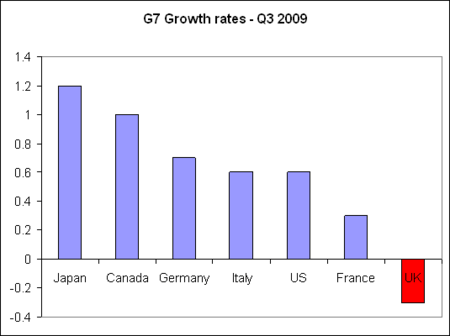

Today’s revised GDP data confirms that the UK remained alone of the world’s major economies in recession in the third quarter of this year*. The fact that the UK remains mired in recession long after most economies have recovered makes clear how uniquely badly positioned the UK economy was to handle a downturn. While some investment banks continue to argue that this performance reflects the inability of the Office of National Statistics to calculate the data correctly, there is good reason to believe that this huge underperformance is grounded in reality. Economic history teaches that bank crises are amongst the worst things that can ever hit an economy. The collapse in credit availability and soaring bank margins have posed very substantial risks to economic growth. The collapse in tax revenues being reported in the monthly government budget updates does not herald a return to good economic health. The now regular collapse of retail chains indicates depressed high street spending. Business investment is suffering an unprecedented decline as credit for investment has largely dried up.

While Governments around the world have sought to help people through the recession by ensuring that interest rate cuts lead to lower mortgages, the UK has seen a stunning rise in bank margins. The data from the Bank of England shown above illustrates that banks have quadrupled their charges to customers for lending over the past 15 months. Costs for credit cards and overdrafts have risen by even greater amounts. With British consumers having around £1.5trillion in outstanding debt, this is sucking almost £50bn a year out of people’s pockets and high street spending. In contrast, mortgage rates in most of the rest of Europe are now below 2%, contributing greatly to economic recovery. The crisis in the British banks has largely shut down the ability of the Bank of England to influence the amount people need to pay each month in a mortgage. The huge amount of money the Bank is printing to fund Government spending is doing nothing to reduce bank margins or improve lending.

As the above chart from the Bank of England’s Inflation Report shows, the ability of businesses to invest has nosedived. As investment is clearly starting to recover in many economies round the world, it is likely that the severe reduction in lending availability caused by the bank crisis is one of the main factors behind the peculiar problems of the UK. The dive in the Pound should be giving British business a great chance to expand exports and market share – but the zombie banking system is preventing the flow of capital needed to raise production and boost investment needed to take advantage of this opportunity.

As the IMF continue to point out regularly the UK banking system has been hit far more severely than that of any other major economy. Soaring bank margins and declining credit show how serious the problem of the banks are for the UK economy. Rather than fix the banks, the Labour Party simply gave them the right to bill the taxpayer and mortgage holders for their losses around the world. It seems sadly inevitable that economic policy is going to be dictated by the need to maintain the political narrative that Gordon Brown “saved the world”, regardless of the cost. Whoever wins the election though will need to face up to the reality that the UK economy will be going nowhere until the problems of the banks are fully resolved.

* The figure for Canadian GDP is the consensus economic forecast rather than actual data, which is not released until next week.

Comments