Here’s the full transcript of this morning’s Today programme

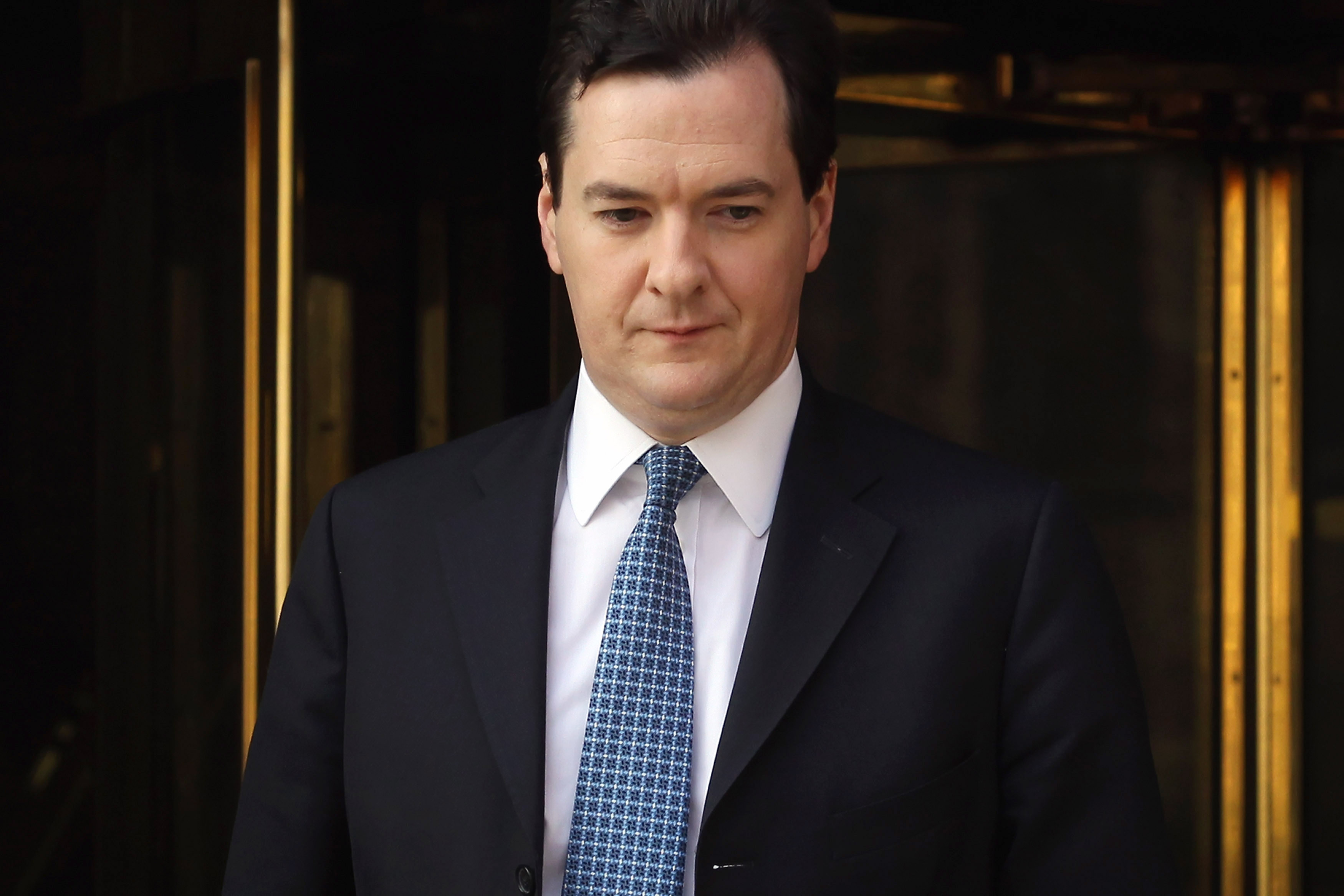

interview with George Osborne:

Evan Davis: If you believe in using the tax system to cut the incomes of those at the top and in using the welfare system to hand money to the poor, then yesterday’s budget was

probably not for you. The Chancellor hinted at big further cuts to welfare and he clearly thinks the tax system has gone too far in trying to harvest cash from those at the top. Yes,

he’s ironing out some loopholes but for him 50p rates don’t work. Believe him, and the game’s over for those who want government to iron out the extremes of inequality in Britain.

