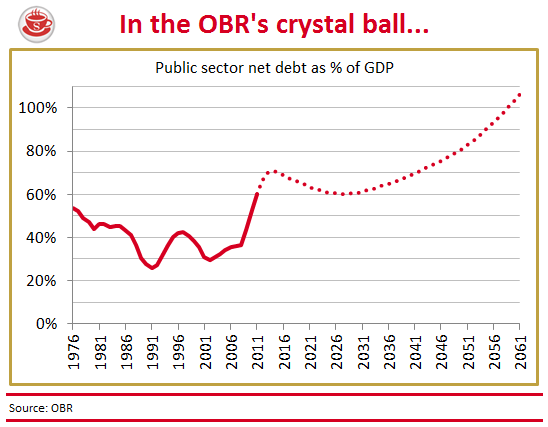

The Office for Budget Responsibility’s 126-page Fiscal Sustainability Report really oughtn’t make for electrifying reading. But it does. What Robert Chote and his gang of number-crunchers have done is to gaze into our fiscal abyss, and summon up forecasts so that the abyss can gaze back into us. I mean, look at the graph above. On the OBR’s account, our country’s debt burden could well rise from around 70 per cent of GDP now to over 100 per cent in 50 years time. It is a perturbing trajectory, to say the least.

But, before we go any further, we should slap all kinds of health warnings across this. Long-term forecasting is, by its very nature, an uncertain science — and there are plenty of uncertainties in the OBR’s work. Grand assumptions have been made about everything from the trend rate of growth to the level of government spending. Indeed, the debt forecasts above assume that underlying spending rises in line with GDP, and that there’s no substantial change to tax policy. But it’s hard to imagine that many governments would allow this sort of deficit to fester between spending and tax receipts (unless, of course, Gordon Brown comes back into power):

So what does the OBR’s work actually show us? Basically, the extent to which demographic changes could upset our public finances. Or, as they put it in the report, “These projections suggest that the public finances are likely to come under pressure over the longer term, primarily as a result of an ageing population.” Most of the upwards pressure on spending that they foresee is because of people dying later. Health spending will go from 7.4 per cent of GDP in 2016 to 9.8 per cent in 2061. Long-term care from 1.2 per cent to 2. And pensions from 5.5 per cent to 7.9 (although public sector pensions are slated to fall). Stir in debt interest repayments, rising from 2.8 per cent to 4.5, and you have a dangerous cocktail of more spending, spending, spending.

As sobering and as uncertain as they are, it’s encouraging that the OBR is putting these projections into the public domain. The fiscal debate has, for too long, lacked the emphasis on the long-term that is more or less normal practice in America. Rectifying that should encourage our politicians to concentrate on some of the choices facing them in the years ahead. Are they happy to countenance health spending at 10 per cent of GDP, or do they need to shift more treatments towards the private sector? Can they do more to curtail in rise in pension costs? And so on.

It is all about drawing lines in the hazy territory of the future, sketching out the path we want to be on. If those lines aren’t drawn, then the dread graph at the top of this post could become an outcome, not a forecast.

Comments