‘Cash is king,’ grinned the bartender as he handed me two pints of dry cider at a music festival I attended several summers ago. Since I’d paid in cold, hard cash, he’d agreed to a discount suspiciously in line with VAT. With nearby food vendors struggling to connect their payment terminals to the internet and fellow festival-goers queuing for cash, I gladly handed over the tenner and glugged down the goods.

Such a bargain is not uncommon. I’ve seen the odd hospitality worker offer a cash discount so they can pocket the takings themselves. After a removal quote once went awry, a surly van man demanded extra cash to shift my piano. Newsagents, meanwhile, tend to set a minimum card payment lest they get scalped on fee charges.

Carrying cash is a pain, the breaking of each note a shard in the soul

It’s such transactions – minus, I suppose, the tax dodging and petty theft – that the Treasury Committee is hoping to encourage. Only last month, the committee warned that Keir Starmer risks creating another ‘two-tier society’, this one divided between those who qualify for an Amex card and those who exchange coppers for the morning coffee. As the committee chair, Dame Meg Hillier MP, argued:

A sizeable minority depend on being able to use cash and they must not be forgotten by Whitehall. As a society, we must avoid sleepwalking into a situation where cash is no longer widely accepted.

The report was coaxed out of the committee by advocacy groups increasingly hostile to the presence of cashless businesses on British high streets. The Payment Choice Alliance has been especially vociferous, throwing a hissy fit over the Treasury Committee’s reluctance to recommend that businesses be forced to take cash.

‘For the Treasury Committee to basically simply ask HM Treasury to report annually on how bad cash acceptance has become is patently unacceptable and clearly against the interests of the British public,’ the alliance fumed. It added that many neighbouring governments have intervened – though Europe is not known as the world’s regulator for nothing.

For all the fury, the alliance’s summary of the committee report is not unfair. The top-line conclusion is a masterclass in official inactivity: ‘The government must act to manage the decline in cash acceptance.’ Institutions as storied as the Treasury, the Financial Conduct Authority (FCA) and the Bank of England will sit and take notes while cash fades into obscurity, at which point the Treasury Committee might finally recommend that something be done.

This would suit the government, which has already announced that it has ‘no plans to regulate businesses, big or small, to compel them to accept cash‘. In March it also revealed that it would be folding the official payment systems regulator into the FCA in an attempt to reduce regulatory burdens.

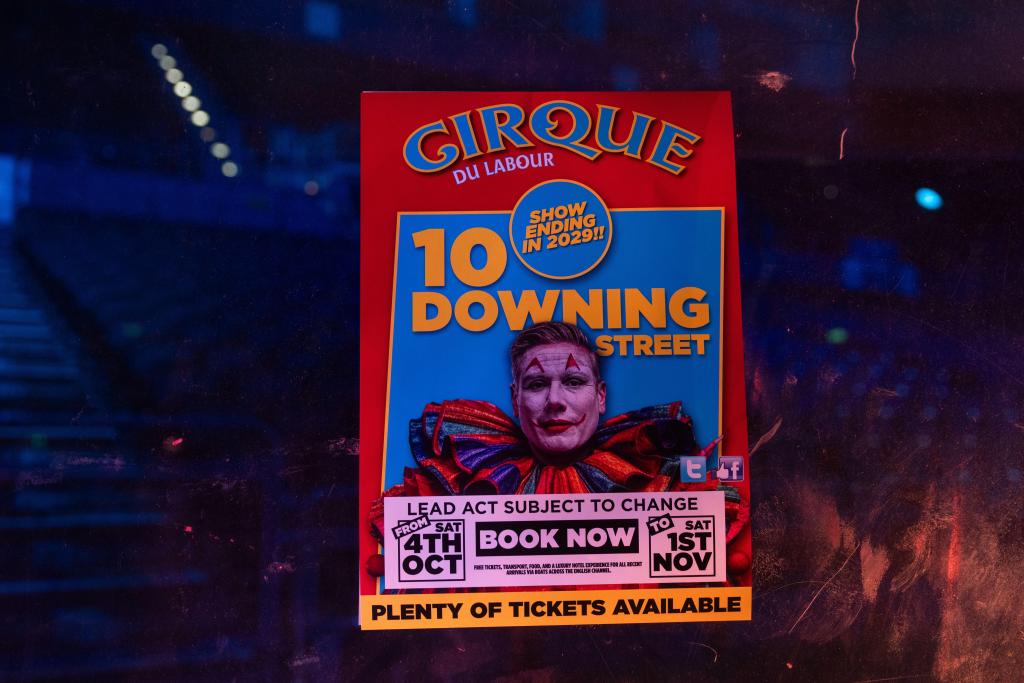

When you consider who Labour will be courting in 2029, one can understand why the cash splashers aren’t a priority. The most devout adherents to the ‘cash is king’ mantra tend to be libertarians. Deeply suspicious of fiat currencies, they like cash because it prevents the government from monitoring their purchases.

To be fair to the libertarians, banking services have proven vulnerable to political tampering of late. Only three years ago Canada’s government froze the bank accounts of truckers who had joined the anti-lockdown Freedom Convoy, affecting $8 million (£4.3 million) across 200 accounts. The year after in Britain, Nigel Farage lost his Coutts account because his politics didn’t align with the alleged values of the bank for the super-rich. Perhaps that’s one reason why he was photographed with a ‘cash is king’ shop sign last year.

Labour doesn’t care about such people, of course. But it will be more sympathetic to the vulnerable groups that the Treasury Committee warns are being excluded as cash recedes from view: the poor, elderly and disabled who are unable or unwilling to take up Mastercard, Apple Pay or Bitcoin.

Some of these people argue that physical cash is better for budgeting. As the report notes, it is easier to teach children about the limited supply of money when they can see it disappearing into a till. You can understand why a pensioner can’t be bothered to embrace the exciting world of contactless mobile phone payments.

But we should not be humouring these luddites. Carrying cash is a pain, the breaking of each note a shard in the soul, your pockets weighed down until you empty the contents down the back of your sofa. Shops must employ men in motorbike helmets to ferry it around town, and write signs to thieves assuring them that none is kept on site overnight. It is only convenient as a choking hazard for over-inquisitive toddlers.

For related reasons, nobody knows how much cash they have. In any British household the amount may stretch from the value of one Freddo to a night at a Premier Inn on the outskirts of Slough. This is in an era where you can look at charts on your monthly spending habits from the comfort of the bog before you return to scrolling TikTok clips.

Indeed, the pairing of payment cards with smartphones means that debit cards accounted for 51 per cent of the country’s transactions in 2023, according to UK Finance, with credit cards accounting for 10 per cent. Cash was used in only 12 per cent of transactions, with the industry body predicting this would halve by 2033. The government was sufficiently confident in this trend that it declined to order new coins in 2024, a historical first.

Far from reversing the trend of declining cash use, the government should be accelerating it. As the Treasury Committee recommends, somebody should be keeping an eye on Mastercard and Visa’s opaque processing fees, the subject of many a class action in the US. IT infrastructure must continue to be strengthened, not least because of the kind of outages that can prevent thirsty festival-goers from acquiring West Country cider on a hot summer’s day.

As for cash, like the British monarchy, it could still enjoy a ceremonial function. The Royal Mint can continue to issue commemorative coins, enjoyed for a moment before being consigned to the back of a drawer. The cash king is dead; long live the plastic king.

Comments