Rachel Reeves may finally have seen sense. A report in this morning’s Financial Times suggests she is ‘exploring’ performing a 180 on the changes to inheritance tax rules which meant non doms would have to pay the death tax on their global assets – even on wealth earned before they came to the UK.

As I explained in our magazine cover piece last month, the fact that these changes – which came into force in April – would apply retroactively is what really sent non-doms over the edge and led them to flee the country in large numbers, taking their wealth and not insignificant tax revenues with them.

Rachel Reeves has to deal with this mess of her own making

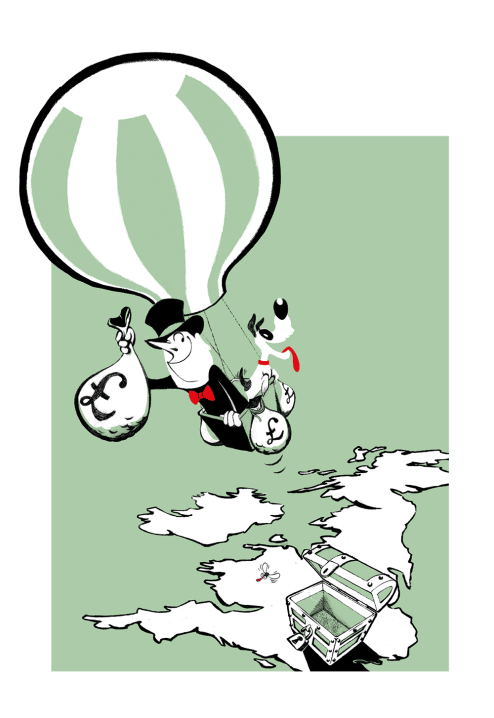

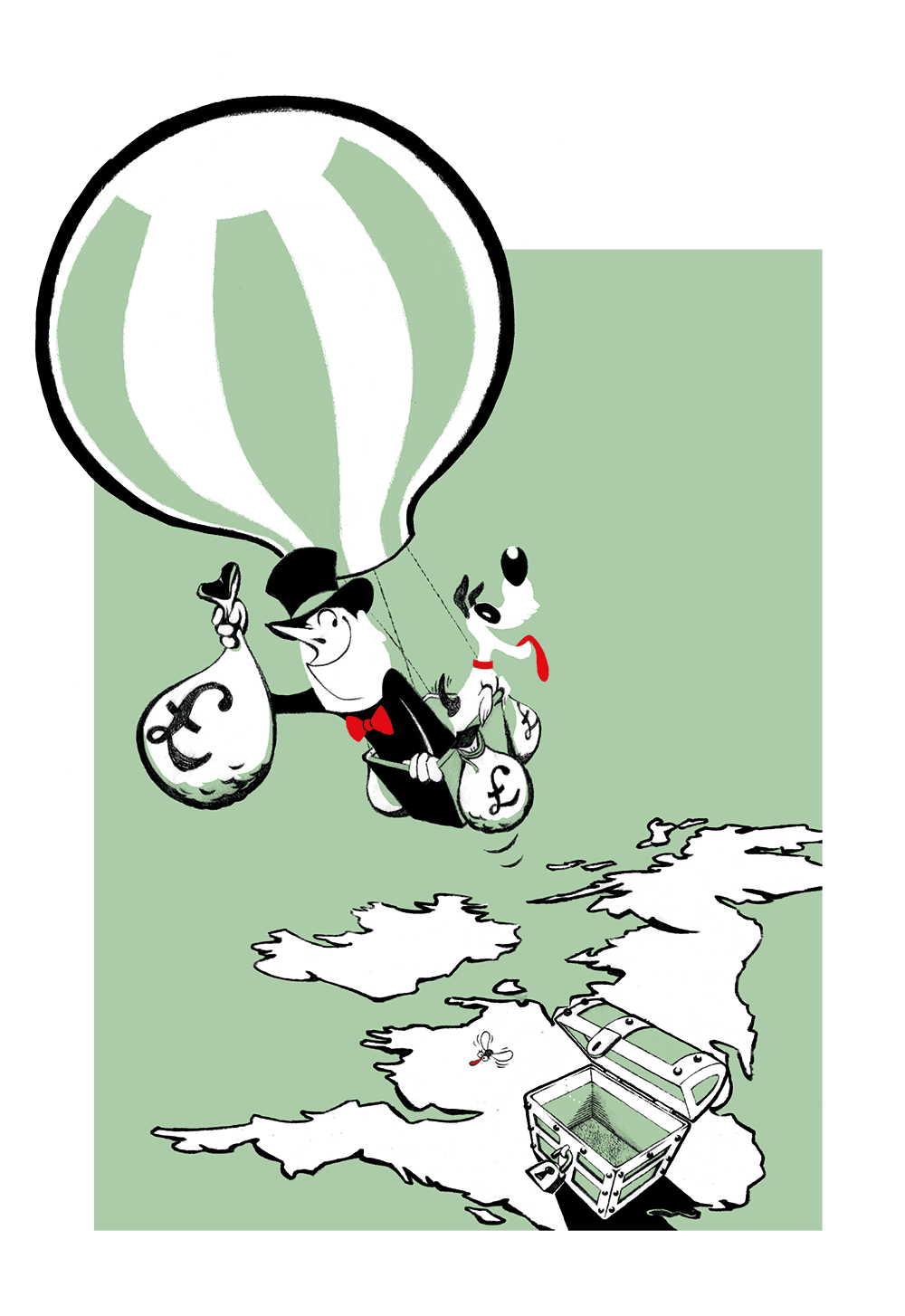

Goldman Sachs’s vice chairman has moved to Milan, the Livingstone brothers to Monaco, the heir to the world’s largest brewing company has gone home to Belgium, and Aston Villa’s owner has shut his London office and moved 40 staff to Abu Dhabi. Meanwhile, tax receipts are coming in billions of pounds short of what the Office for Budget Responsibility and the taxman had been expecting. Last year alone, it’s believed that London lost 11,300 ‘dollar millionaires’.

According to the Financial Times report, those lobbying from the City say Reeves is looking for a way to change the rules in a way that makes Britain competitive again for international wealth without it looking too much like a screeching U-turn.

That’s a challenge for the Chancellor, to put it mildly. Last week, some departments had real-terms cuts to their budgets. There is now constant speculation as to whether Reeves’s £9.9 billion headroom will survive through to October or if she will have to hike taxes. In this context, it would be politically very difficult to implement what would be seen as a tax cut for the uber wealthy, even if it’s clearly economically the right thing to do.

The scale of that political challenge is demonstrated by the fact that shadow business secretary Andrew Griffith even faced opposition from within his own party when he began campaigning on this issue. He told me:

‘It’s not quite reached the volumes of small boat arrivals, but the queue of wealth creators leaving on her watch is too visible even for Rachel Reeves to ignore. The inheritance tax on global assets will cost the UK and it’s a racing certainty the OBR will insist upon marking their forecasts as the result.’

Even if a U-turn doesn’t happen, the fact that Reeves has woken up to the problem is a vindication for Henley & Partners and Andrew Amoils of New World Wealth, who are behind much of the data that originally raised the alarm on the wealthy fleeing the country. They were pilloried for this, including by the group Patriotic Millionaires UK,who last week claimed the millionaire exodus ‘did not occur’. A few years ago, the Ministry of Defence relied on the New World Wealth data to look at wealth fleeing Russia. What was good enough for the MoD now seems to be being taken seriously by the Treasury, too.

Cracking down on nom-doms has always been a popular policy with voters. But Rachel Reeves has to deal with this mess of her own making. She was warned before the election – and once she’d moved into No. 11 – that the policy risked costing HMT far more than it would bring in. Now it looks like there could be a political cost as well.

Comments