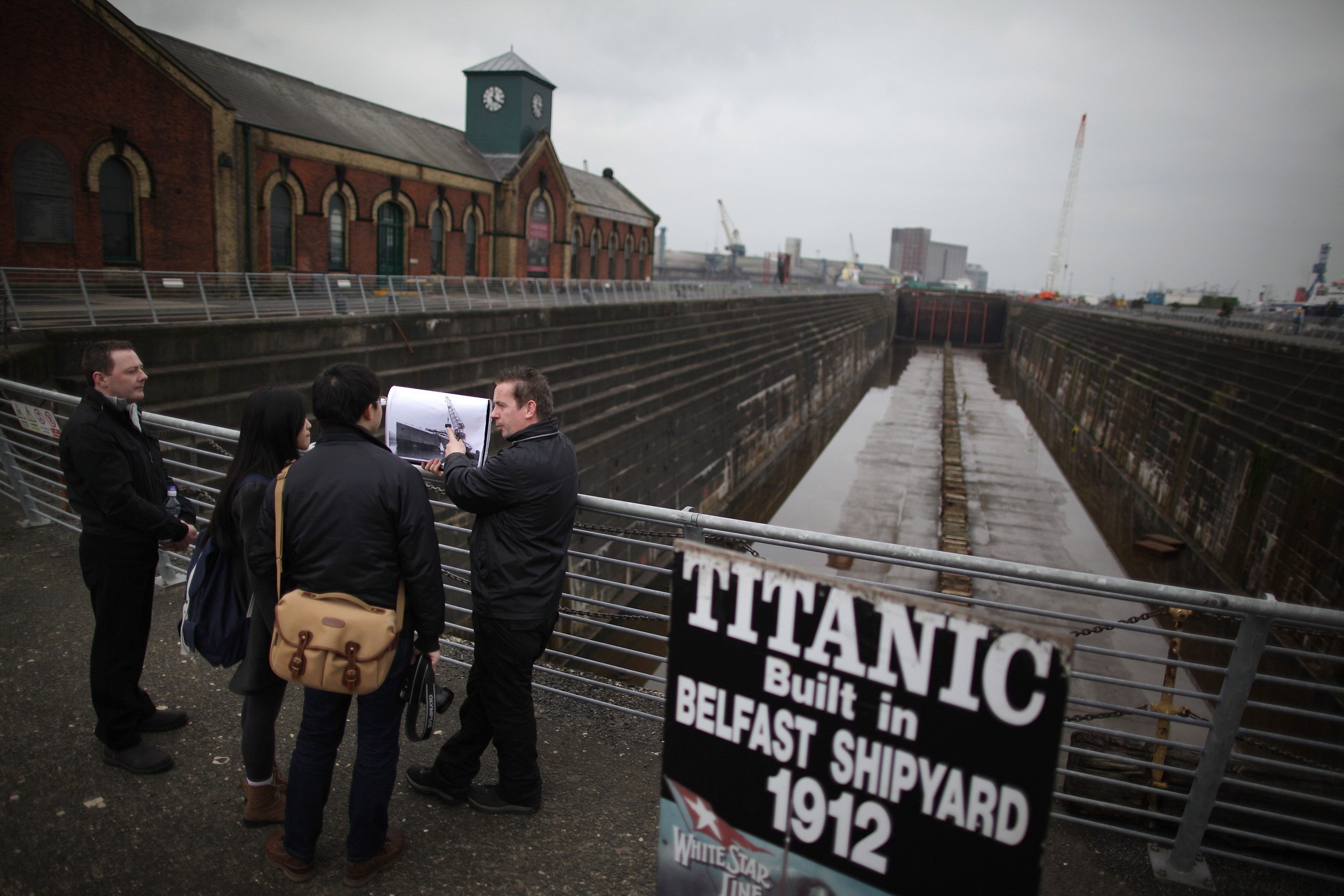

Monday morning in dreich late October. What more appropriate moment to ponder the questions of corporation tax and Northern Ireland? The question of whether the Northern Ireland Assembly should control the rate of corporation tax payable in the two-thirds of Ulster for which it is responsible won’t go away, you know.

