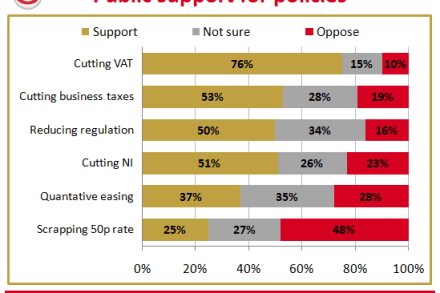

Balls has the public on his side when it comes to a VAT cut

There are few more useful addendums to Danny Alexander’s comments earlier than YouGov’s poll for the Sunday Times today. It asks people about individual policies for growth, and the results will be disheartening for the Tory leadership and encouraging for Ed Balls. An overwhelming majority supports Balls’s call for a cut in VAT, while few back a reduction in the 50p rate: There’s an almost identical picture when it comes to which polices people think would support growth: Perhaps most tellingly, even Tory supporters are against cutting the 50p rate: And, again, a similar picture emerges with respect to growth: Of course, none of this means that Labour has won