Nothing is more permanent than a ‘temporary’ government tax, as George Osborne is reminding us. When Alistair Darling proposed a 45p rate in 2008, even the Institute of Fiscal Studies said it would lose money – but Darling said it would be ‘temporary’. Brown upped it to 50p, Osborne took it back down to 45p but the ‘temporary’ status has been revoked. The Sunday Times has today splashed on Osborne’s interview with Robert Winnett of The Daily Telegraph, where the Chancellor said ‘I’m very happy with the 45p rate of tax. We’ve got it to a good place where it’s competitive.’ Britain had the highest top rate of tax in the G20, now it has the third-highest. If Osborne is “very happy” with this self-evidently uncompetitive rate (de facto 47 per cent after National Insurance, 53 per cent when the employers’ per cent is included), then it’s an important sign of how fiscal policies have shifted to the left.

To Osborne’s credit, he had wanted to cut the 50p rate to 40p – which would have been genuinely competitive. And also raised more money: as the CEBR research (pdf) shows, the optimal rate top rate of tax in the UK is around 37 per cent…

But the Liberal Democrats said they wanted a Mansion Tax in return. Osborne was up for doing this deal, but David Cameron refused – fearing it would hit Boris’s hopes in the London elections. I’m with Cameron on this one: Britain already has the highest property taxes of any developed economy according to the OECD. The budget surprise was that there was no timetable for dropping to 40p, contrary to the briefings. What had started as a “temporary” 45p tax under Darling has become a non-temporary 45p tax under Osborne. Labour should take heart at this: it’s a genuine political victory for them. In this great politics tug of war, the tax rope has shifted to the left.

What Osborne should have done is keep the 50p, and hold out for the 40p rate. The idea of moving to 40p in two stages was never going work, especially when you consider the heat Osborne has taken for cutting from 50p. He may surprise us all and cut it to 40p pre-election, creating yet another stick with which Labour (and The Sun) will beat him. But I doubt it. It was said at the time – with a nudge and a wink – that ongoing Treasury studies into the responsiveness of the rich will make an empirical case for 40p. This does not stand up to scrutiny. As we pointed out in The Spectator’s Budget briefing (pdf), the Treasury outlined three scenarios on Budget day, none of which make the case for 40p.

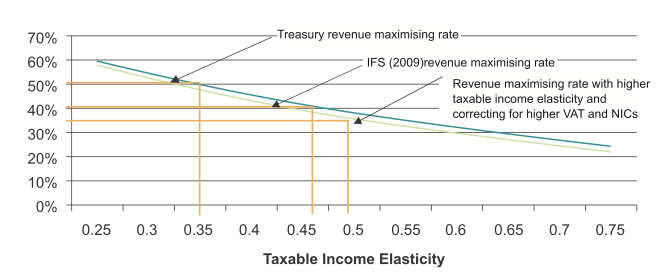

It’s all to do with how responsive you believe the higher-paid are to high taxes, measured by something called the Tax Income Elasticity. The Treasury believes it’s 0.45 right now, but even if they up it to 0.55 then the Exchequer has done the sums in a way to suggest that even this puts the optimal rate of tax at 43p.

Countries need to compete for people in this globalised world of ours – just go to Canary Wharf and listen to the languages being spoken. A top rate of 47 per cent is simply not globally competitive. I have no idea how Osborne can claim otherwise. But he has gone from saying a 45p tax was grimly inevitable to being “very happy” with what is now a 47p tax – so it’s here to stay.

Comments