Nor, despite the fact that the London press has paid little attention to it, is this some local matter of no importance to the rest of the United Kingdom either. On the contrary, David Cameron’s decision on this seemingly-arcane or merely local matter is more important than it seems and, in fact, one of the more significant questions demanding his attention right now.

Theresa Villiers, the Secretary of State for Northern Ireland, denies she has a brief to “kill” the proposal to devolve control of corporation tax but the impression persists that Whitehall is awake to the potential implications of transferring these powers to Belfast. It is certainly true that there are technical and administrative difficulties in devolving corporation tax, not the least of which is calculating how this may be done without breaking EU rules. Those regulations dictate that Stormont’s block grant would have to be reduced. Moreover, one need hardly be an expert reader of Treasury tea-leaves to presume that Whitehall’s very own vampire-squid department is liable to be agin the notion.

Nevertheless, the Northern Irish parties are more or less united in believing that corporation tax should be devolved and, moreover, that Stormont should be permitted to keep the proceeds – assuming there are any – of any increased economic activity that may, however these matters are calculated, be associated with cutting corporation tax in Northern Ireland. (In the short-term, mind you, a cut in the block grant would surely mean immediate spending cuts in Northern Ireland.)

The Commons’ Northern Ireland Affairs Committee – most of whose members represent “mainland” constituencies – published a report last year which, perhaps optimistically, described the case for devolving control of corporation tax to Stormont as “convincing”. Now, plainly, the opinion of backbench MPs is not necessarily dispositive but it is what it is nonetheless. And it adds to the difficulties the government faces when deciding on this matter.

As Alan Trench wrote last year:

This is one of the points where the Coalition UK Government’s policy of treating each of the devolved parts of the UK as if it were quite separate from the others comes to have a profoundly centrifugal effect. While the Blair and Brown governments may have done something similar, the extent to which they did so was much less, and the Labour governments were insistent on the need to maintain an integrated UK-wide economy. It appears that the Coalition are much less interested in that, raising a wider question: what do they see as the point of the Union more generally? That question has huge implications for all parts of the UK, not just Northern Ireland.

Quite. There is no truly-persuasive argument – or none I can see – for devolving control of corporation tax to Stormont but refusing to do so to Holyrood (or, I suppose, Cardiff). Granted, you might try and argue that Northern Ireland is a special case because it shares an island with the Republic of Ireland and must compete with the Republic’s 12.5% rate of corporation tax but this, while certainly true, only means that Northern Ireland’s peculiar circumstances are its own. The fact is that if the principle of devolving control of corporation tax is conceded to Belfast there can be little principled opposition to ceding comparable responsibilities to Edinburgh. No wonder Alex Salmond and the Scottish Government support the Ulstermen’s efforts in this affair.

And this is the difficulty: devolution theoretically allows for a range of policy approaches and there’s no reason to suppose that just because Parliament A enjoys a given responsibility so should Parliaments B and C. In practical terms, however, Parliaments B and C are liable to pipe up with claims of “Hey, if Parliament A can have cake, we want cake too.”

Discrepancies abound, of course, because the United Kingdom has never really been a unitary state. Political – as opposed to mere administrative – devolution, however, has made it harder for all these multiple anomalies to continue as though nothing had happened. Muddling along and the frequent recourse to the blind eye approach – the traditional British way of doing these things – becomes more difficult.

All this puts Westminster in a bind. Again, the technical difficulties in introducing tax competition to the UK are real but voters are, I think, entitled to suggest that resolving these difficulties is what civil servants are supposed to do. It is difficult – in political terms – for Westminster to say No to the devolved administrations when the general principles of devolution – including, in the new Scotland Bill, some greater devolution of tax powers – have already been conceded.

Belfast, Cardiff and Edinburgh will ask a simple question: Why not? And it won’t be quite enough for Whitehall to reply Because we say so or Because it’s complicated. (Even though it is complicated!)

Even so, I think you can see why David Cameron might prefer it if this prickly issue simply disappeared. But it won’t.

Comments