Another day, another downgrade. This time, it’s the Bank of England saying it now expects GDP to grow by only around 1 per cent in 2011 and 2012. In one sense, this is just one organisation’s

forecast and tells us nothing more or less about where the economy’s headed than anyone else’s. Thankfully, the Treasury collects

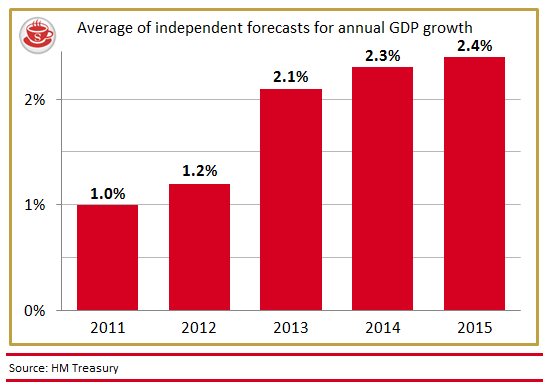

data from 21 independent forecasters – from Barclays and JP Morgan to the CBI and the IMF. Here’s the latest average prediction of GDP growth over the next few years:

So today’s downgrade brings the Bank of England’s forecasts roughly into line with the average. We can expect a similar downgrade from the OBR later this month. Their last forecasts (in March)

predicted 1.7 per cent growth in 2011 and 2.5 per cent in 2012, so they’ll have to bring those down a lot to fall into line.

What the Bank’s projections do suggest, though, is that we’ll be seeing more Quantitative Easing soon. The Monetary Policy Committee announced £75 billion of QE last month, in an attempt to stimulate growth. But in today’s report they say growth will be slow even with this, so we can expect them to step it up in the next few months.

Comments