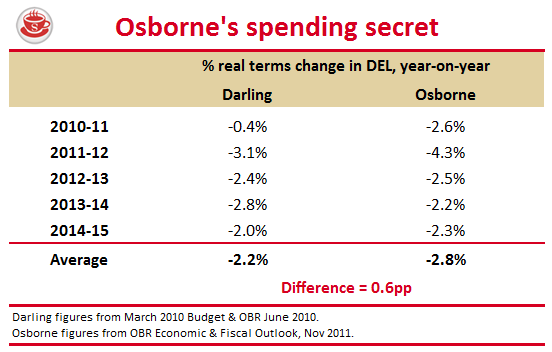

George Osborne is cutting just 0.6 percentage points a year more from government departments than Labour planned to (see table, above). The great joke is that the difference between the two parties

is actually within the margin of error. Government is a gargantuan machine that just can’t be controlled to that degree of precision: a billion quid is, to Whitehall, a rounding error.

Today’s public finances have demonstrated that. The UK government had actually intended to borrow around £102 billion at this stage in the financial year, and instead it has borrowed

£93 billion. This is due to less spending, rather than more tax receipts. So Osborne has, in theory, £9 billion extra to play with in next month’s Budget. He’s also paying far

less on debt interest than he would have were it not for QE (which artificially lowers the rate at which government borrows). In the past, Osborne has cheekily taken low UK gilt yields as proof

that the markets back him: I hope he doesn’t this time. It’s proof that, if the Treasury-owned Bank of England buys hundreds of billions of Treasury debt, the price will be tilted

downwards. (I suspect you won’t see many Treasury-backed studies looking at what the government’s borrowing rates would be if it wasn’t for QE, and the fact that so many UK banks are obliged by the

government to buy its debt, thus further robbing pension funds).

But if today’s public finance figures show anything, it’s the capacity for far more savings to be made by the government machine. It is spending £9 billion less, without even meaning to.

Imagine how much more savings could be found if the government were to deliberately try to save more — and use the money cut taxes and get the economy growing again.

Comments