If they want another woman to depict on bank notes, how about Margaret Thatcher?

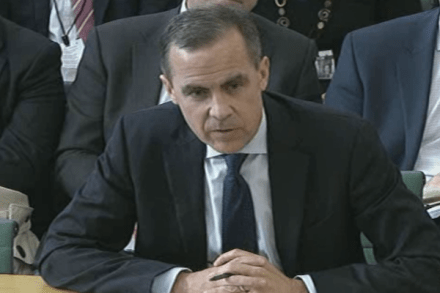

Jane Austen is a ‘contingency character’, we have just learnt. In his last appearance as Governor of the Bank of England before the Treasury Select Committee of the House of Commons, Sir Mervyn King explained that the great novelist rather slightingly so described stands in reserve to feature on any of our bank notes if too many people succeed in counterfeiting the current occupants. She is also in the running for the ten-pound note when Charles Darwin relinquishes it. This is a hot issue, because the notes do not feature enough women, we are told — despite the fact that since 1952, 100 per cent of them have featured a woman