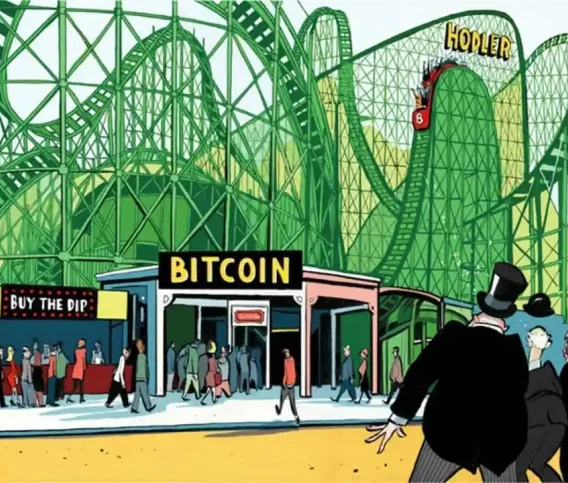

He helped ‘break’ the Bank of England – but now Scott Bessent is helping to shape its future. As a young hedge-fund manager, he served in George Soros’s firm when it made $1 billion on Black Wednesday. But as Donald Trump’s Treasury Secretary, he has overseen an explosion in cryptocurrencies this year which has left many in London looking on enviously.

While the use of cryptocurrencies such as bitcoin has trebled in Britain since 2021, this country’s governing framework has struggled to keep up. A shortage of political bandwidth has meant the UK lacks a national equivalent to Europe’s MiCA rules or America’s Genius Act, passed in July. Our policy is moulded by a trio of the Bank, the Treasury and the Financial Conduct Authority. All have commissioned a slew of reviews in recent years, as overseas jurisdictions motor ahead. ‘It is a perfect microcosm of British policy-making,’ says one Bank official. ‘Inertia as an active choice.’

At the Chequers summit in September, Rachel Reeves unveiled her latest initiative to keep up: a joint taskforce with Bessent, with orders to report within 180 days. Enthusiasts hope that partnering with the pro–crypto Donald Trump administration will ensure a beneficial regulatory environment. In the next couple of weeks, the Bank will launch a consultation on stablecoins. These are digital tokens built to stay at a stable price, usually one dollar, underpinned by real-world assets. With global digital assets now valued at £3 trillion – more than the total GDP of the UK – new rules are essential if the City is to benefit.

Those in the industry argue that this year’s crypto bull run is manifestly different from the boom in 2021. Back then, the picture was more of a Wild West featuring novelty memes and the dead-eyed grin of the YouTube star Logan Paul. Now, institutional wealth has moved in, with BlackRock playing a leading role. Even Jamie Dimon, CEO of JP Morgan – who once claimed he would ‘fire in a second’ any employee trading bitcoin – now praises the underlying technology of blockchain. ‘We went from being pirates to [becoming] like marines,’ reflects Stani Kulechov of Aave Labs. ‘Having clear regulation on stablecoins brought a lot of institutional interest from asset managers.’

Crypto enthusiasts grumble that artificial intelligence distracts Whitehall as ‘the shiny new thing’. Many complain that the watchdogs guard their consumer protection mandates too zealously. ‘They’ve protected the British public from one of the best performing assets of the past 15 years,’ jokes one entrepreneur. Regulators, by contrast, speak frankly about a lack of incentives to act in an area where politicians have failed to legislate. ‘Why should we put our necks on the line,’ says one, ‘when they won’t do the same?’

‘It is a perfect microcosm of British policy-making… inertia as an active choice’

Whitehall is also failing to keep pace with the public. Some seven million UK adults have crypto assets – roughly the same as the number of households that have a mortgage. If a political party got that many votes, it would have finished second at the last election. The failure to speak to – and for – this constituency has left a vacuum, with Reform UK keen to fill it.

Nigel Farage has spent years building ties to crypto firms, eulogising digital assets at a slew of conferences. ‘It gets to his world view about people having more freedom with their money,’ says an ally. ‘Debanked’ by Coutts in 2023, he is happy to attack big banks and big governments with equal gusto. ‘We are the crypto party,’ claims one senior figure.

Reform wants to capitalise on both elite and popular support for crypto. In May, Zia Yusuf published a Digital Finance Bill to cut capital gains tax on crypto. The party wants to attract young men, who might get their news from TikTok or podcasts. ‘A quarter of 18- to 34-year-olds in this country already use crypto,’ Yusuf said. Some in his party believe that newly minted tech types will back the party financially. Crypto outspent oil and gas in last year’s US election, pouring $238 million into the campaign. Even a fraction of that could upend British politics. The Electoral Commission is now offering advice on accepting donations in crypto form, with new guidance due shortly.

Parliament’s detachment from such trends was exemplified a fortnight ago when the House of Lords discussed stablecoin ownership. ‘I have [done] a lot in preparation for this question,’ remarked Lord Liver-more, the Treasury minister. ‘I know very little about the subject – but much more than I did when I started.’ Those peers who have made a study of the subject, such as Lords Vaizey and Ranger, were astonished at the minister responsible airing his ignorance so casually. Only a handful of MPs and peers are trying to get to grips with the crypto world. ‘I just don’t get it,’ admits one new Labour MP. Others are making up for lost time: Mel Stride, the shadow chancellor, debated it at the Andreessen Horowitz firm on his recent US trip. ‘This needs to be part of our conservatism,’ says one Tory. ‘We can’t let Reform own this.’

Several one-time senior Tories are trying to bridge the divide between Westminster and the City. George Osborne, the former chancellor, is leading calls for legislation to future-proof the industry. His successor Kwasi Kwarteng is getting even more involved, this week launching his own vehicle to hold bitcoin reserves. ‘The genie is out of the bottle,’ he says. ‘Bitcoin has been around for 16 years – digital currencies will only play a bigger role.’ An economic historian by training, Kwarteng points out that the paper money system has existed just since the collapse of Bretton Woods in 1971. ‘That’s only 54 years,’ he says, ‘after 2,500 years in which currency was linked to gold or precious metals.’

Reeves knows her history well, too. In opposition, she praised Harold Wilson’s speech on what the ‘white heat of technology’ could do for 1960s Britain. Such heat can help forge – or it can burn. But with digital assets here to stay, the Chancellor needs to ensure our institutions can meet the challenges ahead. As Wilson himself warned: ‘He who rejects change is the architect of decay.’

Comments