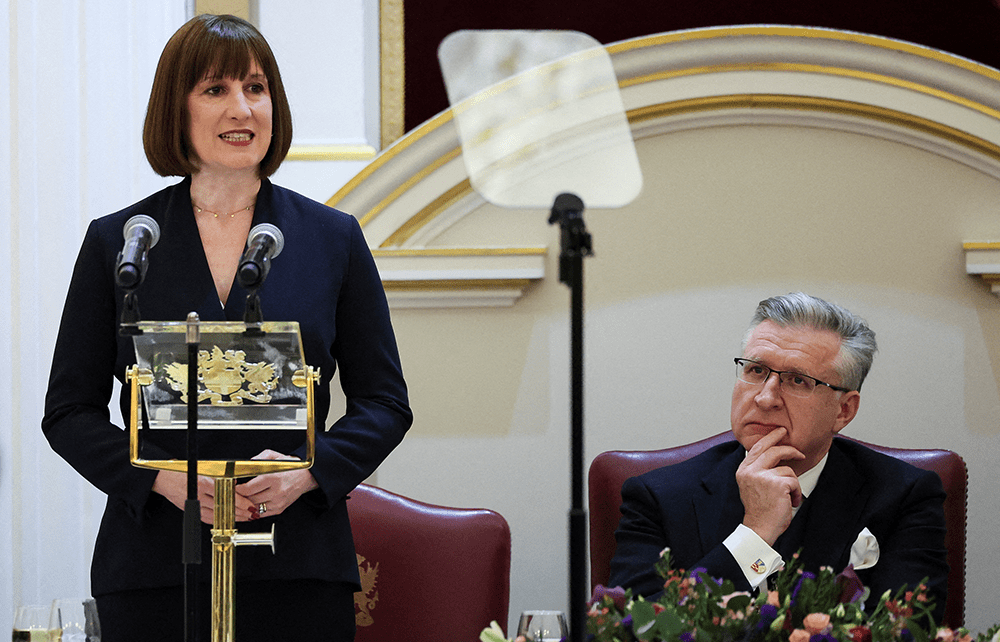

Regular invitations to Mansion House banquets petered out after I asked a shifty-looking waiter for a glass of champagne and he told me he was a deputy governor of the Bank of England. So I can’t report firsthand whether last week’s speech by Chancellor Rachel Reeves was greeted by assembled financiers with napkins on their heads or cries of ‘By George, I think she’s got it!’. What I can say is that – her text having been largely leaked beforehand – she was well upstaged by Governor Andrew Bailey’s unexpected attempt to reopen the Brexit debate; and that she seems to ‘get’ the City a lot better than she understands business owners, start-up entrepreneurs, shivering pensioners, aspirational parents and angry farmers. A low bar, but be thankful for small mercies.

What her banker audience was clearly ready to embrace – not too exuberantly, let’s hope – was a promise to ‘rebalance’ regulation away from ‘a system which sought to eliminate risk-taking’ after 2008 towards a regime with growth and competitiveness at its core, even including relaxation of the ‘pay deferral’ that made them wait longer and work harder for their bonuses.

And the sexier parts of the speech (an even lower bar) showed sensible willingness to build on work begun under her Tory predecessor Jeremy Hunt, whose Mansion House Compact with major pension funds in July last year was the precursor of Reeves’s plan to crunch local government pension schemes into ‘mega-funds’ that would invest, as Australian and Canadian funds do, in high-growth companies and infrastructure. That could be a hugely valuable redirection of capital: but will the Chancellor have the mettle to drive it forward when her non-City policies inevitably start falling apart?

The central problem

Even sexier, possibly, were glimpses in the speech of Pisces and Digit, two more innovations whose origins pre-date the general election. Pisces (an acronym for Private Intermittent Securities and Capital Exchange System) will offer a ‘world first’ platform for periodic dealings in private company shares, free of stamp duty. City minister Tulip Siddiq calls it a critical part of a wider reform agenda – most of which is still deep in the long grass of consultation, leaving many professionals unconvinced by Pisces, which they doubt will increase the much–needed flow of high-growth companies towards stock exchange listing.

Andrew Chapman, head of investment banking at Peel Hunt, puts it another way: ‘Pisces is an interesting idea, but it’s peripheral to the central issue for London’s equity capital market, which is shrinking liquidity in UK listed shares. We’ve had 41 straight months of outflows and reversing this trend is crucial… Collectively we need to act faster, with far greater purpose and candour. Until pension funds are obliged to hold more of their assets under management in UK equities, we’ve got a huge problem.’

In the sandbox

Digit, meanwhile, stands for Digital Gilt Instrument and is a pilot scheme to issue UK government debt in digital token form – akin to a cryptocurrency, that is, except backed by the Bank of England and HM Treasury rather than hype and hot air. It would make use of the one feature of crypto-world that fintech experts agree has real-world potential, which is the ‘distributed ledger’ or blockchain, a kind of vast virtual spreadsheet through which crypto transactions are recorded. And it could attract a new generation of digitally switched-on investors to help sustain the UK’s ever-growing public debt.

That’s probably as much as readers can digest on these esoteric initiatives. But it’s worth adding that both Digit and Pisces are being perfected by means of a ‘sandbox’ – originally a safe play area for children or a toilet for cats but nowadays a fashionable term in cybersecurity and software development, meaning a controlled environment in which innovations can be tested to destruction without affecting wider systems. What a pity the Chancellor didn’t think to put her employers’ NI hike, capital gains tax tweaks and farm IHT raid into a big sandbox and bury them there.

Drizzle of doom

My eye is caught by a BBC report on the spike in the olive oil market as a result of drought, heat and hailstorms damaging crops across southern Europe. Prices of Spanish olive oil rose by 115 per cent in the weather-afflicted year to September 2023, and among continental consumers, for whom the golden liquid is not just a daily ingredient but ‘an irreplaceable cultural marker’, there has been an increase in olive oil shoplifting.

What a vision that conjures of a time, surely not far ahead, when the archetypal British middle-class housewife, traumatised by everything the Starmer-Reeves regime has done to her family, is caught exiting Waitrose with an £18.50 half-litre of organic Greek extra virgin in her handbag and a £4.90 San Francisco sourdough loaf under her gilet. But here’s a robust, patriotic, fewer-food-miles alternative: Yorkshire rapeseed oil at £4 a half-litre from the enterprising third-generation Palmer family farm at Thixendale on the Wolds, exactly the sort of venture that deserves our support as it faces multiple negative consequences of the recent Budget. Their mayonnaise is excellent too.

Faking it

OK, I invented the Mansion House incident at the top, though I won’t name the tanned and tuxedoed bank chairman I did once briefly mistake for a maitre’d. But if the Chancellor herself can fictionalise parts of her CV – turning six years at the Bank of England into ‘a decade or so’ and strangely claiming to have been an economist at Bank of Scotland from 2006 to 2009 when she now says she was working in retail banking at its sister company Halifax – can’t we all add a little colour to our life stories?

Comments