Twice I met the tech tycoon Mike Lynch, once a decade or so ago and again this year, shortly after he returned from his fraud trial acquittal in California. On the first occasion, I followed him as a speaker at a corporate conference in, of all places, the National Football Centre in Burton-on-Trent. He was the star of the show and we exchanged barely a nod. In those days – after he sold his software company Autonomy to Hewlett Packard of the US for $11 billion, but before his career was overtaken by HP’s allegations that Autonomy’s accounts were fraudulent – he had a reputation for arrogance in business which did not help him rally support against the extradition process that eventually took him to a San Francisco courtroom.

But at the second encounter – a private party in London – he was chastened, chatty and instantly likeable. I hoped to get to know him better but now I never will.

He’s the lost leader of British tech who could have done so much more as an innovator and a venture capitalist. The least I can do in his memory is to continue to highlight the scandalous one-sidedness of the 2003 US-UK extradition treaty which has thrown a succession of British corporate defendants into the ruthless jaws of US justice – and in a bizarre way, since the fatal yacht voyage was planned as a celebration of his court victory, determined Lynch’s tragic end.

What’s Revolut worth?

Is Revolut really worth £35 billion? Founded in 2015 as a low-cost foreign exchange app by Nikolay Storonsky and Vlad Yatsenko, Revolut is still a private company and only a month ago received the full UK banking licence it first applied for in 2021. But it already serves nine million UK customers – despite some accounting hiccups along the way, and a relatively high incidence of online fraud which resulted in 3,458 judgments issued by the Financial Ombudsman Service last year, compared with 2,332 for the much larger Lloyds.

It has also courted political connections, sponsoring events at both major parties’ conferences last year but raising its banner most conspicuously at Labour’s opening reception. Indeed, sceptics wonder whether the belated granting of the banking licence by the Prudential Regulation Authority can have had anything to do with hopes of persuading Revolut to go against the trend and list its shares in London rather than on the Nasdaq exchange in New York. City minister Tulip Siddiq has plans to meet Revolut in the autumn, we’re told, even though Storonsky declared last year that ‘London is much less liquid so I just don’t see the point’.

As for the notional £35 billion price-tag that makes Revolut Europe’s most valuable digital start-up, it derives from the terms of the sale of a $500 million block of shares to institutional investors earlier this month – and makes Revolut worth more than NatWest and on a par with Lloyds and Barclays. If that sounds absurd, remember that Elon Musk’s electric car venture Tesla is worth more than all its major auto-maker competitors put together: it’s just the way ardent tech investors see the future of the world.

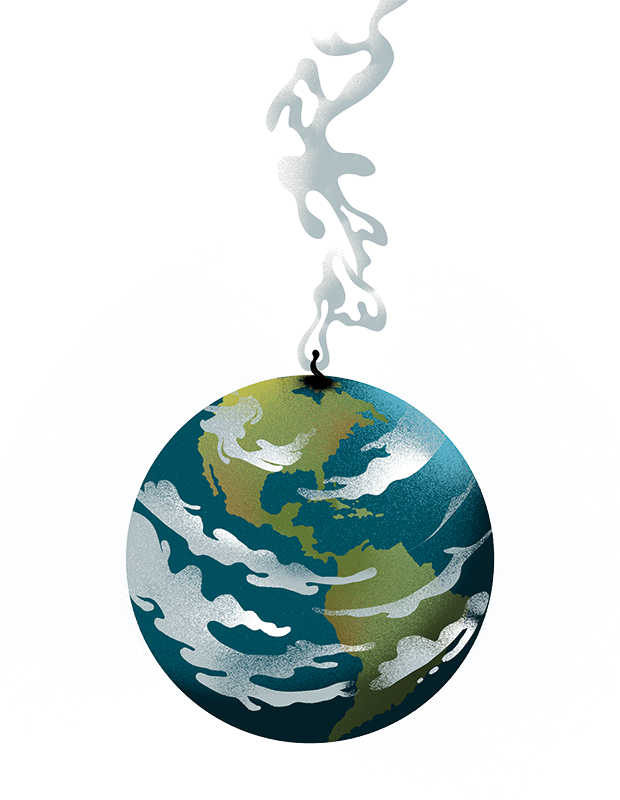

Incendiary

Regular readers know I retain a certain tribal loyalty to Barclays, or at least to the last-century version of Barclays where my father spent his working life and I wiled away ten years before turning to journalism. So I was particularly offended by a video of Chris Packham – I suppose I should preface him as ‘the wildlife broadcaster’ but I have only the vaguest notion of who he is – telling a crowd: ‘If anyone here is banking with Barclays, then I suggest you stick your head in a bucket of fuel and set fire to it.’

I gather he was expressing his feelings about the bank’s alleged funding of fossil fuel projects and arms manufacture. But what a vile thing to say in these literally incendiary times. I hope it brings the bank an influx of new customers who recognise that oil and weapons remain regrettably essential until clean energy and world peace prevail.

I’m reminded of the student fashion of 50 years ago for boycotting Barclays and occasionally torching its branches in protest at its presence in apartheid South Africa. The counter-argument that it was more helpful to stay engaged and press for change (as might equally be argued for lending to oil companies) was drowned out by calls for total withdrawal, until the bank’s board decided in 1986 to dispose of all its South African interests at a loss – only to be welcomed back a decade later by Nelson Mandela with the words: ‘You should never have sold.’

Bitter end

A brief return to England in the middle of my French holiday instantly dispels the sunny mood of last week’s column. First, the train drivers’ union Aslef – fresh from bagging a no-strings-attached pay rise of 15 per cent over three years – announced 22 strike days ahead in a separate dispute on the north-east main line on which I am condemned to travel every week. Having written last month that ‘no one should wish a new chancellor to fail’, I’m already revising that opinion. Have Rachel Reeves and Keir Starmer decided to crash the economy as fast as possible, while they can still blame everything on the Tories, in a desperate move to deflect the tidal wave of public-sector pay claims that will otherwise wreck the new government’s plans?

And as if that’s not enough to plunge me into autumnal gloom, here’s news that Angela Rayner’s Worker Protection Act, due in October, ‘could spell the end of the office party’. What, even at The Spectator? Truly the bitter end – and nothing for it but to head back to France for a last burst of sunshine and gastronomy, even if Ryanair is warning that ‘due to London Stansted airport security staff shortages, we advise all passengers to arrive at the airport three hours prior to departure’. Next week, French restaurant tips to cheer us all up.

Comments