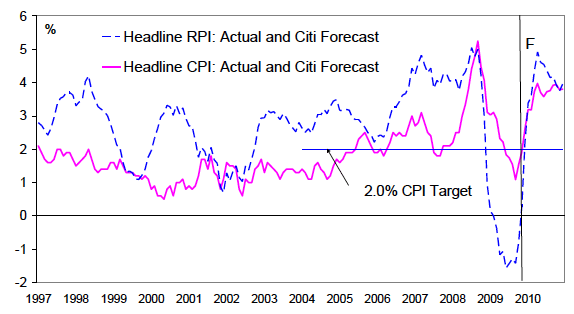

Oops! Britain’s inflation is heading back to 4 per cent territory as you’d expect with the Bank of England printing money and using the debt to finance government spending. If you create more money, you reduce the value of the money. Citi has done another brilliant research note, which it is putting online, laying out the implications. The punters are facing pay freezes, or settlements below 2 per cent. The cost of living is soaring. Result: misery. Here are the two graphs from Citi that spell it out. First, inflation (much affected by the VAT hike in the same way that it was artificially reduced by the VAT cut. The resulting inflation was, of course, a great excuse to print money to finance Brown¹s fiscal debauchery.

And let’s not pretend that this is a global phenomenon. How many other countries have the central banks making newly-minted notes to buy government debt a la Britain? None. How many countries are facing a weird inflation surge in the middle of a recession (or a crawl of a recovery)? None. Our inflation is, by some margin, the worst in the G7. The light blue area in the below graph shows how much higher inflation is in Britain compared to the G7 average.

And the pay packets? Last year, an unprecedented 30 percent of pay settlements were a pay freeze (it was 1 percent the year before). As the below graph shows, the percentage of pay deals with either pay freezes, or rises below 2 percent, has been soaring and is unlikely to change. But if your pay is linked to inflation, you could get a 4 percent rise in April or a 0% rise in Christmas. Depends when your pay is up for negotiation. Huge differences, in a very short time window.

Iain Martin wrote about the political implications of this recently in the magazine: the result will be industrial strife. And it will have Charlie Whelan working overtime to try to keep the lid on all the pressure.

It¹s great that Michael Saunders puts his analysis online now, so y¹all can cut out the middle man and get it direct…

Comments