“We understand how difficult it is for so many people across our country right

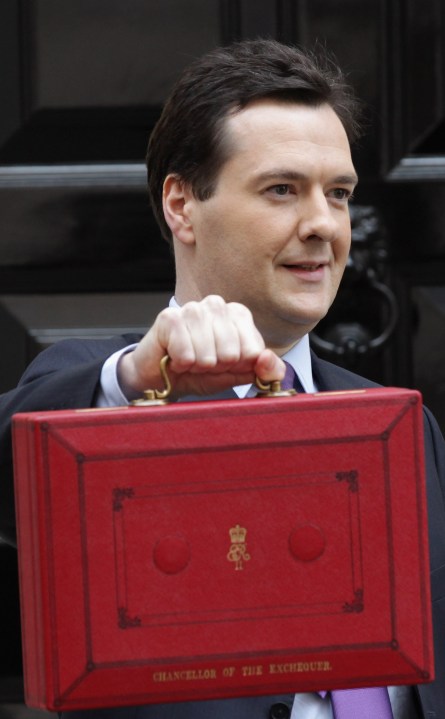

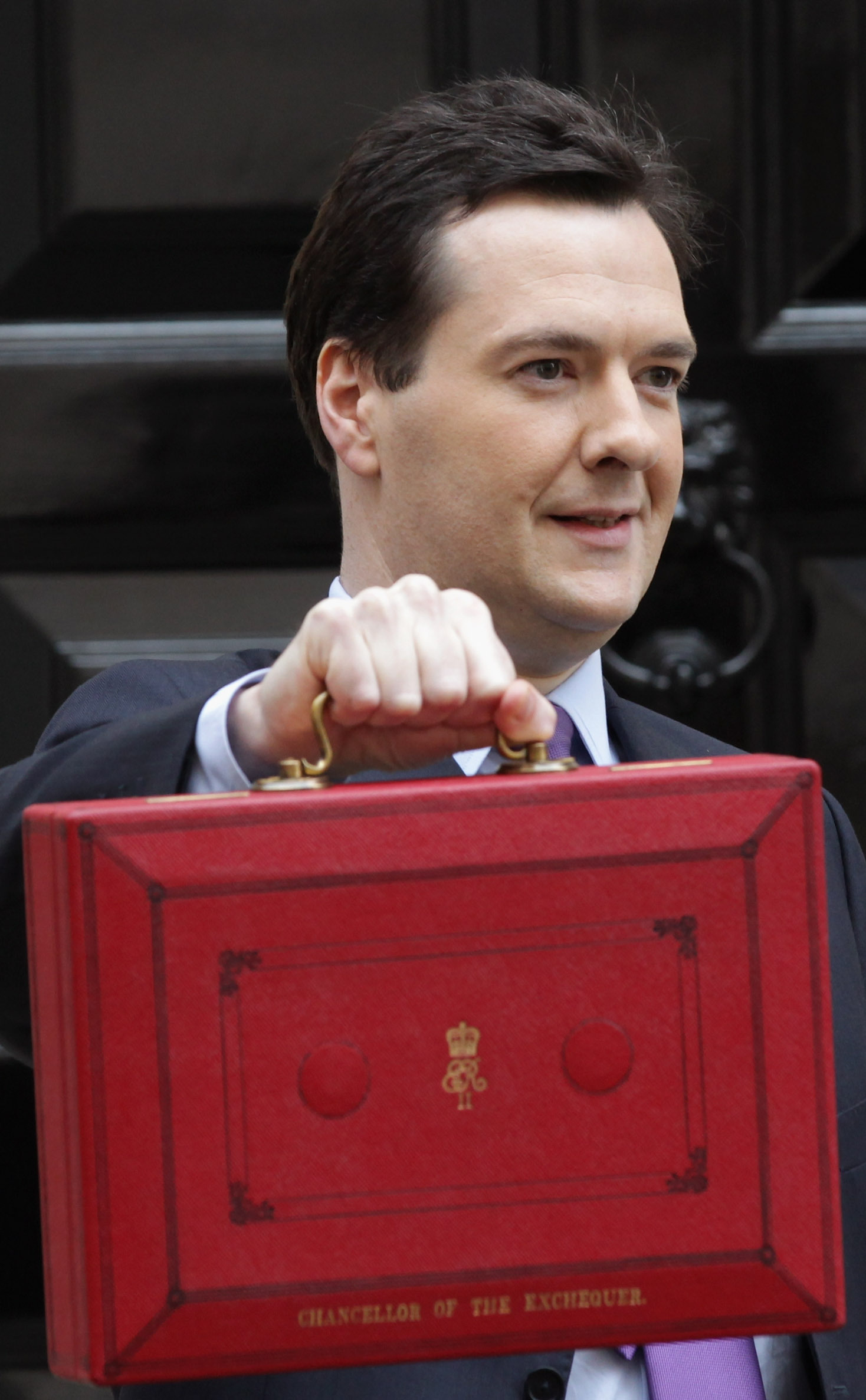

now.” If you weren’t sure which direction George Osborne’s Budget was going to head in, then he clarified it right from the start of his speech. This was one to tackle the rising cost of

living. And much of it — such as the raise in the personal allowance and the fuel duty cut — was welcome.

“We understand how difficult it is for so many people across our country right

now.” If you weren’t sure which direction George Osborne’s Budget was going to head in, then he clarified it right from the start of his speech. This was one to tackle the rising cost of

living. And much of it — such as the raise in the personal allowance and the fuel duty cut — was welcome.

But there is a nagging question hovering above Osborne’s announcement today: has he done enough? The Chancellor will certainly hope so. After all, by scrapping the fuel duty escalator he has effectively encoded a tax cut into all of his Budgets from now on. And, likewise, the coalition’s policy to raise the personal allowance is not just for today, but for the entire duration of this parliament — it will rise further still, to £10,000, by 2015.

But Osborne’s hopes are rather contingent on one factor: the actual level of inflation. If CPI comes down to its 2.0 per cent target level next year, as the OBR predicts, then all well and good — particularly if the OBR is also correct in forecasting that the growth in average wages will surpass inflation by the end of next year. But optimistic forecasts — cf. those made by the Bank of England — have had a habit of being proved wrong recently. So, what if inflation doesn’t come down as the OBR expects?

By way of a comparison, the graph below contrasts the OBR forecasts with those provided by Citi. On Citi’s count, CPI will be around 3 per cent next year; it will hover around 2.5 per cent for years after. As for RPI inflation, Citi have it 4.5 per cent next year:

This isn’t to say that the OBR is wrong, nor that Citi are right. Both are just one forecaster among many. But if inflation does stay up, with the cost of living rising faster than wages, then Osborne might have to take more action in future. That would make today’s Budget less a tonic, and more a precedent for next year — and beyond.

Comments