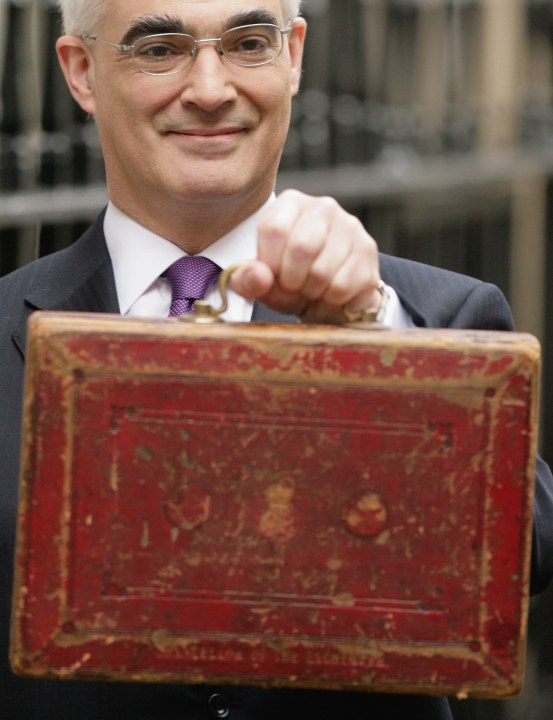

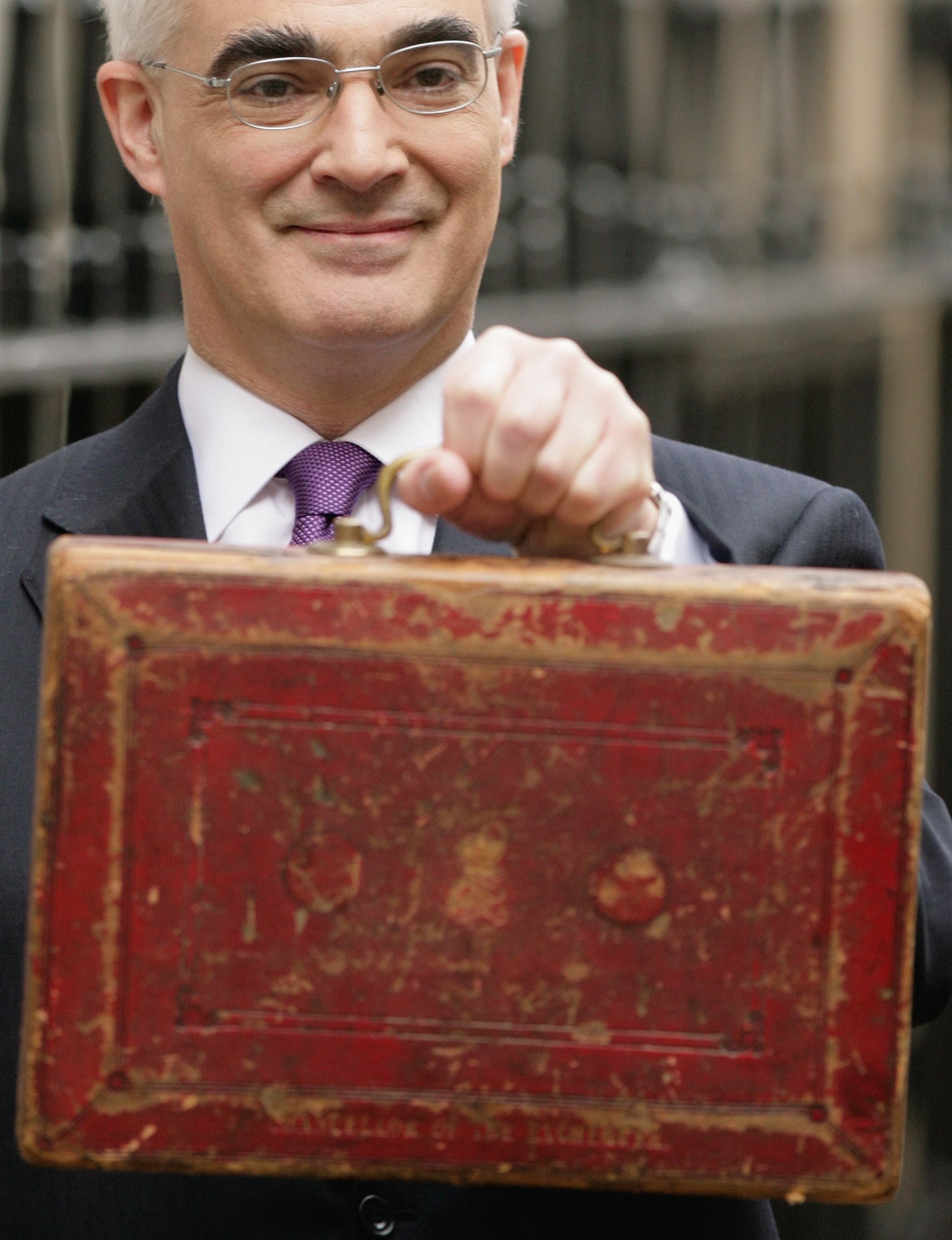

The public finances are deteriorating – and fast. Alistair Darling’s PBR forecasts seemed optimistic back in November, but now they seem like a sick joke at the expense of the taxpayer. Indeed, a report by the Ernst & Young Item club today predicts that government borrowing over the next five years will be some £270 billion higher than Darling accounted for. The debt mountain keeps getting bigger and bigger; measured now in £trillions not £billions.

The public finances are deteriorating – and fast. Alistair Darling’s PBR forecasts seemed optimistic back in November, but now they seem like a sick joke at the expense of the taxpayer. Indeed, a report by the Ernst & Young Item club today predicts that government borrowing over the next five years will be some £270 billion higher than Darling accounted for. The debt mountain keeps getting bigger and bigger; measured now in £trillions not £billions.

The priority for the next government will be to balance the books, to stem the upwards pressure on borrowing. As a great double-page spread in today’s Times suggests, even that’s not going to be easy. Unless the government wants to do something politically suicidal – like protect all public spending and raise the basic rate of income tax by 9p – then spending cuts are going to have to be on the agenda. The shopping list of potential cuts outlined by the Times includes: scrapping Trident (£25 billion); holding down public sector pay by 1 percent (£1.5 billion); ending the ID card programme (£5 billion); and so on and so on.

But, still, Gordon Brown’s debt mountain remains. These swingeing measures are for the sake of preventing more borrowing, not paying off existing debt. That will require even more extreme action, and will hammer future taxpayers for decades to come. Brace yourselves.

Comments