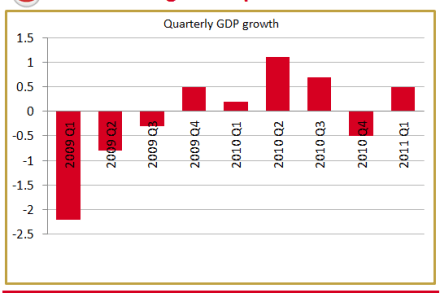

Economy grows by 0.5 per cent in the first quarter of 2011

So, we’re not back in recession, and growth of 0.5 per cent in the first quarter of this year is in line with what many forecasters were predicting, but… It is hardly indomitable stuff. As Duncan Weldon explained in a useful post yesterday – in which he rightly picked me up on a loosely worded post of my own (since, cheekily, edited) – 0.5 per cent merely compensates for the shrinkage experienced thanks to the snow last year. Across the last two quarters, economic growth has effectively plateaued. It’s as we were, Q3 2010. The politics of the situation is fissile, even if we are stuck in the murky area