Oh, and for him too, pensioners can no longer be seen as sacrosanct. A courageous Chancellor or an uncaring one? Well let’s ask him, he’s with us here in Westminster, good morning.

George Osborne: Good morning.

ED: First, can we just start, Ed Miliband asked a rather interesting question in Parliament yesterday, he asked whether the front bench were better off or worse off as a result of this budget. I noticed you all refrained from nodding your heads or putting up your hands, what’s your own assessment of your own income at the end of this? Better off or worse off?

GO: Well I don’t want to spend the entire interview talking about my personal finances but my salary is less than the £150,000 threshold, it’s a Cabinet Minister’s salary and indeed we cut the Cabinet Minister’s salary when we came into office so I’m not personally affected so…

ED: But you get other money, you have other income haven’t you, you don’t just have that income so presumably that does take you over.

GO: I’m not a big winner from this budget, a moral winner from this budget so…

ED: But you are a 50p tax rate payer.

GO: I’m not actually, no.

ED: You’re not? Goodness.

GO: No, so my focus by the way has been on making sure this economy grows. That’s my responsibility and if you look at your news bulletins today the really refreshing thing

is that Glaxo Smith Kline, one of the world’s largest companies, has chosen to create a thousand jobs in Britain. It has done so because the budget has changed its view of Britain.

ED: And do you know what, we are going to be talking to Andrew Witty of Glaxo, later on.

GO: I think it’s important because we’re going to get into all the change and so on but ultimately my responsibility is to get this British economy moving forward and to change people’s perceptions around the world of Britain and I think that is a good sign that we are moving in the right direction, it’s good stuff.

ED: What I’d like to do is talk about pensioner changes and then we’ll talk about redistribution at the top and at the bottom ends but let’s start on pensioners. We’ve just had a rather interesting debate about whether pensioners maybe got off lightly over in the period of austerity and maybe the Treasury had looked at the figures and said, do you know what, young people have had their EMA taken away from them, they’ve had university fees imposed on them, the pensioners can shoulder a burden too. Was that the kind of analysis that led you to put this tax rise on pensioners?

GO: No, it wasn’t. What I thought was that we were rapidly increasing the personal allowance, that’s the amount that everyone in this country can earn tax free if they are earning under £100,000 and we were rapidly increasing it and it was therefore going to overtake the so-called age related allowances. The age related allowances are a complexity in the tax system, lots of people who normally come on to your programme like the National Audit Office have pointed that out and by freezing them rather than increasing them with inflation, we can basically subsume them in the big new single personal allowance which will be easy for people to understand, also easy for people to claim and I think that is a simplification of the tax system. It does save money, I made no attempt to hide that in parliament yesterday …

ED: It is the biggest tax rise in the budget.

GO: I did tell parliament that it saved money and, but as I say it creates a much simpler system for everyone and pensioners, you’ve mentioned pensioners doing well, I’m not embarrassed to say that the pensioners are going to get the largest increase in the basic state pension under this government, from next month it is going to go up by over £5 a week and…

ED: Sorry, sorry, hang on a minute, that pension increase as you well know is to compensate them for the last year of inflation, that’s not about… that’s an inflation, a cash amount to compensate them for what they lost and not a real distribution to pensioners at all.

GO: But of course inflation is lower today than it was in September when it was fixed and we introduced as a government this triple lock, it was a very important commitment the coalition government made that pensions would go up either by earnings or inflation, whichever was higher, and people have been campaigning for decades for that to happen. It has happened, pensioners – and they don’t have to take my word for it, they can check for themselves when they get their state pension in a few weeks’ time, it will be over £5 a week more than they had before.

