Donald Trump’s on-again, off-again threats to sanction Russia for its intransigence over peace talks in Ukraine solidified today into concrete action. The US has announced sanctions against Rosneft and Lukoil, two of Russia’s largest oil companies, and their dozens of subsidiaries. Between them, the two giants are responsible for nearly half of Russia’s oil exports – and a serious crackdown on their ability to export crude could deal a serious blow to Russia’s war economy. How serious that blow is depends entirely on how far the White House is prepared to pursue the sanctions. And whether it will cause Putin to cease and desist from his offensive against Ukraine is another question.

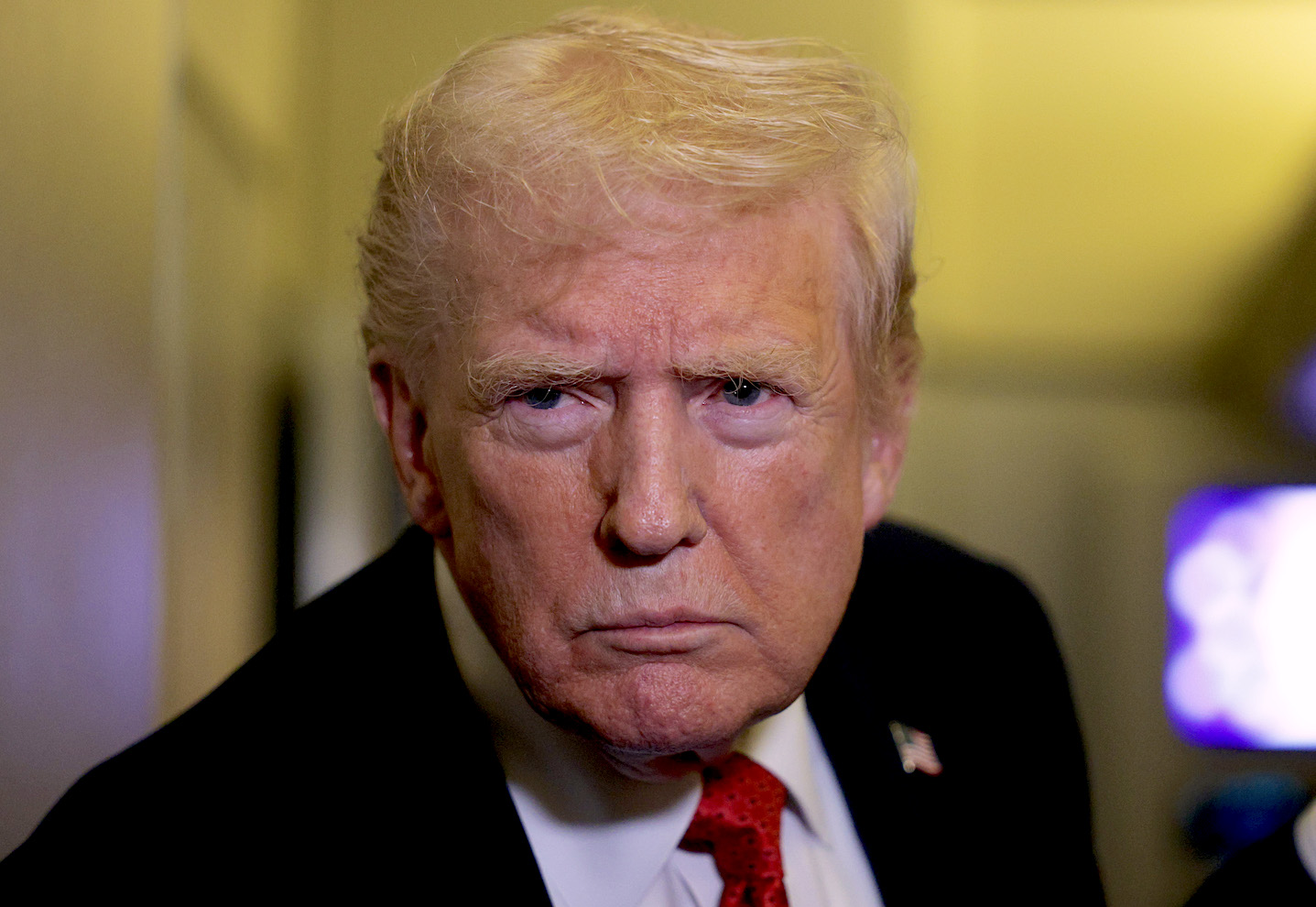

The immediate context for Trump’s unexpected move appears to be personal. Over the last week Trump seemed to offer Tomahawk cruise missiles to Ukraine, then withdraw the offer after Volodymyr Zelensky travelled in Washington. The new plan, proposed by Putin by phone just hours before Zelensky’s arrival, was another top level summit in Budapest. But just days after that, Russia’s veteran Foreign Minister bluntly announced that nothing in Russia’s position had changed and all its demands were still in force. Budapest was off. ‘Every time I speak with Vladimir, I have good conversations, and then they don’t go anywhere,’ complained Trump.

