Donald Trump’s Soprano-like threat that the ‘termination’ of Federal Reserve chairman Jerome Powell ‘cannot come fast enough’ has been headlined as one of his wildest thrusts to date, but is actually one of his most conventional. Prickly politicians always resent unelected central bankers, though they also see them as useful scapegoats for economic trouble.

Liz Truss longed to fire Andrew Bailey from the Bank of England; Gordon Brown gave Eddie George’s Bank its ‘independence’ but took away so much of its power that George nearly resigned; Margaret Thatcher never accepted the most potent modern governor, Gordon Richardson, as ‘one of us’. Trump’s predecessors took fewer potshots at the Fed because they were blessed – in Paul Volcker, Alan Greenspan, Ben Bernanke and Janet Yellen – with a run of excellent chairmen. Powell is also highly regarded in monetary circles but has enraged Trump (who appointed him) by shunning his calls for rate cuts and warning that a tariff war could lead to stagflation.

Powell has a year left of his term and reports say Trump has already tapped another Fed insider, Kevin Warsh, to succeed him. But as the US economy tanks, the President would be smart to keep Powell as a whipping-boy; and even if the Supreme Court permits, he’d be mad to provoke bond market mayhem by sacking him. Then again, as Matthew Parris and I seem to agree, it’s possible Trump really is mad. So frankly anything can happen.

A great time to buy

My wise old City boss Sir Martin Jacomb famously declared that insider share trading was ‘usually a victimless crime’, meaning that stock market dealings are rarely a zero-sum game. So maybe it was OK for Trump supporters to celebrate the fact that he posted ‘THIS IS A GREAT TIME TO BUY!!!’ on Truth Social hours before announcing the tariff pivot on 9 April that sent US stocks soaring. Many of his core supporters being a bit dim, he even helpfully appended his initials ‘DJT’, which is also the ‘ticker’ code for Trump Media & Technology, the Nasdaq-listed company (of which his trust owns half) whose shares have since risen by a quarter.

The noisy Republican congresswoman Marjorie Taylor Greene is one of those accused of profiting from ‘buying the dip’, while Trump has lashed out at a London hedge fund, Qube, which had the temerity to take a short position in Trump Media shares as a bet that they will fall again. And attention has turned to two lesser-known Nasdaq stocks, Unusual Machines and Dominari, whose prices soared for no obvious reason around the respective board appointments, with share awards, of Donald Trump Jr and his brother Eric.

‘No reason to believe [anyone] breached any duty,’ says Unusual Machines. But there’s a pattern in this and so much else in Trump-world. The deal is what matters, duty is for wimps, you’re with us or you’re nothing. The victim is the rules-based order of the civilised world.

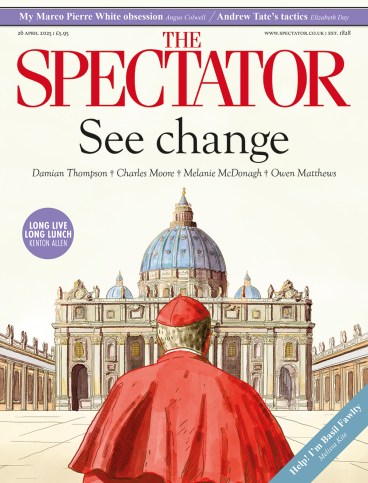

The Pope and the devil

Apropos of which, what might the late Holy Father have said to J.D. Vance? ‘Bless you, my son, but for humanity’s sake please consider becoming a Trappist monk’ would have been good. Happily for Pope Francis, who died less than 24 hours after their brief meeting, there wasn’t time for the Vice-President to say much at all, let alone start an argument about capitalism.

Throughout his pontificate, Francis was criticised by free-market economists for his fundamental view that ‘the devil enters through the pocket’ – formed in the corrupt and failing economic milieu of Argentina when he was a young Jesuit priest. Later he referred to financial speculation as a contagion on healthy savings and investment; more controversially in 2013 he declared ‘We don’t want this globalised economic system that does us so much harm’, in defiance of those who believe that system (as the Catholic scholar Philip Booth riposted) ‘has been responsible for the most rapid reduction in poverty in the history of the planet’.

The Pontiff and the former venture capitalist Vance would probably have disagreed on the positive impact of capitalism in general. But they might have found common ground in dislike of globalisation – from opposed points, concern for the world’s poorest people on one side, advantage-seeking for the world’s wealthiest nation on the other. And the truth is that neither Vance nor his President nor the otherwise saintly Francis will be remembered by history for their basic grasp of economics.

Cabs and clubs

Last autumn I longed not to have to write about Rachel Reeves. Now I dread having to type the name of America’s President. So in this holiday lull let me turn away for one item and praise two aspects of London life. The first is the traditional black taxi and its driver’s mix of ‘knowledge’ and pungent conversation. Hounded by Uber, emission rules and the price of electric cabs, the fleet is shrinking; the Daily Telegraph predicts there could be none left by 2045. Ominously, there’s rarely a queue for them even at King’s Cross station. So I urge you to hail one today – and for fun, ask the driver’s opinion of Sir Sadiq Khan.

Let me also praise London clubs, prompted by a Financial Times report that non-doms fleeing Labour taxes are being advised to resign from Soho House and 5 Hertford Street lest HMRC cite their memberships ‘as evidence they still have strong ties to the UK’. Having no fortune to hide, I confess I’ve enjoyed the roof terrace of Soho House in the Strand and the seafood risotto at 5HS. The Savile in Brook Street is a haven of elegance; the Beefsteak in Irving Street is conversationally unbeatable; Le Beaujolais in Litchfield Street has a world-class cheeseboard. And if the global rich are abandoning the sinking UK ship, that means more room on the club table for the rest of us.

Comments