ED: I really thought you might come here and make the case though that young people have had a big burden. There have been lots of books, including one by David Willetts, a famous book called The Pinch about the, if you like, the sharing of burdens between the generation who now cannot expect to be as rich as their parents for the first time in recent history. I wondered whether that had concerned you?

GO: But I don’t think the way you deal with that problem is by somehow pulling down the pensioners. What you do…

ED: But you’ve got to share the pain haven’t you?

GO: What you do is you’ve got to make sure that there are jobs and opportunities and good schools and good universities and colleges for those young people. I look at my generation and indeed my children’s generation and I think here is this world where you hear about the Brazil’s and the India’s and the China’s powering ahead, how is Britain going to keep up? Lots of western countries are asking themselves that question and I would say if you look at what we’ve done in the last couple of years, whether it’s confronting our debt problem, confronting the fact that our economy was uncompetitive and we had uncompetitive tax rates, we are actually taking these issues head on and saying to young people I’m trying to create a country where you are going to have a job and you are going to have a future.

ED: I think pensioners might have understood it if you’d have said, do you know what, there’s some burden sharing to be done here, the young have suffered a very great deal, we need to come and collect more from the old. You didn’t do that, you presented it as a simplification, you complicated the tax system inordinately in other areas like child benefit which is so complicated no one is going to understand that any more. It doesn’t sound plausible, you’d surely be better off making the case that pensioners need to contribute.

GO: Well as I say we are freezing the allowance, not cutting it, and we are going to as a result create a single personal allowance. You, Evan, used to work at the Institute for Fiscal Studies and you’d pore over all these things, you know the age related allowances were complex, you know it makes sense to create a single personal allowance, so it is good tax reform, it does save money. As I say, pensioners are getting a big increase in the basic state pension…

ED: Well they are getting them as a result of…

GO: No, because the net changes made by this government, including introducing this triple lock, mean that pensioners are better off.

ED: Let’s move on to distribution between the rich and the poor. The Treasury published some tables of the cumulative effect of some of the last few budget’s measures, not all of the measures but the ones that they think they can put in. Just tell us how you would describe the distributional burden, the way that you have chosen between rich and poor, to distribute the pain.

GO: Well first of all no government has ever previously published these papers so we normally would have to wait for independent bodies…

ED: To do it for you!

GO: We are doing it now. I would say what we have tried to do is spread the burden of the fiscal consolidations, dealing with the nation’s debts, as fairly as possible. The biggest weight has gone actually on the richest 1 per cent who don’t always show off in a graph of the whole population but there have been big increases in for example the taxation of very, very wealthy pensions.

ED: The top decile, the richest 10 per cent have in fact suffered the biggest average income loss according to your tables but it is interesting also that the bottom third of the population are the next group to suffer. Effectively it is the middle that have had least pain from the austerity, I’m wondering why that is the case, whether that’s accident or what the rationale for that is.

GO: Well first of all of course it belies the classic media narrative that the people who suffer the most are the people in the middle, right. That is an interesting commentary on the way these things are reported and understood. I think the truth is this: we have tried to spread the burden as fairly as possible across the income deciles but we have definitely focused our effort on the top 10 per cent and the richest 10 per cent, they have had more loss as a percentage of income as well as in absolute amounts. When you are trying to save money on the welfare system, inevitably it is people on lower income deciles who are consumers of wealth and what we are doing are things like capping welfare payments so it is certainly true that if you were previously in receipt of a housing benefit payment of £70 or £80,000 and there were people who were in receipt of £70 or £80,000 housing benefit and …

ED: Yes, but most of these people at the bottom are not in receipt of £70 or £80,000.

GO: But capping housing benefit and capping welfare payments which I think is a very important …

ED: It is a change in the indexing and basic cuts in tax credits.

GO: We have actually increased tax credits for the poorest. I’d say this, these caps on welfare are very important. Inevitably, as I say, when you’re saving welfare you affect those people in receipt of welfare but I think it is actually improving their work incentives as well and we’re trying to sort out a welfare system where it didn’t pay to work. I think that reform is very progressive and it does people no favours to trap them in poverty and trap them in a position where it doesn’t pay to work.

