With all these tax cut suggestions kicking about — and with the British economy

desperately in need of some oomph — it’s worth asking: which would help growth the most? It’s not of course the only consideration, but it is clearly an important one as we

struggle to find our way out of recession.

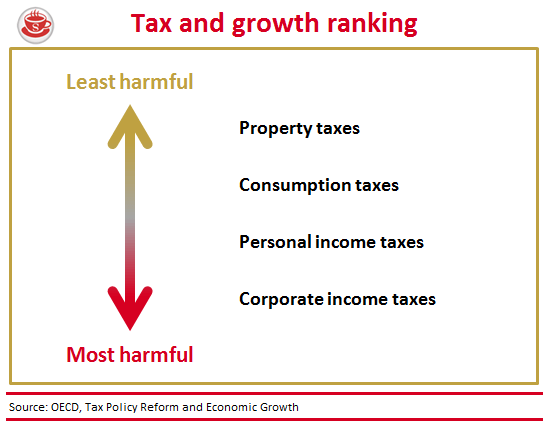

Fortunately, the OECD is on hand with two recent reports to help answer our question. The first, ‘Tax

Reform and Economic Growth’, divides taxes into four broad categories and ranks them on how harmful they are to growth:

This suggests that the Centre for Policy Studies is right — on growth grounds at least — to focus on cutting corporation tax. It also shows the strength of the Liberal Democrat case for

shifting the tax burden from income (by raising the personal allowance) to property (by introducing a mansion tax). In fact, the OECD says that raising property taxes can actually help growth, by

‘shifting investment out of housing into higher-return activities’. On the other hand, the report pours cold water on Ed Balls’ claims that a VAT cut is the answer. Consumption

taxes only have a slightly negative impact on growth, it says — one of the main reasons the coalition upped VAT in the first place.

In the second paper, ‘Taxation and Employment’, the OECD specifically recommends raising the

personal allowance — as the Lib Dems are calling for — to reduce work disincentives for low-income workers and second earners, two groups who are particularly responsive to such

disincentives. The report also highlights the detrimental effects of the Centre for Social Justice’s proposed transferable allowance for married couples, pointing out that such

‘family-based taxation’ reduces work incentives for second earners.

The CSJ argues for its policy based on the supposed ‘social benefits’ of marriage, but it’s worth taking into account the harm it could do to economy as well. Similarly, the Lib Dems advocate their proposals in terms of relieving the pressure on family finances, and asking the rich to pay their ‘fair share’. But the OCED’s findings show that there’s a strong growth-based case for them too.

Comments