What has happened to the SNP’s usually slick media handling during this election campaign? In several recent interviews the famously sure-footed Nicola Sturgeon has struggled to sound credible when asked tricky questions. The bluff and bluster, learned from her mentor Alex Salmond, is still there, but at the same time there is a sense of a previously grounded authenticity slipping away.

In a revealing interview with Channel 4 News last week, Sturgeon was asked if she has conducted any economic analysis on the consequences of independence. Given the UK is now outside the EU (and hence we have clarity on the EU-UK trading relationship) and that Sturgeon wants to use this election as a gateway to independence, you would think this would be of some importance. But apparently not.

‘When we put the choice of independence before the Scottish people in a referendum, we will do what we did in 2014,’ she said. ‘We will set out a prospectus, we will do the analysis at that point, and we’ll let people in Scotland decide.’

This is odd given her administration managed to push out multiple pieces of detailed analysis on the economic impact of Brexit in the build up to the UK leaving the EU single market and customs union.

How can the SNP credibly make these big spending commitments when they plan to sever Scotland from its central bank and treasury in coming years?

In a separate interview with ITV she was asked how she can justify the enormous spending commitments made in her manifesto when it is also her intention to achieve ‘Scexit’, thus cutting Scotland off from funding levels that come from being part of the UK. She effectively deflected the question, but again came across as unconvincing.

The interviewer, Peter Smith, raised a good point though. How can the SNP credibly make these big spending commitments when they plan to sever Scotland from its central bank and treasury in coming years? More specifically, given the critical importance quantitative easing (QE) has played in financing Covid-19 deficit spending, what are the implications of taking Scotland out of a QE-financed economy?

QE is when a central bank creates money then uses that money to buy assets (overwhelmingly its own government’s bonds). The aim is to boost spending and investment in the economy when interest rates are so low that normal monetary measures — reducing rates — have hit their limit. The Bank of Japan started using QE in the late 1990s, but since the onset of the financial crisis in 2008 it has become something of a central bank phenomenon, with central banks in the most advanced economies deploying it ubiquitously.

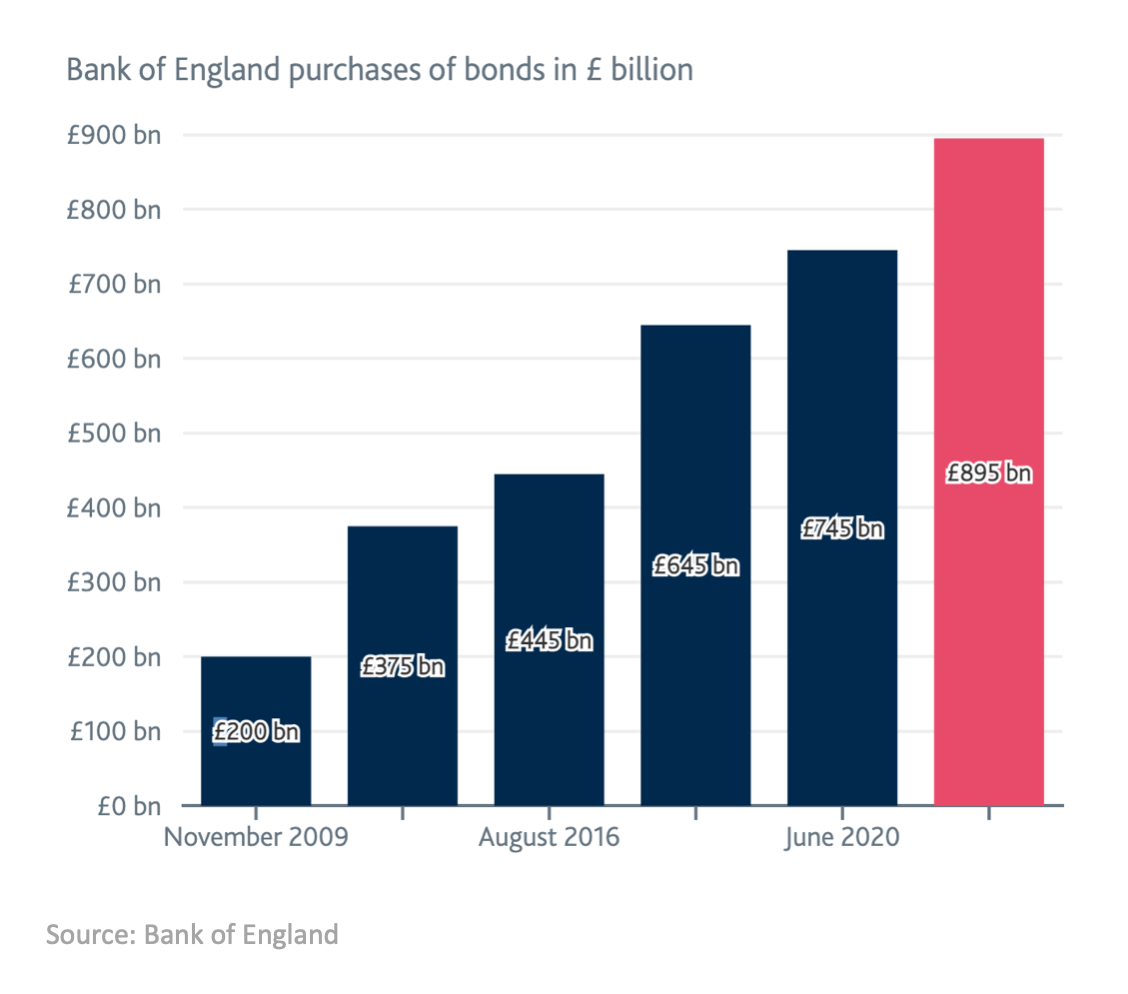

It is not an overstatement to say that QE has saved the UK economy from collapse during the pandemic. The chart below from the Bank of England shows the ramping up of QE in the UK over the last 10 years. The onset of the pandemic saw QE explode.

What is more interesting is how the Bank of England’s asset purchases in 2020 perfectly tracked central government borrowing needs, as outlined in analysis by the Financial Times earlier this year.

Why is this important? Because it shows that the central bank, while still technically pursuing a remit of targeting inflation, has been directly or indirectly (this is a key point of contention) doing whatever it takes to facilitate the government’s enormous bond-borrowing programme. Without QE the UK would not have been able to borrow the vast sums it needed to finance the emergency response to coronavirus. It is the Bank of England’s QE that enabled the borrowing that paid for vaccine procurement, furlough and all the rest of it.

And why should this matter to Sturgeon? Because an independent Scotland could not do any QE. In her interviews Sturgeon reiterated her backing for the SNP’s 2018 Sustainable Growth Commission, which made the economic case for separation, although she conceded its numbers are now out of date. That plan envisages Scotland having a central bank but no national currency of its own and not being part of a broader monetary union. That means it could not benefit from any form of QE.

Since the pandemic began a number of countries, such as Croatia, Poland and Romania have started doing QE. If Scotland left the UK it would be the only country in the world to voluntarily cut itself off from QE. What’s more, it would be cutting itself off from one of only a handful of central banks viewed as most credible when it comes to managing large-scale QE — the 2020s will be a test of whether lesser developed new adopters can credibly run QE programmes.

The simple question for Sturgeon then is why does she want to cut Scotland off from QE at a time when other countries are desperate to have it? As with her Peter Smith interview, she will likely have no answer.

Comments