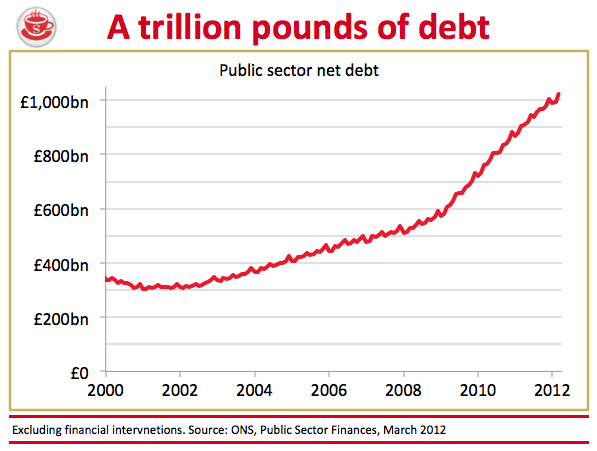

£126 billion. As we discover today, that’s how much the

government borrowed in 2011-12 — the fiscal year that’s just ended — pushing the national debt up to £1.02 trillion. The figures show the deficit falling by 10 per cent in real

terms on 2010-11, but it has come in slightly over the £122 billion the OBR predicted in March last year, and well above the £116 billion it forecast when Osborne delivered his first

Budget.

So the fiscal consolidation is proceeding, albeit a bit slower than planned. So far, it’s mainly being achieved through raising revenues — particularly VAT receipts, which are up 10 per cent on last year. Central government current spending, meanwhile, has fallen by just 0.2 per cent.

In fact, the government’s spending restraint has been a touch better than that figure suggests, as it includes debt interest payments, which are up 7.8 per cent. We now spend £129

million a day just to service the interest on our government debt. It also includes benefits spending, which has risen by 2.6 per cent as unemployment has increased. Strip these out, and

‘core’ central government spending is down 0.8 per cent in real terms on 2010-11: to £570 billion from £574 billion in 2011-12 money.

Comments