Now that today’s inflation figures are up, to a predictable and predicted 4.0 percent on CPI and 5.2 percent on RPI, we can expect the usual response. Nothing from the government (even though the declining standard of living will eclipse cuts as the no.1 problem of 2011); plenty of shocked news stories; and, then, the round of commentators saying that Mervyn King should “hold his nerve,” and not increase the absurdly low base rates of 0.5 percent. Inflation is temporary, he says, and should be okay again this time next year (that’s what he said about the start of 2011). The Spectator does not have much company in finding fault with King and calling for a rate rise. So here’s my case:

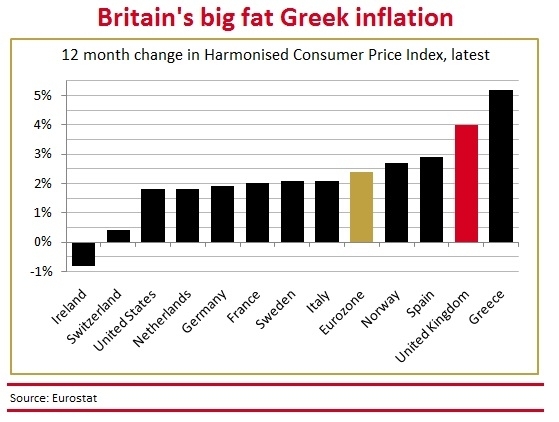

1. Britain has the worst inflation in the Western world, apart from Greece. Yes, the world is facing an inflationary spike. But the world is coping far better than Britain. Look at the latest international figures:

2. Britain’s economic growth is now back to trend. Almost all forecasters agree that the recent GDP shock data was a freak, and that UK economy has bounced back to 2.0 percent growth (the below graph shows where various independent forecasters think it will be this year). So why do we have rates at an emergency 0.5 percent?

3. Mervyn King doesn’t have a good record when it comes to hitting that 2.0 percent target. Any business manager who had such failure rates would be sacked. He’s not paid to have some underlying inflation measure at the right place: he’s paid to have CPI around 2.0 percent. He can have all the academic and journalistic defenders that he likes – when the public lose confidence in the Bank of England’s ability to control inflation, and start adjusting for rising prices, this itself becomes inflationary.

4. ‘Real’ interest rates are at their lowest ever. Look at base rates, adjusted for inflation. Banks are, once again, paying people to borrow. We all know how this ended the last time. It’s as if our policymakers only know one trick: when in doubt, splurge out cheap debt.

5. Yes, British households are heavily in debt. But this is the reason to correct the rates. The bubble burst – but we treated the hangover with more booze. Even cheaper debt, yet another debt-fuelled consumer binge. A recovery built on debt is not a real recovery. The below graph shows how the UK still has the highest household debt ratio that any G7 country has ever known. This is a very dangerous situation to be in, and cheap debt offers us no incentive to remedy that situation.

6. To put this in perspective, for the duration of this parliament UK national debt will grow more than the UK economy. Cameron often talks as if he’s “sorting out” the debt problem. In fact, he’s increasing debt every year. Increasing it by (a wee bit) less than Labour would have, certainly – but the overall picture is still sobering.

Comments