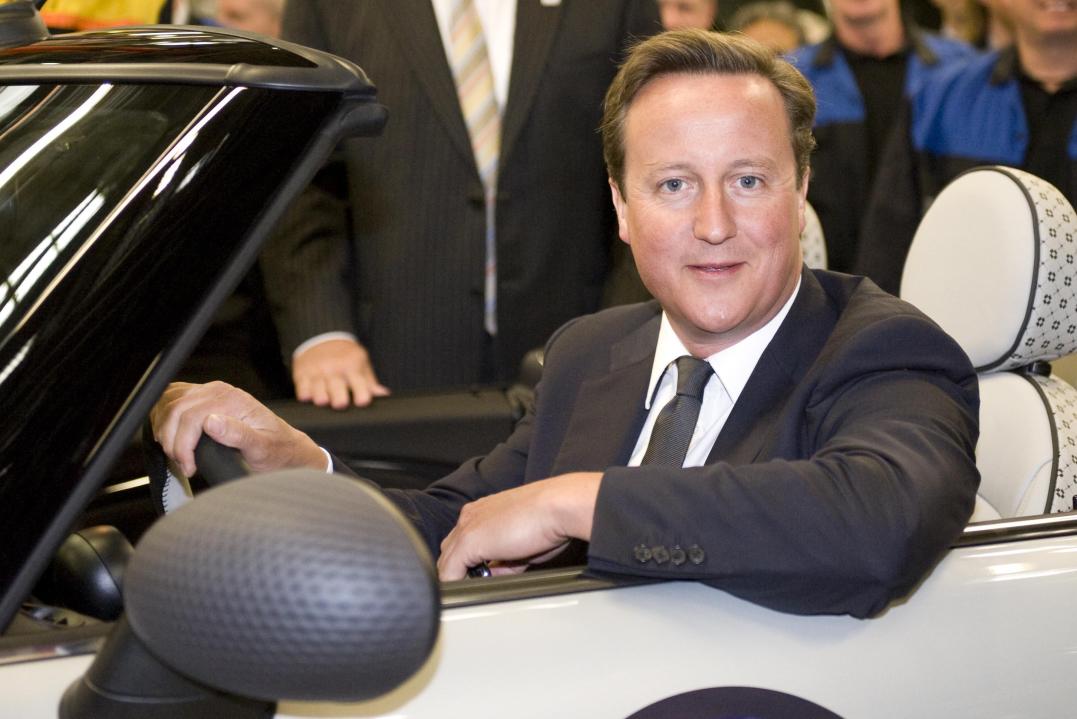

Are we facing ‘toll road UK’, as the Mirror suggests this morning? That is certainly a possibility arising from David Cameron’s plan to allow private firms to bid for chunks of Britain’s motorway system — but I wouldn’t get too excited just yet. It’s a very distant possibility at the moment.

After all, just note the details of the story. The routes that the coalition has in mind are very significant ones, but they still add up to only 3 per cent of the national network — ‘toll road UK’ may be pushing it. And then there’s the fact that nothing has been entirely decided yet. We’re told that, ‘The Treasury and the Department for Transport will carry out a feasibility study with a view to reporting back to Mr Cameron in the autumn.’

Even if the plan goes through, the private firms will only be able to charge tolls on new routes. And, while there’s little word so far on what constitutes a ‘new route’, if we take the M6 toll road as our guide, then it could be decades before we see any. The first glimmers of that toll road appeared in the early 1980s. It then opened, after years of negotiation, dispute and manual toil, at the end of 2003.

But it’s still worth keeping an eye on this proposal, as it represents a crucial and developing strand in Downing St’s mindset: an eagerness to improve Britain’s infrastructure without hitting the public finances. And it also represents an increasingly rare species: a concession, of sorts, to Vince Cable, who has been pushing for this kind of thinking since the start of the coalition government, including in a pamphlet for CentreForum last year. Cable is keen to deploy new forms of public-private financing elsewhere. But it’s thought that the Treasury wants to test them out on roads first, and not least because better roads means more car journeys means more fuel duty for the Exchequer.

The other reason to keep an eye on this proposal is to check that it doesn’t descend into a mess. If the taxpayer gets better roads for less money, then great. But if this is just another PFI-style, off-balance sheet ruse, that will see marginal improvements for exorbitant costs, then, erm… less great. The truth, or at least some of it, will be in the contracts between the Treasury and the private firms.

Comments