The February inflation figures spell more bad news for living standards in the UK. With average weekly earnings growth standing at just 2.2 per cent, millions of workers continue to get poorer in real terms.

However, differences in the make-up of typical “shopping baskets” mean that the spending implications of inflation vary by income group. Since 2007, inflation has been driven primarily by increases in food and fuel prices. Given that such staples account for a larger share of weekly expenditure among lower income households than among higher income ones, the impact is felt more acutely in the lower half of the income distribution.

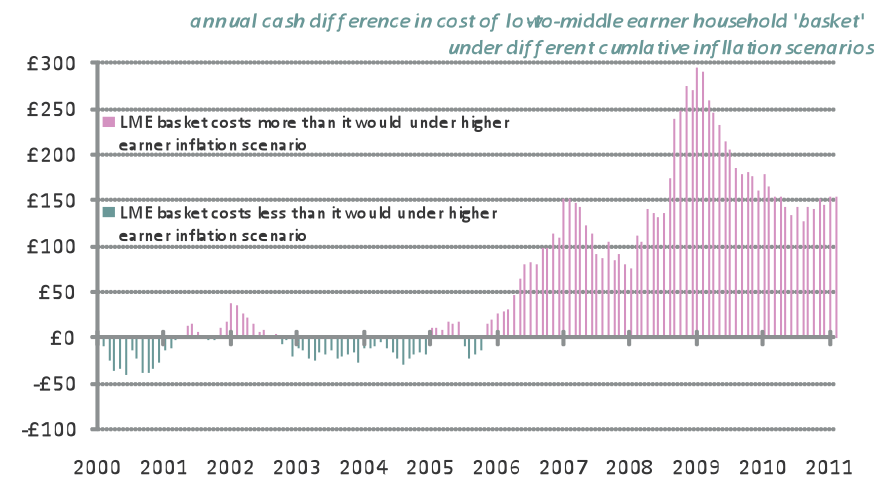

The below chart details the impact of inflation on the purchasing power of low-to-middle earner households (those working-age households in income deciles 2-5) in the period since 2000. It shows that, if low-to-middle earners had faced the same level of inflation as households in the top half of the income distribution over the period, their typical annual basket of goods would cost about £150 less than it currently does. Although lower than the peak difference of £300 at the start of 2009, the gap remains significant — and appears to be creeping upwards once again. (Click on graph to enlarge).

While the forthcoming increase in the income tax personal allowance will provide a welcome boost to incomes for some members of this group, it may feel like small beer when stood against the trends families are now seeing in wages and prices.

Matthew Whittaker is senior economist at the Resolution Foundation.

Comments