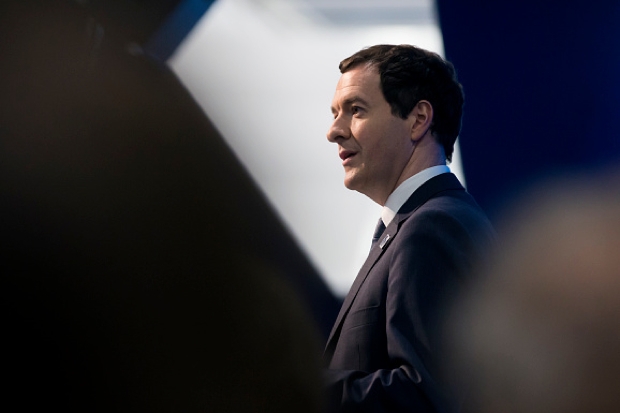

Sooner rather than later, George Osborne is going to have to come clean and tell us what he really wants to do with our pensions – the financial vehicles we and our employers painstakingly fund and that in theory should help us live out our retirement in a modicum of comfort.

Will it be yet more tinkering as befits a Chancellor who has become known as the ‘Tinker Man of Pensions’ – the Government’s own version of footballing Tinker Man extraordinaire Claudio Ranieri ? Another restriction here and another rule change there.

Or far more audaciously, will it be a radical overhaul of the tax incentives available to those who squirrel away money today so that they can enjoy a better tomorrow? We wait with baited breath for the Pensions Tinker Man to declare his hand.

He has certainly been cogitating awhile, far longer than Loyd ‘we’ve deliberated, cogitated and digested’ Grossman ever did on MasterChef in the 1990s. But then let’s cut Osborne some slack – after all, he has had other pressing issues (besmirching the Brexiteers) on his mind.

The fact is, nearly a year has now lapsed since Osborne oversaw the publication of a consultation document on the tax incentives available to those who save into a pension.

Mischievously entitled ‘strengthening the incentive to save: a consultation on pensions tax relief’, it seemed to pave the way for a dismantling of the current regime. One that currently provides high earners the greatest tax breaks to help build a retirement fund which will keep the bailiffs from the front door in later life – and one that costs the Government upwards of £20billion a year (in terms of the net cost of tax relief) to maintain.

As Osborne said in the foreword to the consultation: ‘If people are to take responsibility for their retirement, it is important that the support on offer from the government is simple and transparent, and that complexity does not undermine the incentive for individuals to save.’

Although we were led to believe at one stage that Mr Osborne would outline his preferred direction of travel on pensions in his March Budget earlier this year, he backed off at the last moment, claiming that the economic backdrop was too precarious for any radical overhaul to be introduced. Tax relief in its current form, he said, was staying for the time being.

Instead, contradicting his words in the consultation foreword, he tinkered twice more, carrying out his threat to reduce the maximum amount people can save inside a pension, without tax charges being applied, from £1.25million to £1million – and curbing the ability of additional rate taxpayers to fund a pension.

His piece de resistance was to announce the birth of the Lifetime Individual Savings Account (launch date April 2017) for the under 40’s, a vehicle that many people will surely choose in preference to a pension because of their ability to access it to fund the purchase of a home.

The result of all this tinkering and Lisa-ring is a pensions stalemate – with no one the wiser as to whether major change is imminent or it has been abandoned altogether.

Such an uncertain backdrop is hardly conducive to encouraging a climate of long-term saving. Research just released by asset manager Schroders confirms as much. Its survey results indicate that many investors (44 per cent) are worried they will not have enough money put aside to enjoy a comfortable life when they retire.

More alarmingly, despite the roll-out of auto-enrolment (a government scheme designed to get workers to join a pension scheme provided by their employer), nine per cent of these ‘worried’ respondents do not have a pension while nearly a quarter would prefer to use their salary in other ways – living for today, not tomorrow. Fourteen per cent of millennials (those born between 1977 and 2000) surveyed by Schroders have yet to take out a pension. Whichever way you analyse the results, they indicate a lack of engagement with pensions and a lack of understanding (not surprising).

Robin Stoakley, head of UK intermediary at Schroders, suggests the answer lies in more personal finance education, both at school and in the workplace.

More pertinently, he believes the Government must make up its mind as to how it is going to incentivise long-term savings in the future – and then stick with it. That is, either carry on with the current system where tax relief is given on contributions and tax is paid on pension withdrawals – or move towards a brave new world where contributions are made from taxed income but any withdrawals are tax-free (a world a la Lisa).

Over to you Mr Tinker Man. Stop procrastinating and declare your hand – so that we can start saving again with confidence.

Jeff Prestridge is personal finance editor of the Mail on Sunday

Comments