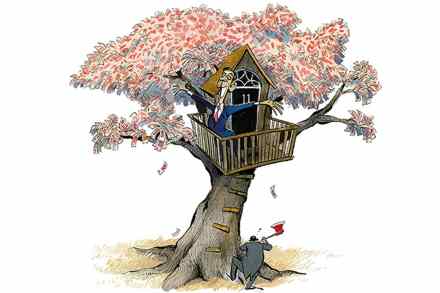

Of course tax rises won’t help economic growth

What’s the most idiotic question ever posed by an interviewer? There was the real-life Sally Jockstrap who asked David Gower whether he considered himself a batsman or a bowler. Or the Radio 1 DJ who asked Marc Almond – at the height of his fame with Soft Cell – whether he was going steady with a girl. But my nomination goes to Anna Foster on the Today programme this morning. In the midst of an interview with economist Mohamed El-Erian about Britain’s dire fiscal state, she suddenly posed: ‘Would raising taxes at this stage, would that help growth?’ I had to listen back on the catch-up facility to check that