An exciting day for policy freaks and numbers geeks: the Institute for Fiscal Studies has released its latest Green Budget, an annual survey of the state of the public finances. But if you can’t face wading through the complete 329-page document, here’s our quick ten-point summary of its main conclusions:

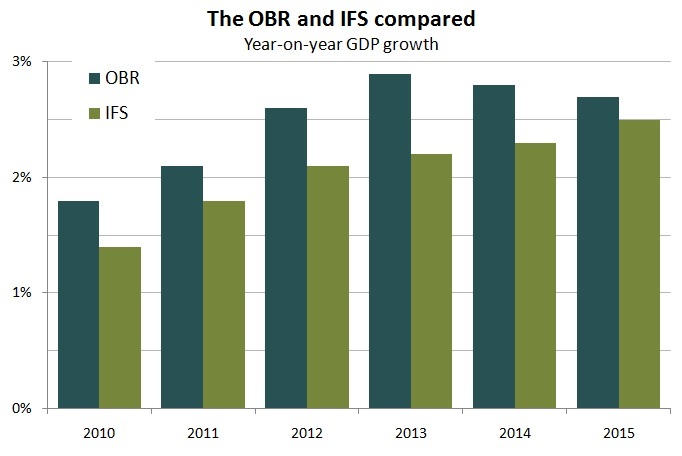

1) IFS forecasts “slightly lower” growth than the OBR. As this comparison shows:

2) But they’re more optimistic about borrowing. According to the IFS, borrowing won’t be as high as the government expects. The differences between their forecasts and the OBR’s are only minimal, but they’re there all the same:

3) The tax and spend forecast. Here’s a neat little graph from the Green Budget which sets out how spending will be cut, and tax revenues increased, as a result of the coalition’s policies. As you’ll see, the burden of deficit reduction is falling far more heavily on spending cuts (the solid, dark green line) than on tax rises (the solid, black line). The IFS puts the ratio at 73 per cent spending cuts to 27 per cent tax rises in 2014-15. As it happens, Labour’s previous plans implied a 70-30 ratio for that year.

4) Osborne on target. You might remember that George Osborne has encoded two new fiscal rules into the Budget. First, that what’s called the “cyclically adjusted current balance” should be in surplus by 2015-16. Second, that overall national debt should be declining as a percentage of GDP by the same time. On the IFS’s analysis, the Treasury is sailing smoothly enough towards both of these goals. They forecast that we’ll be running a surplus of 0.5 percent of national income in 2015-16, and that debt will start falling a year before that. There is still a chance that we could miss those targets, though, depending on factors such as general economic growth. There is “a three-in-ten chance that further tax rises or spending cuts would be required to avoid a cyclically-adjusted current budget deficit in 2015–16,” for instance.

5) The scary graph. But even if the debt/GDP ratio does start falling in 2015-16, it will probably still take a couple of decades until it declines to the level we managed with before the crash. Here’s the graph from the Green Budget:

6) Where we stand internationally. Some of the most eye-catching tables in the Green Budget are those that rank Britain’s public finances against those of other countries. We’ve collated them all into the table below. Note, for instance, that we’re third for borrowing this year, behind only US and Ireland. And our spending cuts are exceeded only by Iceland and Ireland. I’ll leave CoffeeHousers to make other observations:

7) Going up. Here’s another metric that you can file away as encouraging, if not stellar. By the IFS’s forecasts, both real wages and the number of people in employment will begin to rise

this year:

8) Does the government need an alternative? Much is being made, particularly by the left, of the IFS’s claim that “having alternative plans to hand could prove useful”

for the government. But, putting that quotation into context, it sounds less provocative than some might wish:

Another snippet from the report reinforces the idea that the IFS isn’t exactly calling for a Plan B, but rather just some flexibility on Osborne’s part:“The case seems strong for the March 2011 Budget to contain no significant permanent net giveaways or takeaways. Any improvements in the public finances relative to the OBR’s forecasts, such as those implied by our Green Budget baseline forecast, might best be banked to give the government additional headroom against a future worse outlook for the economy or the public finances or a need to top up its challenging plans for cuts to spending on public services. Although there may be no need to implement an alternative plan at this stage, with such large downside risks to the public finances, having alternative plans to hand could prove useful.”

9) The squeeze, continued. CoffeeHousers will be familiar with the figure that the IFS put out earlier this week: that 750,000 more people will be pulled into higher rate tax as a result of threshold changes in April. The Green Budget extrapolates from there:“So, all in all, it appears that the authorities ought to consider, if not a ‘Plan B’, then at least the possibility that they might need to nudge the economy towards a more favourable growth trajectory.”

The report also notes that the “biggest losers” from recent tax changes will be “the very richest households”.“If the government were to meet its aspiration of having a £10,000 income tax personal allowance in 2015–16, this would increase the number of higher-rate taxpayers by a further 850,000 and take another million people out of income tax altogether.”

10) Inflation, deflated? The IFS expends several paragraphs on explaining why it agrees, “in broad terms,” with the Bank of England’s claim that high inflation is just a blip. But, more specifically, they are slightly less optimistic. As they put it, “We are less convinced than the Bank of England that inflation will fall significantly below target next year, however, and we forecast an outcome that is close to the 2% target.”

Comments