ED: One theory which one could say is Osbornism I suppose when it comes to the tax system, is a belief that there is not much you can do as government at the extreme ends of the distribution. Giving too much money to the poor, well that damages their work incentives and damages their lives and you can’t take too much from the rich either so in a way there’s not that much you can do. Would that be a fair description of your view?

GO: I have been in active politics for a couple of decades, I have seen attempts to bash the rich like the 50p rate which completely failed and rich people went around boasting that they were paying lower tax rates than their cleaners, so it was a tax con. What I think is better is to get money from the wealthy by all means by stamp duty on their property, closing these loopholes, capping their tax relief, having a competitive top rate of tax and I guess what I also have seen is the gap between the rich and the poor has grown and grown under the government, the Labour government that I spent much of my time in parliament seeing and the way I think is the best way to improve income equality in Britain is to give more lower income people the chance of a decent job and a decent education. That requires education reform, we don’t talk about education reform too often in an economic context but it is probably the most important thing this government is doing to trying to improve the British economy and I think the tax reforms we’re doing here, you take lower income people out of tax, you have a competitive top rate of tax and you make the wealthy pay more through their assets and other sources of income, is sensible tax reform for a modern age.

ED: Right, but you do agree that 50p is too high and there is a limit, you’ve now got, you’ve harvested as much as you possibly can from the rich, there’s no more you can do now to raise money from that 1 per cent.

GO: No, I don’t accept that.

ED: There is more you can do?

GO: I think you’ve always got to keep an eye on the exploration of reliefs and loopholes and I know it is just a phrase, reliefs and loopholes, but it’s…

ED: So wouldn’t it now be the time to do it?

GO: We are doing it. The reforms we’re introducing in the next couple of years…

ED: On top of the loopholes is there anything you can do or have you run out of things?

GO: At the moment there are unlimited amounts of tax reliefs so there are some people who can reduce, people on many multi million pound incomes who reduce their tax rates to less than 10 per cent. Now if we cap unlimited reliefs, which is what we’ve done in the budget, we can start to tackle that problem but the actual 50p rate, it was a con, it was a thing on a press release. Interestingly of course Labour didn’t actually introduce it while they were in office, it was introduced as they left office and it did not raise money. We have got Robert Chote, a veteran of the Today programme who would normally…

ED: He was very uncertain, he had very little idea about what it raised. No one knows.

GO: …we asked him, we asked him. Evan, we asked him and he said it was a reasonable and central, i.e. the best guess, the reasonable and central estimate that it raised £100 million. How can you justify if you are in my job, whether you are a Conservative chancellor or a Labour chancellor or a Liberal Democrat chancellor, how can you possibly justify a tax rate that is doing enormous damage to the British economy, that the rest of the world looks at and laughs at, and yet raises no money? So we dealt with that.

ED: Why didn’t you find other things to do to the rich? I mean there are things, there is for example taxing housing in a progressive way. At the moment a house that is worth twice as much as another house is not taxed twice as much.

GO: Well we have introduced a new stamp duty and…

ED: No, that’s not the same. That’s when you sell the house, it’s completely different.

GO: No, hold on, the stamp duty is what you pay when you buy the house, is actually when you have got cash with you because you are buying a house so I think that is sensible, we

have been prepared to do these things but we’ve also got to… many wealthy people do pay their taxes. Without their tax contributions we wouldn’t even be able to begin to afford

the public services that we currently enjoy and, as I say, as a result of the budget as independently audited by the Robert Chote’s of this world, actually the rich are going to pay more.

ED: Child poverty target, what’s going to happen to that? You mentioned that you might be looking for another £10 billion cut in welfare, are you still committed to the child

poverty target, eradicating it by 2020? It’s a law.

GO: It is indeed a law and of course as we came in to office, the previous government was already off-track on it, it was not on course to meet it. We are looking, and there are people across the political spectrum like Frank Field and Graham Allison and so on, who actually think it’s not the best possible measure of poverty because all it measures is whether you are on one side or another side of a median…

ED: There is no measure on which anybody is going to meet is, is there?

