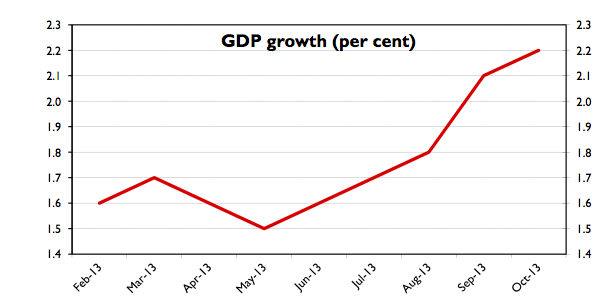

Things are lining up nicely for George Osborne’s Autumn Statement next month (and fairly badly for Ed Miliband, who’s making his economic speech today). For the first time since he became Chancellor, he will be able to report forecasts better, not worse, than his previous suggestions. The European Commission has just upped its UK growth forecast for next year to 2.2 per cent, up from 1.7 per cent – the largest upgrade of any European country. The Eurocrats are, of course, just catching up with the changing independent consensus. The graph pictured above (from the Treasury) shows how the consensus for 2014 growth has been revised upwards month after month.

So where will it end up? Michael Saunders at Citi, the analyst whose forecasts we pay closest attention to at CoffeeHouse, is expecting 3 per cent growth next year – and thinks this may be a bit of a pessimistic estimate.

You can see why. Saunders also notes (pdf) that the financial data company, Markit, has said its services purchasing managers’ index has come in at 62.5, the highest since May 1997. Markit had this to say:-

This has largely been the result of rising levels of incoming new business placed with service providers as market sentiment has improved in line with a strengthened economic climate.

Va-va-voom. The close relationship between the various PMI indices and GDP (below) suggests the British economy could well be midway through a veritable boom right now. When you think about all the cash that companies have been hoarding, too fearful to invest it, then there’s a good chance that success will breed success as corporations reopen their wallets. Don’t expect to see Ed Balls’ flatlining gesture for some time. If living standards pick up (still a very big ‘if’) then Labour really will be in trouble.

The only snag to all this is that Osborne is still borrowing like a drunken Keynsian (£3,200 per second) and that the British economy is still being fed the steroids of underpriced credit. The test of Osborne’s recovery will be if things are still going well when rates get back to normal.

Comments