A lot has happened over the past 34 years: the Cold War ended, several wars have taken place in the Middle East, a banking collapse occurred, and a global pandemic left millions stuck inside their homes. But one thing remained constant throughout: the bear market – a price drop of 20 per cent or more from the most recent high – in Japanese equities ground on and on relentlessly.

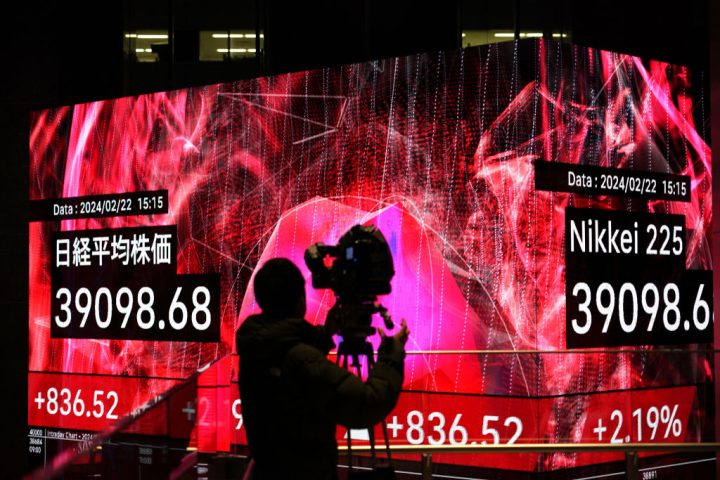

After hitting an all time high of 39,915 points on 29 December 1989, the Nikkei 225 which covers the country’s major companies slumped and slumped again. Today, it finally recovered all those losses, setting a fresh all time high. There is a lesson in that for investors everywhere. All bear markets end eventually, even Japan’s.

As Japan shows, all bear markets end eventually

While artificial intelligence may be grabbing all the headlines, Japanese equities have been the real standout asset of the last year. The Tokyo market is up 11 per cent since the start of this year, and up by 33 per cent over the last twelve months. There are plenty of reasons for that. Japanese conglomerates have finally got round to focussing on their shareholders, instead of just their employees; the Bank of Japan looks to have finally beaten deflation; and while the economy is hardly booming – it has just slipped into a recession like the UK – once you take its falling population into account it is doing far better than most people realise. Add it all up, and if you had been unfortunate enough to put your money into Japan in the late 1980s you would finally have made a profit.

As Japan shows, all bear markets end eventually. Japan witnessed perhaps the greatest bubble of all time, when its companies appeared to be taking over the world, and when one famous calculation reckoned that land under the Imperial Palace was worth more than the whole of California. After it burst, the economy struggled with deflation and recessions, while the central bank slashed interest rates to zero and pioneered quantitative easing in increasingly desperate attempts to fix the slump. It took a heck of a long time, but it worked eventually.

In reality, patience is always rewarded, and so long as you are prepared to measure it over a lifetime, equities are always the best investment. Who knows, perhaps the FTSE-100, which has essentially been in a bear market for 23 years now with no meaningful growth since the high it reached in December 1999, might also recover one day as well.

Comments