Reading today’s newspapers, it seems that the biggest decision of Osborne’s mini-Budget has already been made. Evaporating growth means lower tax revenues, so the choice is between protecting his deficit reduction plan or keeping total spending cuts at less than 1 per cent a year.

Increasing savings to, say, 1.3 per cent a year would mean he could easily meet his deficit targets. But it seems the decision has been taken to borrow even more. In his March budget, Osborne laid

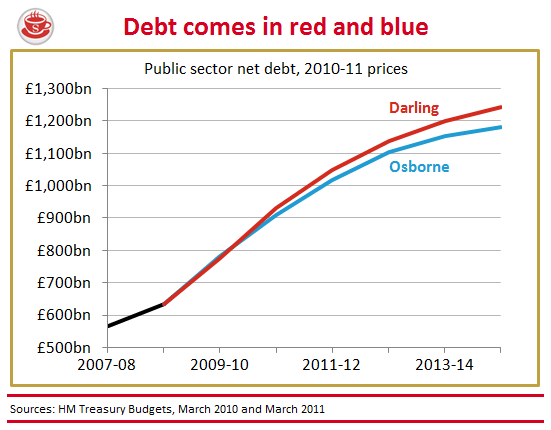

out plans to increase government debt by 51 per cent over the course of a parliament – lower than the 60 per cent that Labour had planned.

It now looks as if Osborne will increase debt by even more than that 51 per cent. Tax revenues are disappointing (corporation tax is down 7 per cent last month, against the 14 per cent annualised

rise the Treasury was expecting), so this means more cuts or more debt. The government’s language very much suggests that, like its

predecessors, it’s choosing more debt.

But will the debt markets accept this? In going for an only-slightly-modified version of Darling’s deficit reduction plan (slow-mo departmental cuts averaging 3 per cent a year, and a long timetable to eliminate the deficit) Osborne has chosen credibility over ambition. Giving himself seven years to balance the books is slow enough to be credible.

And this credibility is one of the most valuable currencies in Europe: for now, it means his government can borrow at 2.2 per cent. In recent weeks, France and Spain have seen their borrowing costs rise. The Italian crisis, remember, was triggered by a change of sentiment in the bond markets. If they get the jitters, for whatever reason, the cost of borrowing shoots up.

And is there more to cut? The monthly figures are out this morning. They only show total current spending (this includes the cost of welfare and the lower-than-expected cost of debt interest) but

it’s still pretty hard to claim Osborne has been radical. He may soon wish that he had been.

Comments