Thanks to the tremors along Westminster’s grapevine, we already knew that

today’s OECD Economic Outlook would make for pretty dreary reading. But now that the report is actually

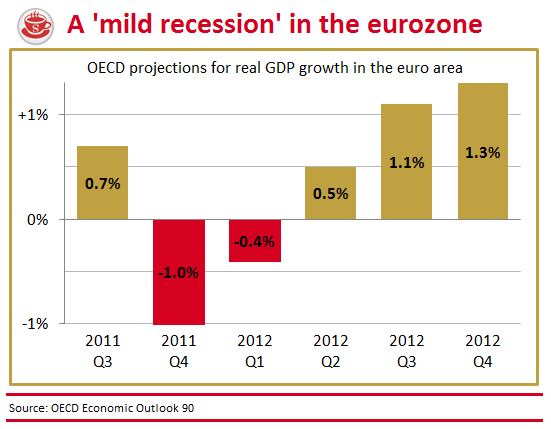

out, we can see the organisation’s numbers for ourselves. The headline point appears to be that the eurozone is in, or is facing, ‘mild recession’. Or to put it in graphic form:

And the current situation isn’t look particularly encouraging for the UK either. The first heading in the section on us reads ‘The economy is weakening sharply’. And a subsequent pair

of graphs predicts, first, that we’ll experience a mild recession of our own across the next two quarters, and then that unemployment will keep on rising to a peak in 2013. Here’s the first:

And here’s the second:

Of course, this has implications for the public finances — which are strengthening, but more slowly than might have been expected. Government debt, on the OECD’s more rigorous definition, is

forecast to hit 100 per cent of GDP in 2013. The deficit will have improved from 9.4 per cent of GDP now to 7.3 per cent in two years’ time.

What’s more, the OECD sees extra quantitative easing as a given. As they explain, ‘The projection assumes that the Bank of England increases QE further to a total of £400 billion by early 2012, leaving the Bank with almost 40 per cent of the total stock of outstanding government bonds.’ This matches predictions made by others, such as Citigroup.

It’s not all doom, gloom, plague and famine, though. The OECD also reckons that ‘Growth will start to pick up during 2012 as exports and household consumption recover, with further strengthening in 2013.’ And there’s much that will please George Osborne from a political perspective, including the line that ‘The ambitious fiscal consolidation has bolstered credibility and helped maintain low bond yields, leaving room for automatic stabilisers to work fully to cushion the slowdown,’ and that ‘planned fiscal tightening needs to continue despite the significantly weakening economic outlook.’

If anything, the OECD suggests that more tightening might be necessary in future. If the downturn is worse than expected, they say, then there may need to be some loosening of spending plans in the short-term — but ‘credibility will demand that the medium-term fiscal targets be retained and achieved, implying greater tightening later on.’ Their ideas for for that include ‘abolishing lowered VAT rates in 2013, or increasing the state pension age.’

In the end, it’s worth remembering that this is just one set of forecasts from one organisation. They may be wrong, they may be worthless. But the timing of this report means that it will influence

much of the debate around the autumn statement. In which case, consider this preparation for what Osborne and Balls will boast and bellyache about tomorrow.

UPDATE: We have more on the OECD report over at the business blog.

Comments