The sanctions on Rosneft and Lukoil are potentially devastating if the US chooses to deploy the financial nuclear option of secondary sanctions on all businesses, banks and agents who handle their international transactions, from bulk crude oil exports all the way down to gasoline retail. Lukoil, for instance, operates hundreds of petrol stations in Bulgaria, Romania and the US. If the US Treasury should so choose, payment systems such as Visa or Mastercard would have to drop ties or risk being sanctioned themselves. Lukoil, Russia’s largest remaining private oil company, also operates refineries in the Netherlands.

But the US’s major target is buyers of Russian oil in India and China, whose payments have helped keep the Russian economy afloat despite 19 rounds of European sanctions. Even before the announcement of the latest measures against Rosneft and Lukoil, Trump had already been pushing India’s prime minister, Narendra Modi, to end Russian imports. The US has threatened – and partially implemented – 50 per cent tariffs on Indian exports to the US, something Modi has been trying to reverse with a new trade deal that would align tariffs to those paid by the rest of Asia. A key part of that deal, the US insists, will be stopping Russian crude. Crucial to this process are legal measures that would allow Indian companies to get out of long-term contracts with Russian suppliers without penalty.

There are already signs that major Indian importers are finally changing their suppliers after three and a half years of profiteering from sanctions-defying imports and re-exports of Russian oil. In the first nine months of this year India imported about 1.7 million barrels per day. But Reliance Industries, India’s biggest importer of Urals crude, has announced that a ‘recalibration of Russian oil imports is ongoing and Reliance will be fully aligned to [Government of India] guidelines,’ according to a spokesman. In practice, that means getting all Lukoil and Rosneft product off their order books – including, presumably, scrapping a long-term deal to buy nearly half a million barrels per day from Rosneft – before a US Treasury Department deadline of 21 November. According to Reuters, oil traders report that Reliance and other Indian refiners buying spot crude cargoes from the Middle East and Brazil to partly replace Russian supplies.

Sanctioning Russian oil exporters was something that Biden never dared do

Sanctioning Russian oil exporters was something that Joe Biden’s administration never dared do – despite their passionately pro-Ukraine rhetoric – for fear of causing a squeeze in supply, a spike in energy prices and a knock-on derailment of a fragile US economy. But in recent months global oil prices have sunk to around $50 a barrel, giving Trump some wriggle room on energy costs. In the immediate aftermath of the new sanctions announcement, oil prices have risen – Brent crude futures rose more than 3 per cent on Thursday – but so far not catastrophically so. Trump’s enthusiasm for oil drilling and fracking also helps supply – and so does his disregard for net zero. But the White House does face a Russia sanctions dilemma. The more successful the new measures are at strangling Russia’s oil exports, the higher world prices will rise. Dealing with the economic consequences will be a tough test of Trump’s never-very-resolute support for Ukraine.

The even more important question, however, is whether squeezing Putin’s revenues will actually change the Kremlin’s behaviour and force Putin to climb down from his maximalist demands, which have remained essentially unchanged since he launched his full-scale invasion of Ukraine in February 2022. Putin has shown himself willing to disregard Russia’s short-term economic self interest in launching the war in the first place, which he sees as a battle for his country’s long-term strategic security. ‘If the White House thinks this is going to lead to radical change in the Kremlin’s conduct or Putin’s policy, they’re deluding themselves,’ Thomas Graham, a fellow at the Council on Foreign Relations told Bloomberg. ‘The Kremlin has been very good at circumventing these kinds of sanctions.’

One thing is clear: Trump, for the first time in this presidential term, has actually got serious about sanctioning Russia. And while squeezing the Kremlin’s revenues is not a magic bullet, it makes Putin’s war ever more costly, both financially and politically. So far, Putin’s decision making has been based on the assumption that Trump’s sanctions threats are bluster. Apparently, Putin was wrong – Trump does not always chicken out. And if Trump sticks to his guns then Putin’s timeline for ending the war just got a whole lot tighter.

Comments