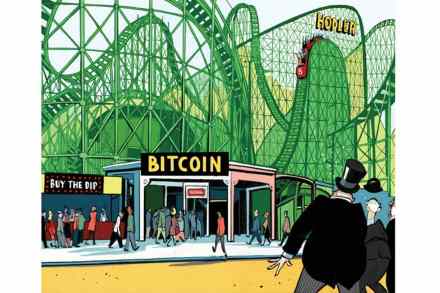

Free money is back – but don’t get excited

There is not a lot of good news on the British economy at the moment: prices are rising rapidly, job vacancies are falling and taxes are almost certainly going to be hiked again in the autumn to fill the ‘black hole’ that has opened up in the nation’s finances. But there is this. Free money is back. ‘Real’ interest rates, which are the only ones that matter, have plunged back close to zero. But we shouldn’t celebrate too soon: this is going to be a disaster for the economy – and we will all have to live with the consequences. Today’s inflation data from the Office for National Statistics came