Russia’s spending on its war in Ukraine continues to grow. Somehow, despite tightening sanctions and increased global isolation, two-and-a-half-years in to the conflict, it appears Moscow can continue to splash the cash on its army – for now.

Spending on president Vladimir Putin’s military is set to increase by more than a quarter to 13.3 trillion roubles (£107 billion) next year, according to a draft of the Russian state budget for 2025 revealed this week. This colossal sum – which is nearly double the 6.4 trillion roubles (£52 billion) spent last year – is roughly twice the size of the amount spent by Britain on its own defence.

Russia’s government had planned to implement a steady reduction in defence bills across 2025 and 2026. This clearly hasn’t happened: the plan to shrink defence spending reflected the financial authorities’ desired fiscal prudence, rather than the Kremlin’s war plans or reality on the battlefield. This wishful thinking has evidently been overridden.

As has happened many times before, Russia’s military boom will undoubtedly end with a bust

Instead, Russia is spending more roubles on tanks and missiles and dedicating an ever-growing share of its GDP to the war effort, from 3.7 per cent in 2023 to an expected 5.3 per cent this year, and 6.1 per cent pencilled in for 2025. Another 3.4 per cent of Russia’s GDP is currently being forked out annually on national security, which can, for all intents and purposes, be included alongside the country’s military spending.

This high level of spending is a record for post-Soviet Russia. But it’s still about half the USSR’s annual average spending on defence in the 1970s and ’80s. Next year’s figure is roughly in line with what the US spent in the 1960s and 1970s and way below what Israel has spent as a percentage of GDP on defence during most of its history.

Not only can the Kremlin afford it for the time being, but it can still count on military spending to boost its industrial production and economic growth. Even with a minor decline in oil and gas export revenue thanks to the lower prices and sales volumes expected next year, the 2025 budget doesn’t look precarious. The country’s rising military bill is set to be shouldered by higher non-oil tax receipts. The recent rise in corporate and income taxes, as well as an overall increase in economic activity, is also helping boost Putin’s coffers.

Another source of income for the government is a slacker fiscal policy compared to that of peacetime. Before the war, the government balanced the budget for years based on an oil price of $40 per barrel with a small annual adjustment. In fat years, when the actual price of oil was above this threshold, the extra money was stashed aside. It was put into what was essentially a rainy-day fund, which could be used in lean years when the oil price dropped below the threshold.

In 2022, following the invasion of Ukraine and the imposition of Western sanctions, the government shelved this fiscal prudence and started spending all of its oil revenue. It also decided to dip into the rainy day fund to finance capital investment and the budget deficit if needed. Thanks to this, Russia can expect a minor budget deficit of just 0.5 per cent of GDP in 2025.

Russia has maintained a positive trade balance for years, gaining more from exports than spending on imports. However, a large chunk of this extra money was still leaving Russia, as people and companies bought assets abroad, stashed money in foreign accounts or under mattresses in dollars, and spent on foreign holidays and property. Western sanctions may have failed to stiffen Russian energy exports but they have dried up the capital outflow as Russians now find it harder to spend money abroad, inadvertently facilitating Moscow’s war efforts.

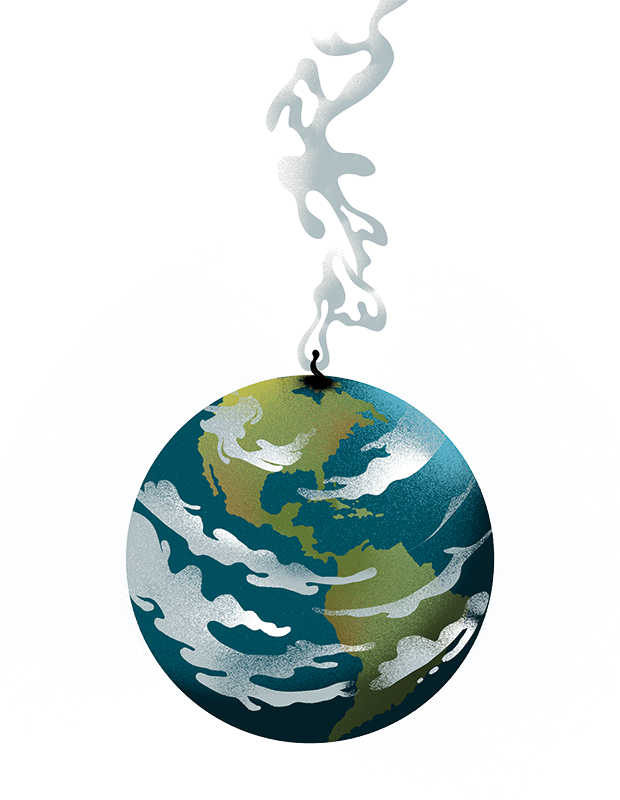

As has happened many times before in history, Russia’s military boom will undoubtedly end with a bust. But for now the Kremlin is living day by day, seemingly oblivious to the future. Even the finance ministry has admitted to worsening external conditions: lower oil prices, declining transborder trade and tougher sanctions.

The fact that Russia’s war economy is still growing beyond its means is creating a plethora of problems for the country: productivity is declining, inflation is sticky, investment is booming only in war-related sectors, and the labour market is constantly short of workers. Oil still accounts for about 27 per cent of the economy’s fiscal revenue, and the government has become more dependent on the oil market thanks to the depletion of its rainy day fund.

There is no doubt that Russia’s economy is overheating. As it has almost no spare capacity, a devaluation of the rouble would not shield the budget from a drop in export income, regardless of whether oil prices were lowered, sanctions strengthened or both. All this would do is fuel inflation without boosting production. Russia’s overdependence on China, technological embargoes and financial sanctions make the economy even more vulnerable.

Ordinary Russians are beginning to feel the squeeze, though, thanks to the Kremlin’s decision to pivot the country’s economy onto a war footing. It is not clear how long Putin will manage to keep financing his war machine without causing mass grumbling, if not open protests, when boom turns to bust.

So far, the economic outlook has been good for the Kremlin, but the decline in oil prices, a stiffening of sanctions and a constant labour shortage have made the Russian war economy precarious. It will not collapse tomorrow, but it can’t continue to flourish for long. The question for Ukraine, then, is whether it and its allies can hold on until Russia cracks.

Comments