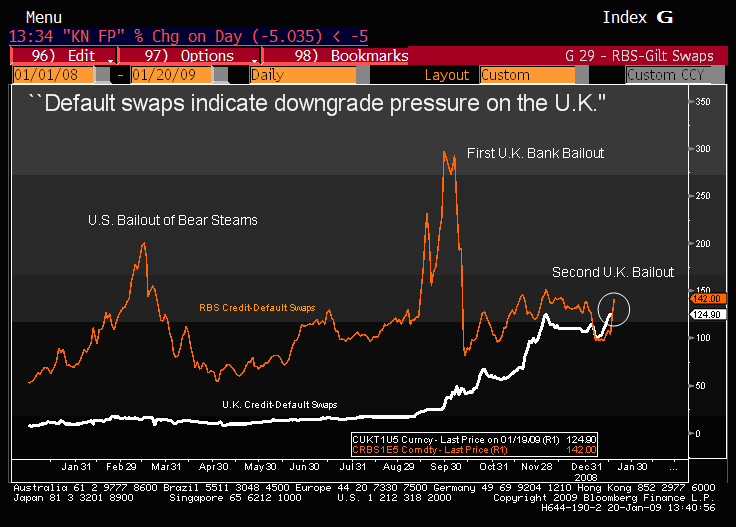

Britain to go the route of RBS?

Britain is now as likely to go bust as RBS – this is the official verdict of the markets. At the bottom of this post is Bloomberg’s Graph of the Day, which shows how Britain’s dodgiest bank and Europe’s dodgiest government now have the same “credit default swap” rating – the yardstick the markets use to guage whether something’s about to go bust. No wonder, you may say, given that RBS is state-owned. But my point is that this has major implications for our ability to borrow – and borrowing is what both Cameron and Brown will be relying on to pay the bills. Spain lost its AAA rating yesterday, and the