Why Ed Balls shouldn’t brag if the OBR downgrades its growth forecasts

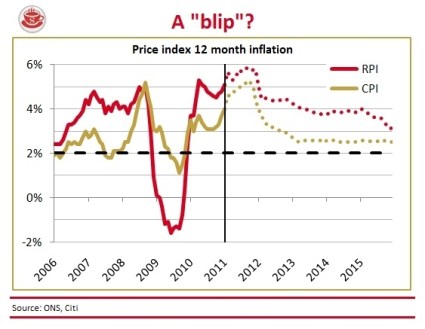

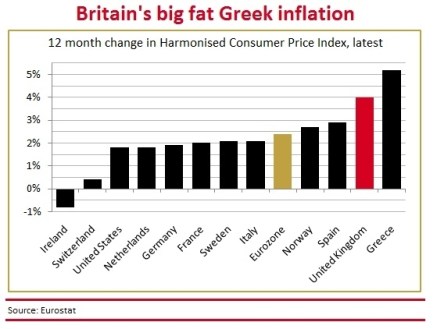

Some speculation (£) today that the Office for Budget Responsibility will shortly downgrade its 2011 growth forecast – and hence the growth forecast in next month’s Budget. If so, then you can expect Ed Balls to crow on and on about it. He did, after all, prime the attack in his recent clash with George Osborne across the dispatch box: “With consumer confidence falling, with inflation rising, with no bank lending agreement, no plan for jobs, no plan for growth, no plan B – does he really expect us to believe he can meet this forecast for economic growth this year or will he have to stand here at the