There’s much to applaud in this budget, but as ever we in Coffee House are focusing on things jumping out from the small print. Here are a few things I’ve noticed so far.

1. Don’t mention QE. In his Pre-Budget Report, Osborne was candid about his economic policy: ‘fiscal conservatism, but monetary activism’. That is to say, fiddling about on the margins with taxes, while the Bank of England — 100 per cent owned by the Treasury — is midway through the largest QE experiment ever attempted in the developed world. It is impossible to understand Osborne’s economic policy, his Budget and those it affects without also considering the effects of QE — the inflation, the low interest rates and the game-changing implications. But it’s striking how Osborne made no mention of it at all.

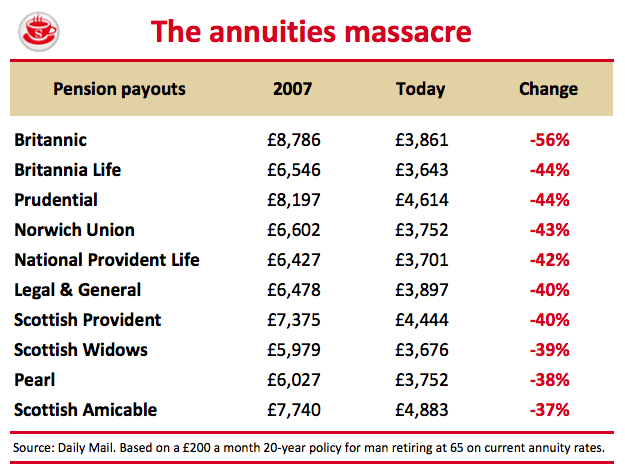

2. Pensioners hit. The giveaway to the low paid has been partly financed by freezing their tax-free allowance at £10,500 — it’ll stay there until the tax-free allowance for earners catches up. The Treasury justify this by saying that the poorest half of pensioners don’t pay income tax anyway, so this will hit the wealthier ones. It’s worth remembering that pensioners have also been the main victims of QE — both by the inflation it stokes, and by its effect of lowering interest rates. This has heavily hit annuities. The below table shows how pensioners have already been hit:

3. The 45p tax fiddle. The decision to go to a 45p tax rather than a 40p one was political, not economic. George Osborne wanted to go to 40p and was willing to strike a deal in exchange for a mansion tax. But Cameron didn’t want to do that deal, and vetoed Osborne (this is quite rare). Fair enough. But the Treasury magically came up with a graph suggesting that the optimal rate of high tax is between 45p and 50p. This is, of course, nonsense. Does anyone doubt that if Cameron had gone for a 40p tax, those HMRC figures would have showed that 40p is actually the best rate? You can fiddle this graph by choosing how responsive the rich are to high taxes: the so-called Tax Income Elasticity. This is between 0 and 1. To justify 45p, the Treasury went for 0.45 — replacing Brown’s mendacious 0.35 used to justify 50p. But even this 0.45 is based on behavioral data from the late 1980s. So we’re now working on the rather strange idea that the poor, and their money, have become more mobile since then. You can bet that the real figure is way higher. It was brave of Osborne to get rid of the 50p tax, and he deserves credit for this. But I was against the 45p tax when first proposed for exactly the same reasons: it raises no revenue (above 40p), even the IFS acknowledged that. And it remains a symbol of Brown’s enduring legacy over this government.

4. Spending untouched. The last few months have been about taxes, and the idea that every tax cut needs to be offset by a tax rise. The idea of funding tax by a spending cut was ruled out of bounds. The below graph shows how Britain’s very high government spending is remaining just as high. I’m not quite sure why totemic importance has been placed on not ‘reopening the spending envelope’ — high spending levels are sacrosanct but deficit reduction is apparently not. This can’t be right. The Budget shows the deficit will be halved over five years — Darling wanted to do it in four. The below graph shows Osborne’s plans for debt, versus the Labour plans he attacked at the last election. They are now, in effect, identical.

5. Osborne ought not to talk about ‘cutting the debt’ when he’s increasing it by the fastest rate in Europe. A recent poll showed that just 9 per cent of UK voters realise that national debt is going up — no wonder, when even the Chancellor says ‘cut the debt’ when he means cut the deficit. I had thought Osborne had mis-spoke the first time he did this, but when he made this slip twice in the Budget speech it seemed to be more deliberate. Maybe he is referring to paying one loan, even though he’s taking out even more. But there’s still no excuse. We all know about using your Amex to pay off your Visa card.

6. Nor should Osborne boast about low gilt rates. He presented low gilts as being a standing ovation from the markets — when, in fact, this is the result of his QE. And a very weird QE, one that only buys government debt notes (the American QE buys corporate debt). The Bank of England estimates that QE artificially lowers rates by 1 percentage point. A small point, but it’s simply dishonest of Osborne to try to present this as something it’s not. There is something depressingly circular about this: Mervyn King artificially lowers rates, so Osborne pays less in debt interest. He uses this to give a tax cut to people. But these people are facing higher shopping costs, due to the inflation exacerbated by QE. Osborne is lucky QE is generally seen as a subject too boring to be analysed.

7. Afghanistan: a retreat dividend. Now that we’re leaving Helmand earlier, some £2.4 billion spread over three years has been written back into the accounts, deducted from the reserve.

8. Another bank raid. I’m not quite sure why banks should be punished, to make sure they don’t benefit from the corporation tax cut. This is, I think, the third time Osborne has increased the bank levy. And there’s another £330 expected from North Sea Oil. Not a tax, the Treasury says, but the fruits of additional predicted investment due to giving certainty on decommissioning costs.

9. A tax cut: thank you, Danny. It would be churlish for a Conservative not to acknowledge that the tax cut for the low paid is only the result of a coalition. The Tory high command has been allergic to tax cuts, but the Lib Dems wanted to push them through as a political priority. Yes, many Tories want them too — Michael Forsyth’s tax commission proposed raising the limit back in 2005. But it was Lib Dems in the government that made it the case. The 40p tax band is lowered, to neutralise the effect of the raised threshold for higher earners. But no one will be worse off as a result.

10. But let’s get this tax cut in perspective. The figure Osborne used for this tax cut was £220 a year. But don’t expect people to spend it all at once. The same familes are each £1,000 a year worse off due to Britain having suffered the highest inflation in the Western world, stoked by the QE. Much of this inflation would have happened anyway, but Bank of England figures estimate that QE added up to 1.5 percentage points on inflation.

11. The Royal Mail pension trick. By taking over the Royal Mail pension scheme, bagging the assets but not accounting for the liabilities, Osborne has managed to artificially

reduce the debt by £23 billion. This is a fiddle. Even Brown always provided debt figures net of financial transactions (RBS etc). But even then, debt is higher – as a per cent of GDP

– than Labour’s plans:

12. Child Benefit: a new trap. Osborne’s decision to remove the cliff-edge means a £50k limit, beneath which everyone can keep their child benefit. It’s tapered away to £60k, so no one loses out by taking a pay increase. But this, of course, creates its own complications. Parents who do take pay increases will face different marginal rates of tax. Ian Mulheirn from the Social Market Foundation reckons it’s 11 per cent for one child; 17 per cent for two children; and 24 per cent for three children.

Comments