UK insurers have been under fire since George Osborne’s Budget, and many must be reeling from the shock of it all. Suddenly the landscape seems to have changed. No longer will people be forced to buy annuities, and suddenly people have a lot more options. As an observer who has for so long campaigned on behalf of customers, it has been heartening to witness such regulatory action at long last, yet nevertheless astonishing to see how long it has taken for meaningful intervention from the Regulator on behalf of customers. The time for change has arrived. Here are ten things that have gone wrong in the UK insurance sector.

1. Failure to understand end-customers and flawed profit models: It seems to me there are two fundamental issues. Firstly, insurance companies have failed to recognise who their customers are and secondly, their profit models are flawed as they rely on consumer inertia and high initial selling costs being recouped over many years with often unfair charges.

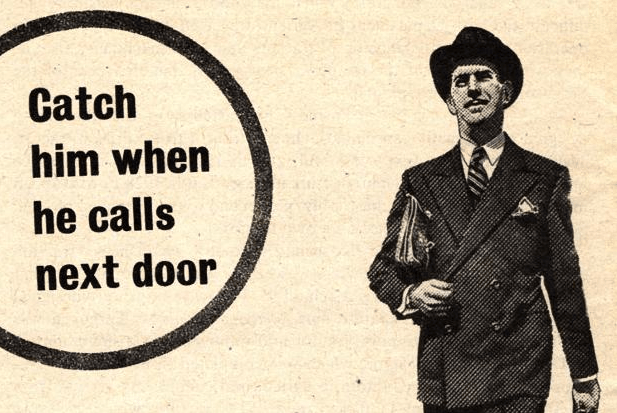

2. Insurance companies considered intermediaries as their customers: The standard mantra is that UK financial products are ‘sold’, not ‘bought’. Whether it was ‘the man from the Pru’ or the commission-driven salesmen, insurance companies considered the intermdiaries who actually brought in the funds to their products as the customers. Salesmen, financial advisers and even employers were the ‘gatekeepers’ who collected and directed the money, so products were designed to be attractive to them. The insurance sales force was handsomely rewarded, while the end-customer was all-too-often forgotten.

3. Flawed profit model relied on high initial sales commissions and customer inertia to recoup costs: The long-term savings profit model of the insurance sector was based on paying huge up-front fees to salesmen and then recouping those outlays over many years from the unsuspecting end-customer who had trusted others to look after their money. Exit penalties were often levied because the initial commissions paid to sales staff would not be recouped if customers did not keep paying fees for many years.

4. Commission bias led to successive mis-selling scandals: Commission-based sales have already spawned a succession of mis-selling scandals in the pensions and bancassurance industry, with perhaps more yet to come. Designing products with an intermediary’s interests in mind is hardly likely to result in an industry that understands the end-user and treating customers fairly is quite a challenge if you do not know who your customer actually is.

5. The last shake-up did NOT stop commission bias: The so-called Retail Distribution Review ended commission-driven ‘independent’ advice, but the insurance industry continues to by-pass advisers and slip commission to others who can sell their products without any advice or quality checks. It can be workplace auto-enrolment schemes that force workers to pay the costs of setting up their employer’s scheme through ‘adviser charges’ . It can be annuity sales where ‘non-advice’ brokers were rewarded with handsome commissions (or tied deals to sell potentially unsuitable annuities to pensioners). But the flawed commission model has been kept in place – to the detriment of ordinary customers, in too many cases.

6. The annuity market is a classic example: Even the most basic of concern for end-customers would have required at least cursory suitability checks, including health and marital status, before selling a standard annuity. Yet, the insurance industry has fought for years to protect its right to foist annuities on unsuspecting end-customers at continually worsening rates without any attempt to understand their needs. Insurers even offered annuity ‘brokers’ a significant percentage of customers’ pension savings just for making the sale – without worrying about whether it was an appropriate sale – even though this product is completely irreversible. Osborne’s Budget will bring many of the annuity scams to an end. But its such a shame that it happened at all.

7. Dodgy deals have shattered trust in financial services The insurance industry can provide vital products to enhance people’s lives, yet the ongoing exposure of poor practice has shattered trust in financial services. Customers need protection against events they hope will not happen – with insurance at fair price. They also need savings for events they hope will happen, managed by experts who are on their side and can offer them honesty, transparency and risk control.

8. Too often, insurers rely on customer inertia and abuse people’s trust. Insurance is meant to offer both protection and future growth at a reasonable price, yet all too often its product pricing relies on customer inertia to recoup costs from captive customers. Even on basic house insurance, let alone complex financial products, the best deals are reserved for new customers, while existing loyalty is penalised with higher premiums. How many of us have called our insurer at renewal time to tell them we have a better quote elsewhere, only to be immediately offered a discount? Does that not suggest the price was too high in the first place? The industry does not reward loyalty, quite the reverse. Hardly a sustainable model for long-term success.

9. Financial products are about people – not just about money. In order to serve customers properly insurers need to understand their lives. They are not all the same. They need flexibility and value for money. That means fundamentally reappraising insurance company profit models, modernising operations and delivering more flexible products and services that individuals can relate to, without jargon and reams of confusing paperwork.

10. The annuity market is a good place to start: As the investigation into the annuity market continues, this would be an excellent place to look for hidden charges that have hurt consumers. To force the insurance industry to reappraise its profit models. Nobody should be paid commission for selling an annuity – and fees should only be paid to those who have made some checks on whether that product is suitable or not. These problems are much more recent than policies from the 1970s.

The new Financial Conduct Authority (FCA) is shining lights into the dark recesses of industry practice to force modernisation. Customers are crying out for new solutions, on-line information, apps that engage them and far more flexibility. I believe the insurance industry can – and will – rise to this challenge.

Comments