GO: Well I think you can raise the opportunities available to the lowest paid people and the lowest income people in our country. I think if you …

ED: But not in this generation, you’re not going to meet it for years, the target on child poverty.

GO: Let’s try and do it in this generation. So we are for example, it is interesting that for the first time there is free child care for disadvantaged three year olds, we’ve got a pupil premium so in other words the school gets extra money if they have got a poorer background pupil in their class, we are introducing all sorts of reforms and …

ED: But are you going to hit the legal target or are you going to scrap it? It is quite within your power to hit it incidentally by just raising taxes on middle Britain and giving money to people at the bottom end.

GO: I don’t believe that simply using a welfare system to move people from one side of a median income line to the other is genuinely tackling poverty. If that approach had worked then the previous Labour government which built up these tax credits would have succeeded but actually the gap between the rich and the poor increased under that government so we have got to try a different approach which is the life opportunities for people who currently don’t have life opportunities, education for people who currently don’t get very good education. That is surely the right way to improve life chances.

ED: Can you see though the criticism of people who say what this government is about is it says you give money to people at the top in order to give them incentives and you take money from the people at the bottom to give them incentives? It is a really interesting contrast.

GO: That’s not true. We were just talking earlier in this interview about the income distribution and we both agreed I think that the richest 10 per cent have paid the most under our deficit reduction plan.

ED: Until yesterday.

GO: No, including yesterday and – the chart you were reading out includes yesterday – and if you look at what this government has done, it has spent billions and billions of pounds trying to lift the incomes of the poorest and our welfare reforms are trying to reduce the effective tax rates, the marginal tax rates, that people have on benefits because under the system we inherit people lose sometimes £9 out of every 10 extra pounds they earn in the benefit system and with universal credit, the new welfare reform we are introducing, that will be reduced so in other words we are creating work incentives both at the lower end and in the middle and at the top end. We are trying to get Britain working and I point to Glaxo’s announcement today as a classic example of jobs being created which is what we want to see.

ED: A quick point, tax avoidance is morally repugnant you said yesterday, so all those people who avoided the 50p tax are morally repugnant?

GO: What I said was tax evasion and aggressive tax avoidance is morally repugnant and when you have things like this stamp duty trick where people buy a home in a company, use a company to buy and sell the home… But the evidence with the 50p was that people were shifting their income into capital gains, people were…

ED: And that’s morally repugnant?

GO: What I would rather do is just get a competitive rate of tax that raises money. This country could not have a tax rate that was higher than Italy, higher than France, higher than Germany, that was not raising money so I have dealt with that problem but the biggest thing in the budget was a tax cut for working people on low and middle incomes, actually the biggest tax cut for a generation, that means they can now earn more than £9000 of their income tax free.

ED: A final point, just in presentational terms, what you’re meant to do is keep back from the leaks the good news. What was going on? The only thing you kept back was the

biggest tax rise in the budget.

GO: Let me tell you, budget making in a coalition is difficult. The coalitions that you see in other countries are inevitably a process of getting two parties to agree to a common plan. I

think by the way we have not gone for the lowest common denominator with this budget which you might well have expected with a coalition two years in, we have actually gone for the maximum ambition

of a really exciting budget that is going to change Britain’s economic fortunes for the better but inevitably the days when the Chancellor of the Exchequer dreamt this all up in secret,

shared it with the Prime Minister 48 hours before he delivered his speech are gone and…

ED: You just forgot to let us know about the pension one then?

GO: No, no, we negotiate. There are lots of things in the budget that people found out about on the day but in a coalition it is an orderly process, it is a process of negotiation and we came up not with a Conservative or with a Liberal Democrat budget but with a coalition budget and as I say, we raised the bar. We did not go for a do-nothing budget, we actually… the very fact we have had this long interview talking about all the things we’ve done in the budget shows that this government, far from running out of stream, is setting the pace, not just setting the pace in Britain but setting the pace around the world for the kind of economic reforms you need if western economies are going to grow and compete.

Comments