It’s time to warm up the printing presses. When growth evaporates and governments feel politically unable to cut spending or raise taxes, there’s only one tool left: printing more money. We can expect more of it soon. As James says today, Osborne believes he has created the conditions where the Bank of England can do some more Quantitative Easing and it could start as early as next month; an unusual move, given how high inflation is. But the Bank is (as ever) forecasting a return to the 2 per cent target soon – and may now claim that economic weakness makes an undershoot likely.

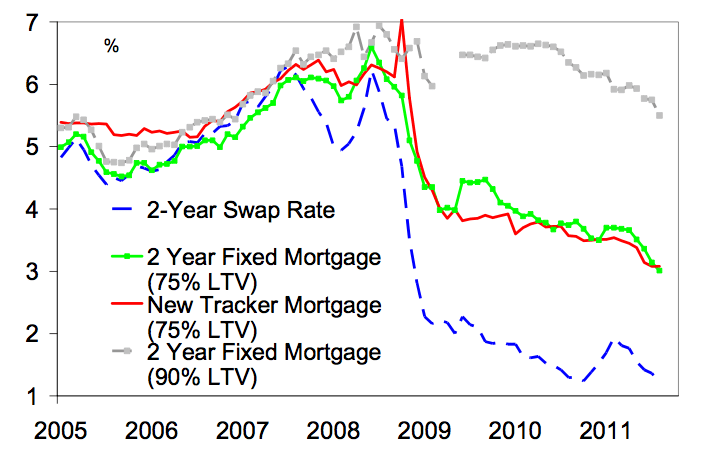

And so (the logic will run) it’s time for more QE so as to keep inflation to target. The other arguments for QE are harder to make. Last time, it was supposed to boost bank lending – that didn’t really happen. It’s pretty hard to argue that QE is needed to lower the cost of borrowing for either consumers or the government. The Asian savings surplus and Eurozone crisis have helped governments borrow at rock bottom rates. However you measure it, there’s no shortage of cheap debt – as the below graph from City shows:

So what will more QE achieve? You’d think that such a massive intervention in the UK economy would come with some assessment of what it’s all supposed to do. I suspect none will be forthcoming. Neither Sir Mervyn King nor George Osborne know what, if any, difference it will make. Economists are still trying to work out the effects of QE the last time it was tried, or its relationship to the inflation confronting shoppers right now. There is still huge uncertainty around how effective QE is. But right now, it seems to be the only tool our policymakers believe they can use –so we should expect to see it deployed quite soon.

Comments